Up to 200K potentially fraudulent jobless claims filed in Nevada, report says

It’s happening from coast to coast.

Washington state lost $650 million in potentially fraudulent employment insurance claims. In Maryland it was more than $500 million.

It’s happening in Nevada, too, as the unemployment crisis has created an opportunity for bad actors to bilk another money tree.

Nevada’s agency overseeing unemployment insurance suspects that anywhere between 133,748 and 185,484 possibly fraudulent jobless claims have been filed.

“Systemic fraud has constipated the system and put additional strain on vexed people and limited resources,” attorney Jason Guinasso wrote earlier this month in a comprehensive report on the Department of Employment, Training and Rehabilitation and the claims process.

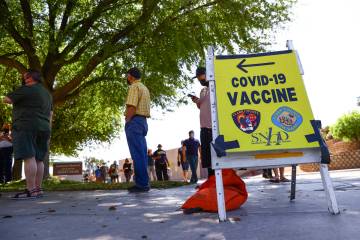

The COVID-19 pandemic has catapulted hundreds of thousands Nevada workers into the unemployment system, overwhelming DETR and causing a backlog of claims to be processed. Fraud is further contributing to delayed payments as thousands struggle to cover basic expenses.

DETR has repeatedly declined to provide any additional details on fraud or comment on the amount of money that has fraudulently been collected.

Local, state and federal officials have all identified fraud as a problem and say they are collaborating to combat what they warn are a number of schemes and scams born out of the pandemic.

National problem

Unemployment insurance fraud investigations historically made up around 10 percent of the Department of Labor’s workload, according to Derek Pickle, acting special agent in charge of the department inspector general’s office.

“Today, more than 50 percent of our investigative matters pertain to unemployment insurance, and that number continues to grow by the day, and that includes investigative matters in all 50 states,” Pickle said at a news conference earlier this month discussing fraud in Maryland.

The U.S. Secret Service formed a cybercrimes task force earlier this month. A July 9 news release indicated that Las Vegas was among 42 cities included in task force operations.

A separate release that day described “a well-organized fraud ring” massively defrauding state benefits programs and named Washington as a primary target.

Criminals use stolen personal identifying information, for example a Social Security number or home address, to file fraudulent state unemployment claims, a Secret Service representative told the Review-Journal in an emailed statement.

Fraudsters then often trick ordinary people into becoming their money mules, laundering their ill-gotten gains to protect their own identity, according to the statement.

A significant source of the nation’s fraudulent benefits claims appears to be a Nigeria-based scheme ring, according to California-based security firm Agari, which has previously investigated the group and nicknamed it “Scattered Canary.”

“As long as there’s money, they’ll target that place,” said Ronnie Tokazowski, a senior threat researcher for Agari. The scale of the fraud problem is “absolutely mind-boggling,” he said.

Agari is working with law enforcement — he wouldn’t specify which agencies — to investigate Scattered Canary’s connections to the widespread fraud.

He said he hasn’t seen evidence of Scattered Canary making moves in Nevada’s employment benefits system, at least not yet.

“Just because we don’t see anything from them doesn’t mean it’s not going on there,” Tokazowski said.

Big problem, little info

The Nevada attorney general’s office and U.S. attorney’s office formed their own COVID-19 task force in April to tackle all sorts of fraud in the state during the pandemic crisis.

A spokeswoman for the attorney general’s office declined to answer questions, citing an open investigation.

The office has previously said fraud victims typically learn that their information has been compromised when they or their employer receive a notice from DETR about a claim they never filed, just as was the case with Lisa Hack, the business manager for the Nevada Broadcasters Association.

“We got a notice from DETR saying that I, Lisa Hack, was unemployed” and that she had applied for traditional unemployment benefits after being laid off, she said. “Which, obviously, I had not.”

DETR confirmed to her that it had handed out the maximum allowed benefits backdated to March and that the applicant had used her Social Security number and date of birth, Hack said.

The department told her it hadn’t confirmed her job status with her employer because the normal waiting period for benefits was waived. She thinks the fraudster could have received roughly $20,000 in her name.

“There’s one or more people out there with all this money, and it really upsets me,” Hack said.

The CEO of the Nevada Association of Employers, Thoran Towler, told the Review-Journal that more than half of the 485 private and public Nevada employers in its membership had reported having workers fall victim to unemployment insurance fraud.

A couple of association members have reported a dozen or so employees as fraud victims, he said. One member has reported 40.

“I only heard about the ones they’re catching,” Towler said last week. “One thing that keeps me up at night is wondering how much of this they’re collecting.”

Pandemic Unemployment Assistance

DETR has said the jobless benefit system created for self-employed workers and independent contractors, Pandemic Unemployment Assistance, is particularly suspectible to fraud.

Created out of the $2 trillion federal Coronavirus Aid, Relief and Economic Security Act signed in March, the PUA provision allowed such workers to be eligible for unemployment benefits for the first time.

The program requires applicants to certify themselves as eligible for the program, but DETR has argued in court filings that it doesn’t have the authority from the federal government to require additional documentation to prove someone’s identity, leaving the program an easy target for fraud.

The employment department reported that 332,536 PUA claims have been filed since the program began accepting applications in May, according to data released Friday.

“Given the estimates of self-employment in Nevada range from about 85,000 to potentially 150,000-200,000, the rapid increases that we’re seeing in PUA seems to exceed the number of people who we would expect to be eligible for this program,” DETR chief economist David Schmidt said at a news conference last month.

At a Friday news briefing, Employment Security Division Administrator Kimberly Gaa said DETR is working with the U.S. Department of Labor and law enforcement to address fraud. She said the department couldn’t comment further on investigative efforts.

Gov. Steve Sisolak also weighed in on fraud Friday morning via Twitter. He suggested Nevadans and employers report fraud on DETR’s website, adding that the investigation was ongoing and “no further details are available at this time.”

“The State is aware unemployment fraud is a significant issue,” he tweeted. “This fraud is a felony under (Nevada law). Nevada will be investigating fraudulent claims up to & including prosecution & other civil penalties.”

Nevada officials haven’t announced any charges in their fraud investigations.

The state employment department has seen more than 577,152 claims this year, with more than 550,000 filed since the week ending March 14. It’s more claims filed than in any full calendar year in state history.

Contact Mike Shoro at mshoro@reviewjournal.com or 702-387-5290. Follow @mike_shoro on Twitter.

Information for fraud victims

Possible victims of fraud can file a complaint by visiting DETR's website (detr.nv.gov) and clicking "Fraud Reporting Form" under the "Quick links" tab.

Complaint can also be filed with the FBI's Internet Crime Complaint Center at ic3.gov.

The Nevada Attorney General's office has its own insurance fraud reporting mechanism. Visit ag.nv.gov to file a complaint.