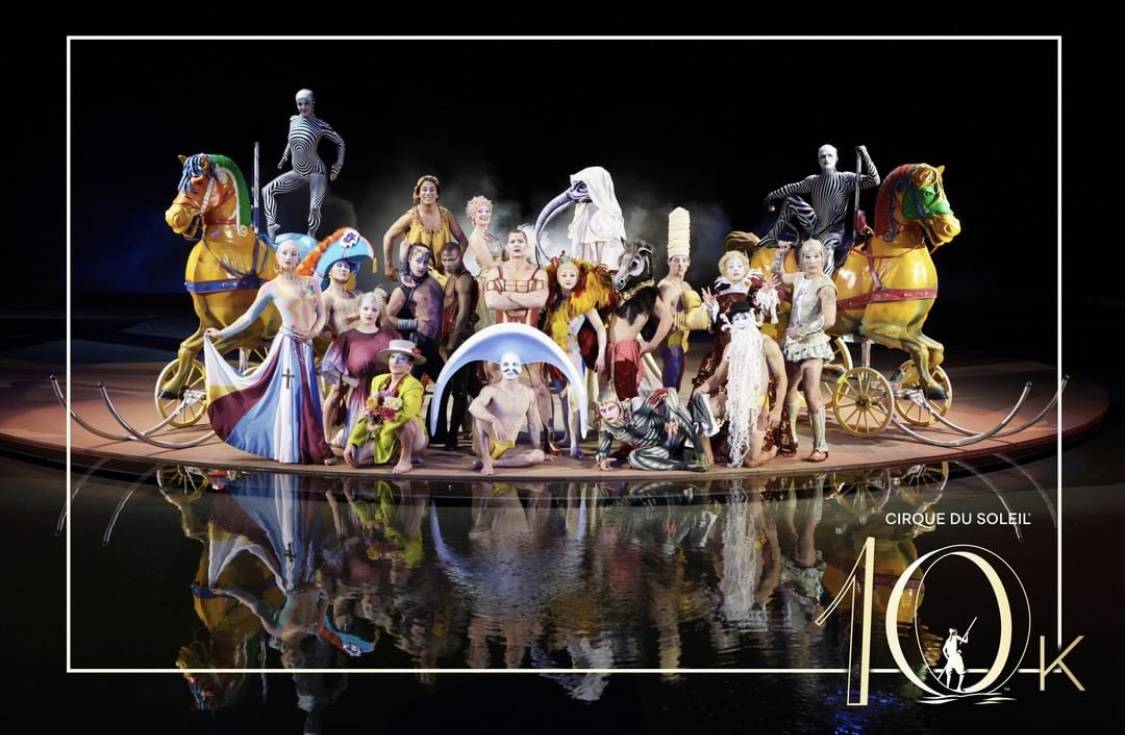

Las Vegas favorite Cirque du Soleil in financial battle

Cirque du Soleil’s shows are dark. But away from the stage, the company is performing “O”-style acrobatics to stay afloat.

Sidelined by COVID-19, Cirque is currently fielding outside offers to purchase the company, even as it has been given a $50 million infusion from its current investors, is considering bankruptcy protection and is planning to restart its Las Vegas Strip productions.

All of it, at once.

