Nevada banks to start accepting Paycheck Protection Program loan apps

Southern Nevada businesses will be able to apply for the latest round of the federal Paycheck Protection Program — a lifeline that helped firms and nonprofits retain jobs and weather the COVID-19 pandemic and related lockdowns — starting on Wednesday.

“It’s sad that we have to have the PPP second draw in some ways,” said Joe Amato, director for the U.S. Small Business Administration’s Nevada district office, said Tuesday during a virtual seminar with the Las Vegas Global Economic Alliance. “But it’s also obviously something that the SBA and the federal government has seen as being more than a necessary funding or stimulus source and, without a doubt, something a long time coming.”

More than $4.1 billion in PPP funds went to Nevada businesses in 2020, according to the Nevada Bankers Association. The program, administered by the SBA and the Treasury Department, allowed community financial institutions and minority depository institutions to process PPP applications on Monday before opening it up for other lenders.

Congress in December authorized $284 billion to provide forgivable PPP loans to small businesses as part of a broader $900 billion COVID-19 stimulus relief bill, which President Donald Trump later signed that month. The “second draw” of PPP is targeted at small businesses that can demonstrate need.

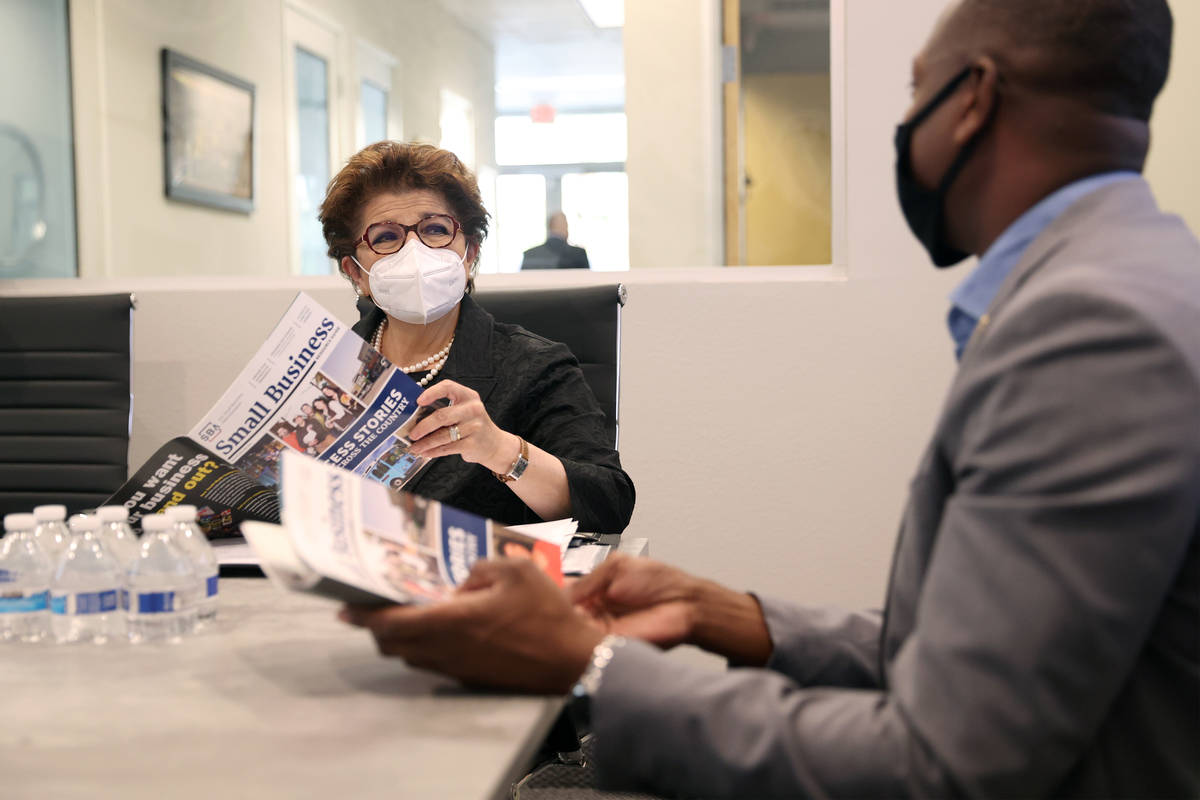

Last year, SBA Administrator Jovita Carranza visited Las Vegas firms that benefited from PPP funds.

“When you talk to entrepreneurs in any state, and here in Nevada is really no different, one of the common threads between all small businesses is that the Paycheck Protection Program served as a lifeline, as a bridge, to sustaining their businesses, protecting their employees, as well as retaining the level of wages and benefits,” Carranza told the Review-Journal last August. “The other consideration they all express is whether we are able to provide another lifeline.”

Preparing

Amato said businesses need to provide financial documents as part of their PPP application, usually a profit and loss statement, which shows a 25 percent drop in revenue during any quarter of 2020 when compared to the same quarter of 2019.

Businesses looking for the maximum loan amount on PPP is 2.5 times the borrower’s average monthly payroll costs. “In a lot of cases, you can use whatever you used to get your first draw, you can use that same documentation,” said Amato.

Melissa Liu, of the Las Vegas Asian Chamber of Commerce, told the Review-Journal on Tuesday that the chamber has been reaching out to its members about the new PPP round.

“Lots of them applied last round, were very happy and it was a great help for them and right now it is still hard on their business so they were very happy to know the second round is starting now,” said Liu, adding that the funds will help reduce some stress for business owners. “The money will help them stay open and try to get through this hard time and it will help them to pay for rent and any necessary expenses.”

Some banking leaders across Nevada said last week that they’re anticipating another wave of PPP applications, and are well-prepared.

“The lending in the first wave of PPP in 2020 was unprecedented, and we managed the tsunami of requests as best we could,” said Nevada State Bank CEO and president Terry Shirey, adding it will “do all that we can to ensure we are even better prepared for this next wave of funding, knowing that so many businesses are in need of the support to get through this final phase of the pandemic and back on the road to economic recovery.”

Nevada State Bank said it processed more than $647 million in PPP loans to 5,137 businesses across the state last year. The overwhelming majority of the loans were made to businesses with fewer than 10 employees, with an average loan for clients at approximately $126,000.

Phyllis Gurgevich, president and CEO of Nevada Bankers Association, said that businesses “may benefit from gathering anticipated documentation and talking with their banker confirming the bank will be participating in round two.”

Contact Jonathan Ng at jng@reviewjournal.com. Follow @ByJonathanNg on Twitter.