Nevada should increase tax incentive oversight, report finds

Nevada could be doing more to ensure the combined $1.7 billion that Tesla, Amazon, Switch, Faraday Future and others received in tax incentives was well-spent, according to a national report.

“There is no regular, systematic process for studying the results of (abatement) programs and using that information to improve policy,” said Josh Goodman, research officer at The Pew Charitable Trusts, which published the report.

The report identified 10 states which “rigorously measure the economic and fiscal impact of their programs” that allow for policymakers to improve the effectiveness of tax incentives. Nevada was identified as one of 23 states that does not.

A total of 97 companies received tax abatements in the past two fiscal years.

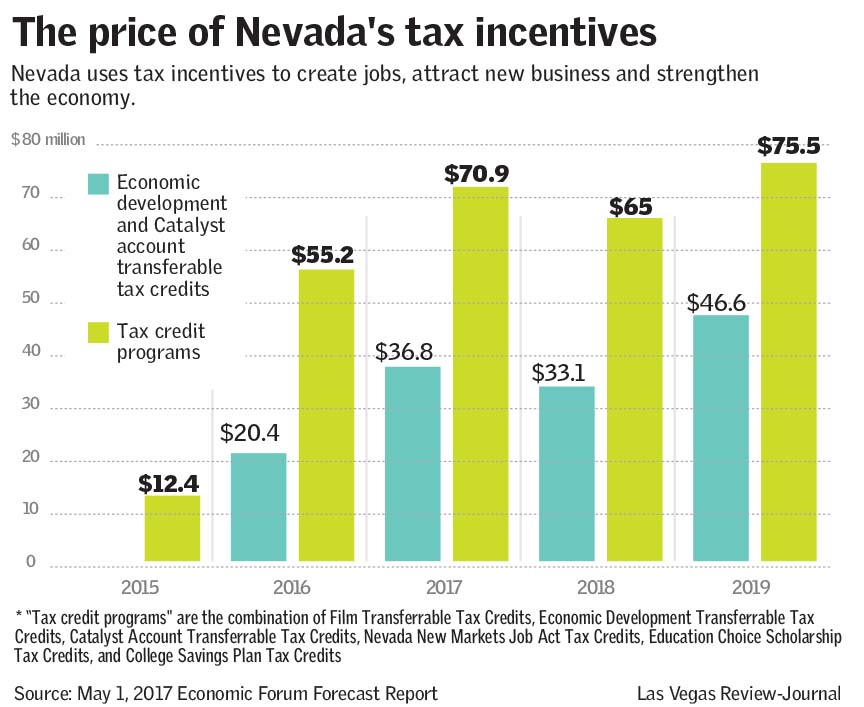

Nevada’s Economic Forum — the state’s five fiscal forecasters — estimates economic development tax credit programs are slated to cost Nevada about $79.6 million over the next two fiscal years.

Given that tax abatements are a “major budget commitment,” Goodman said Nevada could use an oversight body that asks key, big-picture questions, like “is this (overall) program cost-effective? Are we getting good results? How does it compare to some other economic development strategy?”

Steve Hill, who is charged with approving most tax abatements as the director of the Governor’s Office of Economic Development, said he agrees.

“I think it would be helpful for the Legislature to have an opportunity to interact on this subject more than the way it’s structured,” Hill said. “The Legislature decided in 2011 when they created GOED that the oversight should be the GOED board.”

The status quo

The board submits an annual report to the Legislature outlining tax abatement activity, and every two years, during the legislative session, the economic development board recommends tax abatement program changes.

In states that Pew identified as ahead of the curve in oversight of tax abatement policy, a third party often provides analysis to lawmakers.

“In general, states haven’t tasked economic development agencies with being the ones doing the evaluations,” Goodman said, adding that it might be somewhat “awkward” for the economic development board, which is charged with promoting tax abatement programs, to be also critically analyzing those same programs.

For example, Florida’s Legislature adopted a law tasking the Office of Program Analysis and Government Accountability and the Office of Economic Demographic Research to evaluate economic development incentives every three years. While the program analysis office conducts program performance evaluations, the demographic research team provides economic analysis to lawmakers.

Change on the horizon

Nevada lawmakers are getting on board.

Assemblywoman Irene Bustamante Adams, D-Las Vegas, proposed a bill, Assembly Bill 143, that would create a legislative committee tasked with evaluating the cost and effectiveness of each of the state’s incentive programs for economic development every six years.

The bill would authorize the committee to contract with private consultants or academic institutions to complete its reviews, and the committee would ask those key, big-picture questions like whether there is a more effective method to achieve the goal of the incentive and how the incentive affected business behavior.

Hill testified Feb. 23 in favor of the bill to an Assembly committee, saying, “The policy that is in this bill will allow a group of legislators to more deeply understand and be able to weigh in and represent the Legislature more thoroughly in developing the policies that our office implements. The added benefit of that is that it will engender more trust in the system,” according to meeting minutes.

Hill told the Review-Journal he does not know why this dialogue is forming now. Bustamante Adams did not return multiple requests for comment. Hill, however, said he and Bustamante Adams spoke with Pew researchers four or five months ago and received some recommendations that he believes helped to form Bustamante Adams’ bill.

Michael Schaus, communications director at Nevada Policy Research Institute, which promotes policies consistent with limited government, said the bill is encouraging.

“Lawmakers are starting to wake up to the fact that taxpayers want this (oversight),” Schaus said. “It is a very sellable idea to say, “Let’s track this money that we’re giving away.’”

Randi Thompson, state director of the National Federation of Independent Business, said she too supports the measure.

“It is imperative the Legislature look at the total impact these incentives are having at the local level,” Thompson said. “By adopting a plan for regular evaluation of tax incentives, Nevada would be better able to determine if the incentives are being effective, as well as being abused.”

Contact Nicole Raz at nraz@reviewjournal.com or 702-380-4512. Follow @JournalistNikki on Twitter.

Nevada's project-level evaluations of tax abatements

The Pew Research Center did not rank how states stack up when it comes to project-level evaluations.

"It's important to have a distinction between what we call project-level accountability, or company specific accountability and programmatic evaluation," said Josh Goodman, research officer at The Pew Charitable Trusts.

The Governor's Office of Economic Development's holds projects accountable by:

— Releasing tax abatements based on performance

— Requiring regular auditing and reporting by and of companies

— Tasking the Department of Taxation with auditing companies approved for regular tax abatements two years after approval and five years after approval.

— Requiring companies to pay back the monetary value of their abatements to the state, enforced by the Department of Taxation, if they are found not to be in compliance

— Requiring companies that receive larger abatements, like Tesla and Faraday Future, to submit quarterly reports from the date of approval through the end of the following fiscal year of the project as well as an annual audit report for the length of their abatement term.