Slowdown in housing socks LV Valley’s economic index

Developers are proceeding with caution as Las Vegas' economy continues to show signs of a slowdown, led by the declining housing market.

Residential and commercial permit activity fell by 34.8 percent and 35.6 percent, respectively, in March. Home sales, both new and existing, are in a similar spiraling slump.

Falling home equity, rising energy prices and tighter lending requirements have all contributed to weaker consumer spending, a local economist said.

"All in all, we can clearly say the economic outlook is guarded at best," said Keith Schwer, director of the Center for Business and Economic Research at University of Nevada, Las Vegas.

The Southern Nevada Index of Leading Economic Indicators moved down in April to 133.03, compared with 133.17 in March. Moreover, the index is heading down as measured from the same month a year ago, Schwer noted.

Trends based on more than two months a year apart, however, yield a flat line, suggesting neither expansion nor contraction, he said.

"It's not dipping enough. By growth standards of the past, it looks like we're going into a deep freeze, whereas it's really going sideways," Schwer said. "Not housing, though."

The index compiled by the center is a six-month forecast from the month of the data (February), weighted for each of the 10 series after adjustment for seasonal variation.

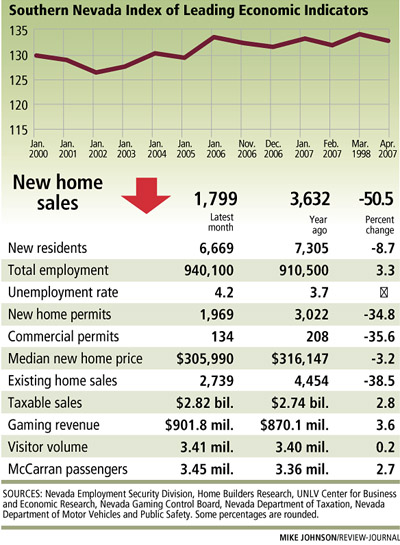

The accompanying Review-Journal chart includes several of the index's categories, along with data such as new residents and employment and housing numbers, updated for the most recent month for which figures are available.

After seven straight months of decline, the Clark County Construction Index went up 0.49 percent in February, based on a five-month moving average. Using the same month trends from a year ago, the index has declined for nine consecutive months, largely a reflection of rebalancing in the residential construction market, Schwer said.

Aside from the plunge in housing-related indicators, other crucial components of Southern Nevada's economy are still posting modest gains. Gaming revenue grew by 3.6 percent to $901.8 million, taxable sales increased 2.8 percent to $2.82 billion and total employment rose 3.3 percent to 940,100.

"I look at all of that, but I also tend to look at the interconnectivity of certain elements," said Guy Hobbs, principal of Hobbs, Ong & Associates financial advisory firm. "When construction is 15 percent to 20 percent of the economy, that's not much different than gaming. When you have that much linkage between fiscal and economic systems, you're going to feel some ripples."

Hobbs said issues from the Governor's Task Force on Tax Policy of 2002-2003 have manifested into problems today such as the $3.8 billion shortfall in the state's transportation budget. He also has concerns about revenue from sales taxes and real property transfer taxes, which have become a big part of the state budget.

"If it weren't for the huge upturn in commercial construction, we'd really be hitting the skids," Hobbs said. "You have huge commitments going forward for megaresorts on the Strip. Those people who are making those commitments have to feel strongest about it."

The 12-month rolling total for commercial permit valuation reached $1.64 billion at the end of last year, according to the UNLV business research center. It was less than $500 million from 1981 through 1995 and climbed to about $1 billion from 1997 to 2005.

Schwer said people are no longer able to refinance their home mortgage and withdraw cash to buy big-ticket items such as automobiles. Many home owners have tapped out their home equity and spent the money on who-knows-what, he said.

"There's always a group out there that mismanages their affairs," the UNLV professor said. "It only goes to show you people should be taking economic courses."