Many small businesses have closed. Those open are barely hanging on.

David Lee’s The Liquidators is among the hundreds of Las Vegas businesses that have seen sales slump because of the COVID-19 pandemic.

Lee’s business, a Las Vegas retailer of used hotel furniture, has seen sales drop significantly year-over-year.

“Through September, it was probably close to $1 million in sales this time last year. Right now, we might be close to $500,000,” he said. “It might sound like a lot, but when you’re doing payroll and counting rent, it’s not really a lot of money.”

In March, the U.S. economy fell into a freefall as business shuttered and people stayed home to help contain the virus’s spread. Now in its seventh month with no end in sight, many small businesses are operating at limited capacity or have shuttered.

Lee is among the thousands of Nevada business owners who are unsure whether they’ll be able to stay afloat in the long term without another round of federal stimulus relief and a strong comeback of Las Vegas’ convention and trade show businesses.

“Las Vegas’ economy drives our state’s economy,” said Randi Thompson, the Nevada director for the National Federation of Independent Businesses. “Until Las Vegas can fully open, our state’s economy will not recover. We need conventions and entertainment back on the Strip.”

Financial woes

Since the start of the pandemic in March to June, the Las Vegas area suffered “from the highest rate of permanently closed businesses with 861 businesses permanently closed, as the city reacts to a decrease in tourism,” according to a Yelp study in June. Recently, the online review platform found that one out of every 100 Las Vegas businesses has permanently shuttered.

Approximately 60 percent of all U.S. businesses that closed during the pandemic have not reopened, according to Yelp.

In a recent survey of small businesses, conducted Oct. 4 to Oct. 12, the U.S. Census Bureau found 23.3 percent of businesses expected to need financial aid or additional capital in the next six months.

About 44.7 percent expected it would take more than six months to return to a normal level of operations relative to a year ago. Only 26.9 percent said they had cash on hand available to cover three or more months of operations.

The Vegas Chamber said the top concern it has heard from businesses is a need for more federal help to continue keeping their doors open.

“While larger numbers of people are allowed to gather, there is real concern for businesses connected with meetings/conventions/special events that it will take time for business to come back, and they are worried about how to sustain operations until then,” said Cara Clarke, a spokeswoman for the chamber.

Struggling

Many small-business owners across Nevada have tapped into personal savings to weather the pandemic’s toll.

Many are barely holding on. Businesses like Lee’s have taken out loans from the Paycheck Protection Program and Economic Injury Disaster Loans through the U.S. Small Business Administration.

Lee said that without the federal funding, his business would have closed immediately. Even with the SBA loans for his business, “the collateral is my house. This isn’t just dollars and cents, it’s personal because it goes all the way home,” he said. Lee declined to say how much he received in federal loans.

Lee’s company liquidates from the Strip properties when they order furniture for remodeling. The Liquidator sells those to other off-Strip properties, hotels, motels and Airbnbs and to the public across the country.

Sales seemed to rebound at first: “In June, when everyone reopened a bit, it was 70 percent, and that was like, ‘Ok, wow, it is going to be a V-shape recovery and everything is going to come back,” he said.

When the $600-a-week stimulus ran out in July, sales dropped back to around 50 percent. “You can’t pay rent and your employees at 50 percent in sales,” said Lee, who pays $20,000 a month in rent.

Another issue core to Lee’s business: None of the furniture at the Strip properties is being liquidated anymore because they’re not doing any remodeling work.

“Now we’re forced to go with the regular furniture manufacturers out of a catalog like everybody else, and that’s not our price structure and business model. It’s hurting us,” Lee said. “If business continues at the current levels, it’s only going to be a matter of time. Right now, it’s a waiting game. Hopefully the capital we have right now will hold us through the next few months.”

While some Las Vegas businesses have struggled, some have found success in pivoting their business model amid the pandemic. The Liquidators recently moved its business model to include selling carpets.

Henry Valentino was also able to pivot his business, eConnect.

His software company used to provide services to the gaming industry, including video surveillance.

“It was a particularly rude awakening in mid-March, when we realized that every single one of our (hospitality) customers was closed, or if they were open, it was in a very, very diminished capacity,” Valentino said. “We started thinking, ‘Well, what can we do to help them get reopened?’”

So, his company created eClear, contactless kiosks that can prescreen employees and visitors and take thermal temperatures.

Businesses in the hospitality industry, including casinos, airports and restaurants have adopted Valentino’s eClear system.

Valentino’s business received $535,000 in PPP loans.

Chipping in

Cash-strapped local and state governments across the U.S. have stepped in to help small businesses, deploying more than $9.27 billion in grants and loans, according to a recent analysis by the Institute for Local Self-Reliance.

Grant programs were not meant to be a substitute for federal aid like the PPP, a lifeline for small businesses, which ran from April through early August.

In early October, Gov. Steve Sisolak announced a $20 million small-business grant program. When the state rolled out its online portal to accept applications, the Governor’s Office of Economic Development received 1,500 applications within the first 15 minutes. Two days later, Sisolak said the state would double funds after increased demand.

Thompson, of the National Federation of Independent Businesses, said it “shows you the need for funding that so many businesses and organizations still have.”

