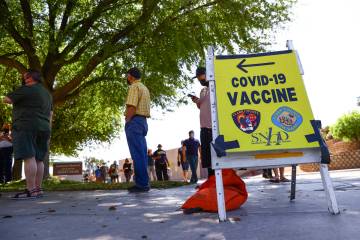

As COVID-19 cases rise, fewer tourists come to Las Vegas

Foot traffic in Las Vegas casinos is starting to slow as the number of COVID-19 cases continues to rise.

Roughly 350,000 visitors were estimated to be in Clark County casinos Saturday, the lowest Saturday count since casinos reopened on June 4, according to a Monday note from J.P. Morgan analyst Joseph Greff. More than 400,000 were in casinos the previous Saturday, and roughly 550,000 on July 4.

The analyst attributed the drop to increased COVID-19 cases in Nevada. The Southern Nevada Health District reported 1,288 new coronavirus cases in the state on Sunday, 88 percent of which were in Clark County. It was the fifth day in a row officials reported more than 1,000 cases in the county.

“We view most recent data as neutral to modestly negative,” Greff said in the report, noting that Las Vegas casinos are continuing to reopen despite the drop in visitation. He did not return a request for comment.

Bally’s, owned by the newly formed Caesars Entertainment Inc., is set to open its doors July 23. Penn National’s Tropicana is set to follow suit on Sept. 1.

‘Step backwards’

The report was based on data from Visitdata.org, which tracks foot traffic from 13 million opted-in Foursquare users.

Daily visitation in Clark County casinos during the week of July 12 was estimated to be 44 percent lower than the average rate in February, before the pandemic wreaked havoc in Nevada. The previous week, there was a 38 percent drop.

The analyst views the most recent data as “a modest step backwards” and said it was somewhat expected, given the continued increase in COVID-19 cases and declines in consumer spending.

Josh Swissman, founding partner of The Strategy Organization in Las Vegas, said in a normal year a dramatic decrease in visitation for the two weekends following a three-day holiday weekend is typical, but this drop was amplified since it was the first holiday weekend since casinos’ reopening.

Brendan Bussmann, director of government affairs for Global Market Advisors LLC, said travel restrictions in other states, quarantine mandates and limited air traffic could also hinder visitation rates.

A lack of meeting and convention business, limited traditional entertainment offerings and rising cases in neighboring states such as California and Arizona — two major sources for drive-in traffic — could also hurt numbers, said Greg Chase, founder and CEO of Las Vegas-based Experience Strategy Associates.

“It’s important to remember that the drive-in market is going to be the lifeblood of the Las Vegas casino business for the foreseeable future,” he said. “As the public continues to stay home in fear of what they keep hearing about spikes and record cases, the less they will want to venture out, especially to a city that is a melting pot of visitors mainly from current hot spots.”

He said these factors make it risky for casino operators to continue reopening properties at their current pace.

Regional vs. Strip

“The demand thus becomes thinner spread amongst the current inventory,” Chase said. “This is why you are starting to see more companies offer no resort fees and increase promotions.”

But Swissman said operators’ “tremendous insight” into future visitation volumes through future room reservations is driving them to continue to reopen properties throughout the summer.

“However, it is the lack of group, convention and business visitation that may likely cause those same operators to shut down some of their assets during midweek time frames to better match supply with demand,” he said.

While there are fewer visitors, those who do come are spending more time inside casinos. The median visit duration in Clark County casinos since reopening is 7 percent higher than the average levels in February.

Greff says this is indicative of more dedicated, “higher quality” players traveling to Las Vegas.

The report also says Strip properties are probably faring worse than those that cater to locals, which have advantages through their exposure to sports betting revenue, a stronger post-pandemic operating-expenditure structure and “better than feared” gross gaming revenue recovery levels.

“Given recent trends, we prefer regional operators such as (Penn National Gaming) and (Boyd Gaming) over Las Vegas centric operators,” Greff said.

Bussmann expects visitation rates will continue to fluctuate until the number of reported cases drops and other states end quarantine orders.

”The challenge to visitation would be if orders come down that would shut down the Strip, which would be devastating to the industry,” he said.

Chase said there will always be people willing to come to Las Vegas, regardless of regulations or case counts. But, in order for visitation rates to grow, “that depends on the larger percentage of the population who you just haven’t seen quite ready to travel yet.”

Contact Bailey Schulz at bschulz@reviewjournal.com or 702-383-0233. Follow @bailey_schulz on Twitter.