Critics outline Raiders stadium objections, but Nevada casino group weighs in with support

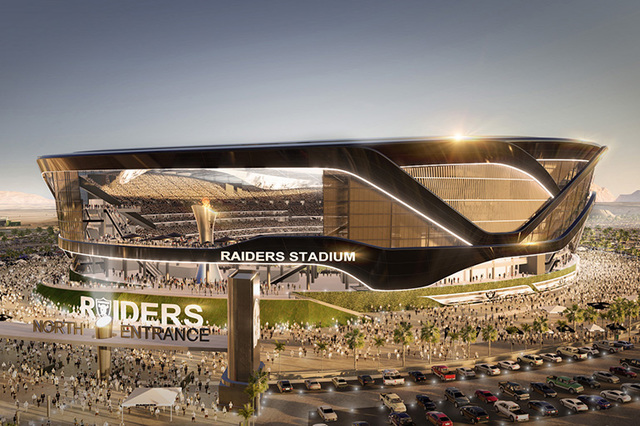

Critics of a proposed $1.9 billion, 65,000-seat domed football stadium say they want a better deal for Southern Nevadans if tax dollars are used to help fund construction, but an influential casino lobbying group joined the debate Wednesday by saying stadium developers and government officials have covered all concerns.

Representatives of Nevadans for the Common Good released a five-page report, “Seven Hidden Risks in the Stadium Plan,” at a news conference Wednesday.

After the group voiced its concerns, a representative of the Nevada Resort Association, whose board unanimously supported the stadium plan, said most of the opponents’ questions have been answered.

“Tourism is the core business in Nevada,” the association said in a statement. The stadium “will create thousands of jobs and generate millions of dollars in economic activity while increasing visitation and adding a new dimension to the visitor experience.”

Nevadans for the Common Good, a faith-based organization composed of more than 40 religious and nonprofit groups, wants Nevada lawmakers to seek a public funding plan that’s more favorable than the current recommendation, which calls for $750 million in increased hotel room taxes.

“If we’re being asked to swallow this nasty pill, then we need many additional community benefits attached to it,” said the Rev. Marta Poling Schmitt, the president of the organization. “Stadium revenue should be earmarked to pay down the bond, not line the pockets of developers and investors.”

That group and the Nevada Taxpayers Association are among the first organizations to take a public stance against the stadium plan developed by the family of Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson, Majestic Realty and the Oakland Raiders. The Raiders have promised to seek relocation of the NFL franchise to Las Vegas if the stadium financing plan is approved.

CONCERN OVER RAIDERS HISTORY

Schmitt said the Raiders’ history of relocating the team suggests that Las Vegas officials need to lock down a lease for the team that is at least as long as the 33-year term of the bonds under consideration.

Established in 1960, the Oakland Raiders have changed cities twice before. In 1982 the team moved from Oakland to Los Angeles, and in 1995 it moved back to Oakland.

“Nevadans for the Common Good has studied the stadium plan and has concluded that this is a bad deal for taxpayers with an unacceptable level of risk for the residents of Clark County,” the organization said in its summary of the report.

“We cannot afford to gamble $750 million of public money on a deal that doesn’t include the guarantees for substantial public benefits,” the group said.

Similar concerns were raised by the Nevada Taxpayers Association in an email sent to members of the organization on Monday.

Several of the group’s concerns were addressed in meetings of Southern Nevada Tourism Infrastructure Committee, which recommended the project to Gov. Brian Sandoval earlier this month and spent most of the year vetting the proposal.

Sandoval last week said he would call a special session of the Nevada Legislature in early October to consider the stadium financing package unanimously endorsed by the SNTIC.

NEVADA RESORT ASSOCIATION WEIGHS IN

Separately, Jan Jones Blackhurst, senior vice president of communications and government affairs for Caesars Entertainment, speaking on behalf of the Nevada Resort Association, said most of the questions asked by Nevadans for the Common Good have been answered in public meetings of the SNTIC and the Clark County Commission.

Nevada Resort Association board members representing 70 properties voted unanimously last week to support the recommendations of the SNTIC.

Blackhurst said county officials vetted the SNTIC’s recommendation and required that revenue generated to pay off general obligation bonds be 1.5 times the amount needed for payments. Right now, she said, collections are tracking at 1.87 times the necessary amount.

“All of the adverse circumstances were factored in to how we structured the bonds,” Blackhurst said. “If there is some cataclysmic circumstance, the payment would fall back to the county but the chances of that happening are slim and none.”

The SNTIC has recommended a 0.88 percentage-point increase in Clark County’s hotel tax rate to assure that bond obligations are met. Blackhurst said two years’ worth of payments would be collected to become a savings account in the event that collections are lighter than expected, giving administrators plenty of time to address any shortfall.

In addition, Blackhurst noted that Adelson has promised to pay for any overages. But she doesn’t think that will happen based on the prospects for revenue-generating events in the stadium.

“I don’t think there will be any operating losses because there are so many different uses for this facility: soccer games, exhibition games, UNLV games, Raider games, concerts, boxing matches. But let’s say that there was a problem. Sheldon (Adelson) has said he would assume that responsibility,” she said.

As for the Raiders’ propensity for moving, Blackhurst said the committee plans to sign the team to a lease that is at least as long as the bond obligation — 33 years — so there’s no reason to believe the team would leave without paying its share.

“I continue to be surprised at some of the public response to what very clearly is a community arena,” Blackhurst said. “People forget that we have not had a major investment in Las Vegas tourism infrastructure in almost a decade.”

The Review-Journal is owned by the family of Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.

RELATED

Stadium critics say they aren't opposed to Las Vegas dome, want better deal for public

Cowboys owner Jones urges aggressiveness in bringing Raiders to Las Vegas