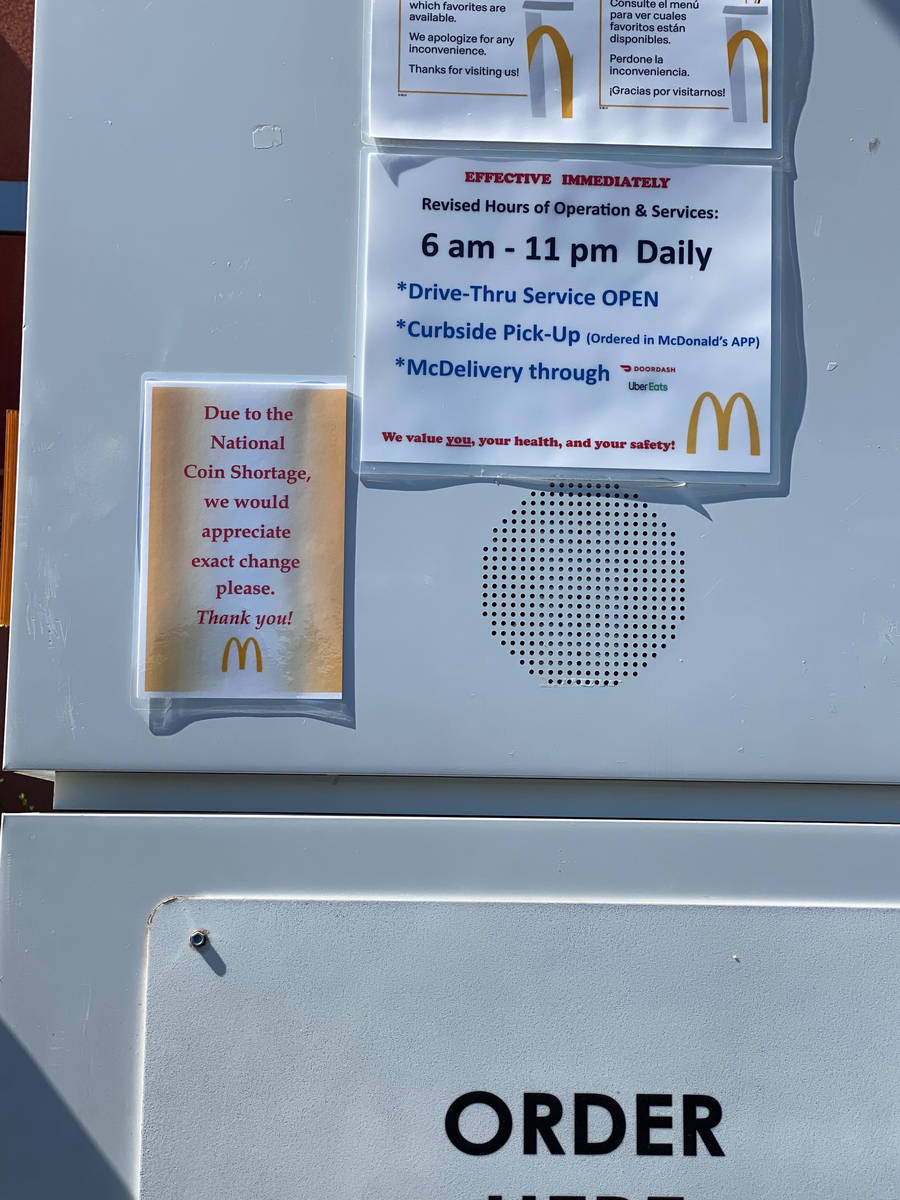

National coin shortage adds to business hardship amid pandemic

At first, it was toilet paper, face masks and meat.

Now, the nation is facing a new crisis from the coronavirus pandemic: a coin shortage.

As businesses and organizations shuttered their doors and the local economy went into full shutdown mode as the pandemic arrived in Southern Nevada and elsewhere in March, there were fewer in-person transactions and the recirculation of coins has slowed down.

“With the partial closure of the economy, the flow of coins through the economy has kind of stopped,” said Federal Reserve Chairman Jerome Powell before the U.S. House Committee on Financial Services in mid-June. “Stores have been closed, so the whole system of flow has come to a stop. We’re well aware of this and we’re working with the reserve banks, and as the economy reopens we’re seeing coins begin to move around again.”

As local businesses reopen, it has created a demand from merchants to stock their coins at higher levels, but the vast majority of coins remain in consumer piggy banks, said Phyllis Gurgevich of the Nevada Bankers Association.

Some businesses are grappling with the shortfall of coins, asking customers to pay with exact change, if possible. Grocery chain Smith’s said in a statement, “Like many retailers and businesses, we are adjusting to the temporary shortage in several ways while still accepting cash.”

Banks like Wells Fargo are “actively managing our coin inventory and working with customers to meet their coin needs to the extent possible after the Federal Reserve put limitations on coin deliveries to all financial institutions nationwide,” said spokesman Tony Timmons.

Some banks are being creative to encourage customers to increase coin deposits, says Gurgevich.

“Some offer free coin counting or free coin wrappers, others are using the shortage to create an education opportunity for customers’ children who have piggy banks,” she said.

Thoran Towler, CEO of the Nevada Association of Employers, said he’s heard from several businesses asking about the coin shortage.

“They’ve asked if I know of any banks that are giving coins out,” he said, adding that some have gone to banks and aren’t able to get all the coins they’ve asked for.

“It’s tough. If you’re out of change, you can’t do much, and rounding down could end up hurting any profits that you may have in a difficult time anyway,” Towler said. “ And, we all know there’s the credit card fees. So, either way, (whether rounding down or paying fees) it’s another nail in the coffin” for already reduced profits, he said.

Powell said last month the central bank is working with the U.S. Mint, the manufacturer of U.S. coins, to resolve the crisis. That could happen as early as in a few weeks, said Ted Rossman, an industry analyst with CreditCards.com

“The mint has since been back up and running and they’re actually working overtime to try to pump more coins into the system,” Rossman said. “My gut feeling on this is that it’s going to be resolved within a few weeks, or maybe in a month or two. I’ve seen some projections as far out as November.”

Contact Jonathan Ng at jng@reviewjournal.com. Follow @ByJonathanNg on Twitter.