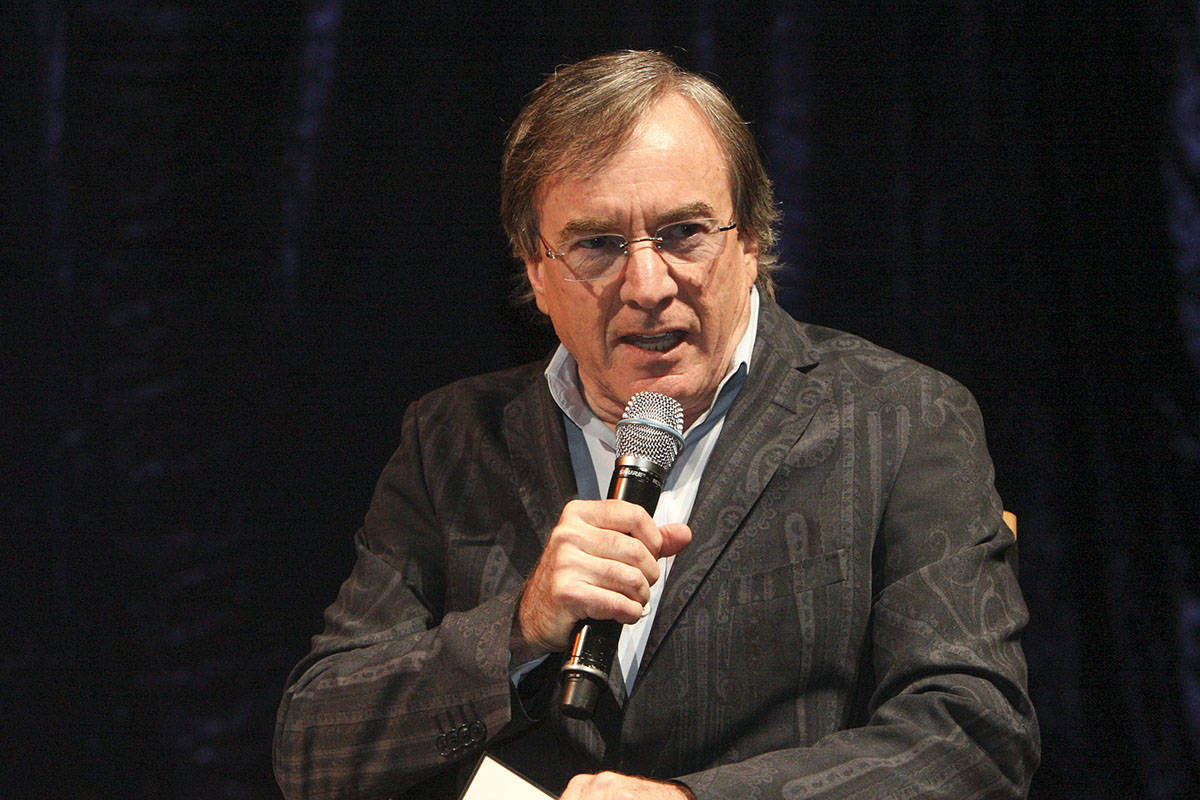

Cirque CEO Daniel Lamarre mapped the company’s ongoing revenue challenges during a phone chat last week. Most recently, the company has been thrown a lifeline from ownership partners TPG Capital, Chinese investment company Fosun and the Canadian government pension fund Caisse de dépôt et placement du Québec (CPCQ). All are multibillion-dollar entities.

Classified as “emergency funds,” $50 million split among those three interests was a message to the international entertainment community that the company plans to be back, beginning with its six shows in Las Vegas.

“The good news, though, for the Vegas situation, compared to our touring situation, is about 100 percent of our artists, the cast and crew of each show, lives in Las Vegas,” Lamarre says. “At least in Las Vegas we don’t have to deal with trying to regroup our touring people from a different side of the world.”

Lamarre says Cirque shows would be able to return to performance after three or four weeks of rehearsals, provided its theaters practice all COVID-19 safety measures implemented by their host hotels.

Cirque is following the reopening plans at Treasure Island (home of “Mystere”) and MGM Resorts International, its primary partner in Las Vegas. MGM Resorts has announced plans to start reopening on the Strip in early June. Acting CEO and President Bill Hornbuckle said in the company’s most recent earnings call that Bellagio (home of “O”), New York-New York (home of “Zumanity”) and a third unspecified property would be first to begin returning to business.

MGM’s theaters, such as those staging Cirque shows, would open later as properties gradually restart room reservations, then segments of the casino floor and smaller food and beverage areas.

Treasure Island has moved its phased-in reopening to Memorial Day weekend.

When asked if the general timeline across the Strip meant it Cirque could conceivably be back on stage in August or in the fall, Lamarre said, “That is reasonable, yes.”

Meantime, the company’s 4,700 cast and crew around the world, including 1,300 in Las Vegas, remain out of work. The company’s current financial strategy is to build an environment where the company can put its shows back on stage.

“The fact that our actual shareholders put back $50 million in the company to go through the refinancing process … that was to send a clear signal to the market and to our partners and employees that they want to remain owner of the company,” said Lamarre, who joined Cirque in 2001.

Lamarre qualified that the money has actually bought time.

“Right now we’re going to go through the process to see all the options that we have ahead of us, to bring sustainable financing,” Lamarre said, “because $50 million is quite a bit of money, but it’s far from enough to make our organization sustainable.”

The new revenue infusion was announced last week, just after the Canadian telecommunications conglomerate Québecor Inc. went public with its plans to “help save the Cirque.” The company said its plan included tens of millions of dollars to cover the payrolls for thousands of sidelined employees, along with paying vendors past-due money.

Then, in a second phase, Québecor said it was ready to invest several hundred million to allow Cirque to resume its operations.

This has not been a smooth negotiation, complicated by Québecor’s public statements that is actively planning to rescue the company, while claiming Cirque has blocked a formal review of its finances.

Lamarre and Cirque du Soleil Chairman Mitch Garber both counter that Québecor is not permitted to look at the books because it has declined to sign a confidentiality agreement during the talks.

But Québecor is not alone among potential Cirque suitors. Lamarre says there are companies interested in buying Cirque that have signed confidentiality agreements.

“There are other parties that are interested, big companies as well,” he says. “So, right now we’re going to go through the process to see all the options that we have ahead of us. … But unfortunately, the reason you’re only hearing about Québecor is because they haven’t signed yet the confidentiality agreement.”

Lamarre adds, “They didn’t sign it because I think they wanted to get some publicity before they do and that is their strategy, but all the others bidders that are interested that signed the NDA so therefore I cannot unveil their identity.”

While reviewing possible investors, Cirque since late March has been investigating Chapter 11 bankruptcy protection to renegotiate its $900 million debt load.

“Yes, it is possible we will go with that option,” Lamarre says. “I cannot tell you what percentage odds are, to use the Las Vegas terminology, but it’s a scenario. It’s one of a few scenarios that we are exploring.”

The company’s financial standing has also taken a hit from Moody’s Investors Service, which cut Cirque’s credit rating into “junk” designation, claiming a “high risk” the company would have to default on its debt.

Lamarre says that rating can and will be improved.

“One day I will come to them with refinancing in place that is robust and solid,” he says. “Obviously they will review and hopefully upgrade the rating of the company.”

Lamarre says restarting the company and putting its nearly 5,000 employees back to work “gives me a lot of energy.” He still believes in Cirque’s du Soleil’s commercial appeal and artistic equity.

“The reasons why I’m not anxious or nervous is that because the brand is so, so strong,” Lamarre says. “We have a lot of interest from a lot of people that want to make sure that Cirque will come back with a financial situation that is going to ensure not only next month, but ensure many years to come.”

John Katsilometes’ column runs daily in the A section. His PodKats! podcast can be found at reviewjournal.com/podcasts. Contact him at jkatsilometes@reviewjournal.com. Follow @johnnykats on Twitter, @JohnnyKats1 on Instagram.