Report: Feds investigating Walters, Icahn, Mickelson in possible insider-trading inquiry

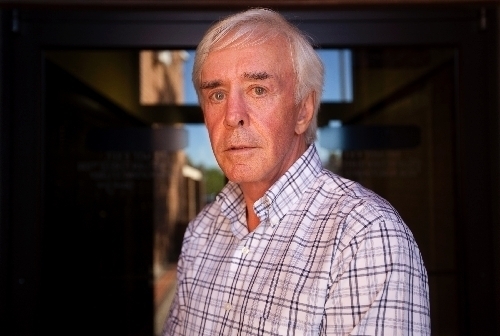

The FBI and the Securities and Exchange Commission are investigating possible insider trading involving Las Vegas developer and gambler Bill Walters, billionaire investor Carl Icahn and golfer Phil Mickelson, a source familiar with the matter said.

Federal investigators are looking into whether Mickelson and Walters may have traded illegally on private information provided by Icahn about his investments in public corporations, the source told Reuters, confirming reports on Friday.

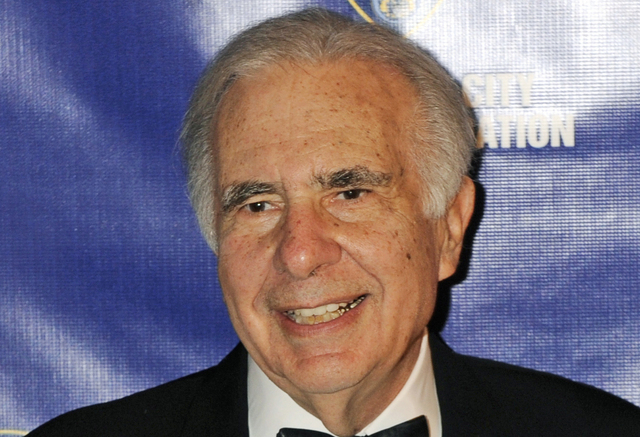

Icahn, a legendary activist investor, told Reuters that he was unaware of any investigation and said that his firm always followed the law. He acknowledged a business relationship with Walters but said that he did not know Mickelson personally.

“I am very proud of my 50-year unblemished record and have never given out insider information,” he said.

Walters and Mickelson golf together, the source familiar with the investigation told Reuters.

Walters gambling habits have drawn attention of federal prosecutors in the past. In 1992, he was acquitted in federal court of illegal gambling charges.

Walters is a generous contributor to local political campaigns, and he owns the Bali Hai Golf Club. Walters is also closely associated with local charity Opportunity Village.

Walters did not respond to Reuters’ requests for comment. Representatives for Mickelson, the FBI and the SEC declined to comment.

The Wall Street Journal cited Glenn Cohen, Mickelson’s lawyer, as saying the golfing legend was not a target of the federal inquiry.

None of the three men have been accused of any wrongdoing, the source told Reuters.

YEARS OF INVESTIGATING

The investigation began three years ago according to the source. It is the latest to emerge from a multiyear crackdown on insider trading by U.S. authorities.

The investigation centers on suspicious trades in Clorox Co. by Walters and Mickelson as Icahn was trying for access to the board of the consumer products company in 2011, the New York Times reported, citing people briefed on the probe.

Icahn had accumulated a 9.1 percent stake in Clorox in February 2011. In July, he made an offer for the company that valued it at above $10 billion and sent its stock soaring.

Investigators were also looking into trades that Mickelson and Walters made related to Dean Foods Co., the Journal cited the people as saying. The New York Times cited people briefed on the investigation as saying that in that particular case, investigators are looking into trades placed around 2012 just before the company announced quarterly results.

Those trades appeared to have no connection to Icahn, the newspaper added. Icahn told Reuters he had never purchased shares nor been involved with Dean.

Icahn has a business presence in Las Vegas. In January 2010, he bought the unfinished Fontainebleau on the Strip in Las Vegas for $150 million out of bankruptcy.

MAKING HEADWAY

Federal prosecutors in Manhattan are handling the inquiry in conjunction with the FBI and the SEC, the New York Times reported.

The current investigation made little headway initially, the Times reported. Investigators are searching phone records, seeking to determine whether Icahn had spoken to Walters before the trades, the Times cited anonymous people briefed on the probe as saying.

And about a year ago, FBI officials approached Mickelson at Teterboro Airport in New Jersey, asking the celebrity golfer to discuss his trading, the Times cited its sources as saying.

Icahn, a prolific tweeter and vocal critic of some of America’s largest corporations, habitually broadcasts his thoughts on corporations and, occasionally, stock positions he has taken. The billionaire took to Twitter earlier this year when he pushed Apple Inc.’s board to expand the iPhone maker’s buyback program, and several times tweeted when he had increased his position in the tech company.

Even if Icahn did leak information about his plans regarding Clorox, it may not necessarily have violated the law. Insider trading regulations prohibit trading based on material, nonpublic information obtained from someone who breached a fiduciary or confidentiality duty by disclosing it.

The Las Vegas Review-Journal contributed to this report.