While Congress acted quickly to pass the CARES Act in March and established the PPP for America’s small businesses, the relief isn’t enough.

More than 31,000 Nevada businesses applied for the PPP funds.

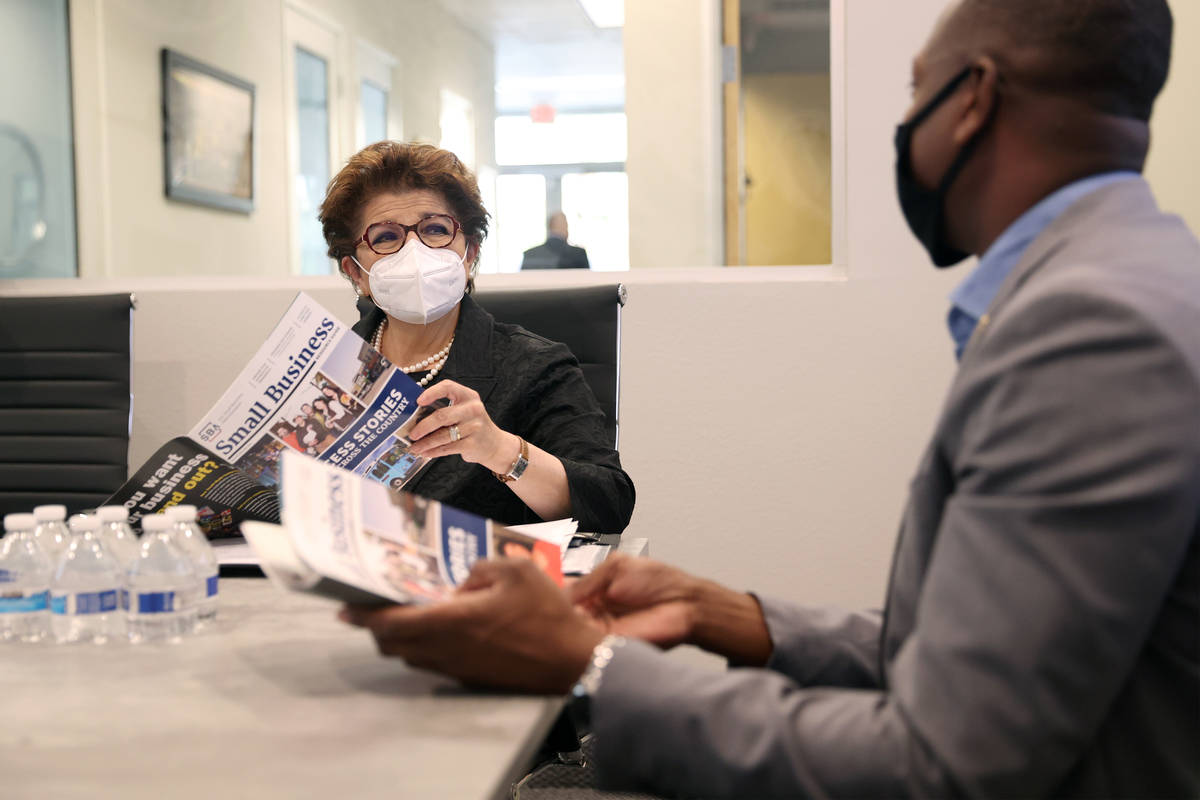

In late August, Jovita Carranza, the administrator of the U.S. Small Business Administration, visited several businesses across the valley to see how PPP money was being used.

“When you talk to entrepreneurs in any state, and here in Nevada is really no different, one of the common threads between all small businesses is that the Paycheck Protection Program served as a lifeline, as a bridge, to sustaining their businesses, protecting their employees, as well as retaining the level of wages and benefits,” Carranza said. “The other consideration they all express is whether we are able to provide another lifeline.”

Talks in Congress stalled leading up to Election Day.

Bankruptcies on the rise

Lee is preparing for all possibilities and has been consulting a bankruptcy attorney.

A Chapter 11 bankruptcy protection allows a company to continue operations while reorganizing its obligations, said Andrea Gandara, a commercial bankruptcy attorney at Holley Driggs Law Firm.

The filing also gives a company time to assess finances and negotiate with creditors to resolve outstanding debt. Those can include landlords, vendors and employees who are owed wages.

“When my CPA said the outlook on recoveries is like 18 to 36 months in this town, we might not survive that long, ” Lee said. “So one option is to get with a bankruptcy attorney and protect what you’ve got.”

Nationally, there has been an uptick in Chapter 11 commercial filings since the pandemic, according to analysis from the American Bankruptcy Institute, a national organization that does research on insolvency.

Commercial Chapter 11 filings increased 33 percent during the first nine months of this year compared with the same time last year. The institute reported 5,529 Chapter 11 filings from Jan. 1 through Sept. 30, compared with 4,148 filings in the first nine months of 2019.

In Nevada, Gandara said she has seen an uptick in commercial bankruptcy filings since the pandemic.

“Right now, I think, with the foreclosure and eviction moratorium no longer being in effect for commercial properties, that’s probably going to trigger even more than we’ve seen so far, unfortunately,” Gandara said.

^

Contact Jonathan Ng at jng@reviewjournal.com. Follow @ByJonathanNg on Twitter.