Southern Nevada’s economy stays flat

Southern Nevada's economy is performing a "high-wire balancing act" between a strong push of big investment spending along the Strip and the drag of falling residential construction and real estate sales, a UNLV economist said.

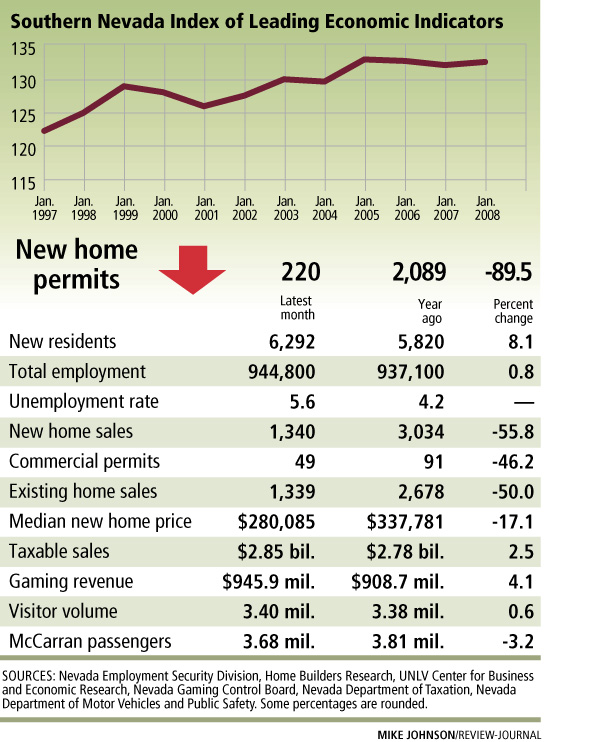

The Southern Nevada Index of Leading Economic Indicators has followed a flat trajectory for the past 12 months, dipping slightly to 133.56 in January, the Center for Business and Economic Research at University of Nevada, Las Vegas reported.

The index climbed from 132.98 in January 2007, peaking at 133.82 in December.

A 16.3 percent decline in November's gaming revenue contributed to the downward trend. Seven of the index's 10 data series showed positive change from the same month in the previous year.

"Still, the six-month forecast remains flat, (with) no clear sign of an overall recession in the data, despite the veil of pessimism coming from the media," economist Keith Schwer said.

The economic index, compiled by the Center for Business and Economic Research, is a six-month forecast from the month of the data, based on a net-weighted average of each series after adjustments for seasonal variation.

The accompanying Review-Journal chart includes several of the index's categories, along with data such as new residents and employment and housing numbers, updated for the most recent month for which figures are available.

A separate index measuring Clark County business activity declined 1.7 percent from the previous month and 3 percent from a year ago. It's the largest monthly decline in the past year, Schwer said.

The business activity index had been increasing at an average of 0.9 percent each month, even with housing in the doldrums and international finance markets left scrambling for liquidity and in some cases facing insolvency, Schwer said.

"Essentially, the Southern Nevada economy has been flat over the past year and a half," he said.

Las Vegas' commercial market performance could become the story of the year, research analyst Jeremy Aguero of Applied Analysis said at a recent economic forecast. Commercial building permits fell to 49 in December, compared with 91 in the same month of the previous year.

Still, the market has 14 million square feet of commercial space coming on line during a time when employment is slowing and apartment vacancy is substantially higher than a year ago, he said.

"Expect projects not to be completed. Fewer projects will go from planned to under construction," Aguero said. "There's going to be less office and industrial development."

Robert Shiller, professor of economics at Yale University, said there's a "good chance" the housing recession will go on for years. American real estate values have lost about $1 trillion and that could triple over the next few years, he said.

Housing futures contracts are pointing to losses of around 35 percent in area such as Florida, California and Las Vegas over the next five years, Shiller said.

After posting nine consecutive months of decline, the construction index turned positive in August, September, October and November. The stockpiling of residential permits toward the end of the year inflated the index on a month-to-month basis, Schwer said.

The construction industry has lost about 4,500 jobs, roughly 4 percent of its work force, and conditions are not as strong as suggested, he said.

"Looking ahead, jobs for completed projects may not be as easily taken up by the same number of jobs for new projects," Schwer said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or (702) 383-0491.