Trump International sales help lead Las Vegas high-rise surge

The Las Vegas high-rise market, which slumped in 2020 amid the COVID-19 pandemic, has re-emerged in 2021 with one of its strongest first quarters ever, led in part by a surge in sales at the Trump International on the Strip.

Even the segment with closings of $1 million and above had one of its strongest quarters ever.

The strength of the high-rise market has extended into April, where the reported highest price per square foot ever paid for a Strip condo was set at The Cosmopolitan. Also, the highest high-rise sale of the year, $4.35 million, took place in April at a Sky Las Vegas penthouse.

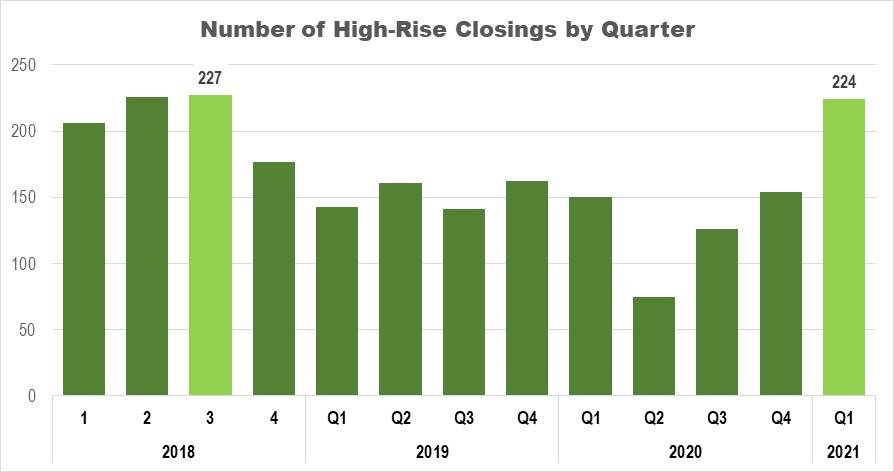

Research firm Applied Analysis reported there were 224 high-rise closings between January and March, which is less than half of the 505 for 12 months of 2020 and well above the 150 during the first quarter of 2020.

The 224 are the most sales since the third quarter of 2018, when there were 227. The firm tracks 21 high-rise towers, most of which are on or near the Strip.

“Thinking back to this time a year ago, sales activity, particularly in the resort corridor, contracted and a heightened level of uncertainty prevailed as Las Vegas Strip resorts closed their doors for 78 days,” Applied Analysis Principal Brian Gordon said. “It appears there is pent-up demand for leisure travel to Southern Nevada. It will be interesting to see how that might translate into demand for real estate within the resort corridor in the second half of this year.”

Las Vegas broker and Realtor Anthony Spiegel, a member of the Ivan Sher Group in Berkshire Hathaway HomeService, Nevada Properties, had the highest sale this year at Sky Las Vegas for $4.35 million. He said the strength in the single-family market Las Vegas that started in the second half of 2020 has spread to the high-rise market — some of it in part because of a lack of single-family home inventory but also the winding down of the COVID-19 pandemic with increased vaccinations.

“I think you’re having this slingshot sort of effect,” Spiegel said. “What you saw with traditional housing, the slingshot effect came to fruition in the third and fourth quarter in 2020. There was a time high-rise sales were down 80 percent, give-or-take. They were damaged by a pandemic. It was dense living. There was this move to the flight out of cities, high-rises and densities to places where there wasn’t much density, including the suburbs of Las Vegas.”

Spiegel said now that people’s concerns about the pandemic have waned, they still want to live in Las Vegas and want that high-rise lifestyle again. People are changing their perception of density.

“You also have a lack of single-family inventory, which is forcing people to consider condo living when they otherwise might not,” Spiegel said. “It’s a flight to Vegas and the lack of inventory on the single-family side and reconsideration of a product category, (which) because of COVID was completely discarded in 2020 over density. I think people are comfortable being communal again. We’re not completely out of the woods, but people are feeling as though they go to restaurants and shows are opening and all of these different things we didn’t do for a year we are starting to do, now — even getting in an elevator with somebody.”

Forrest Barbee, a Realtor with Berkshire Hathaway Home Services who tracks the high-rise market of five stories and higher throughout the valley, said the first four months of 2021 have been phenomenal with 396 closings. That’s up from 194 for the first four months in 2020, which isn’t unexpected given the shutdown of Las Vegas in mid-March. But what’s surprising is that it blows away the 228 sales in the first four months of 2019, 195 in first four months of 2018 and 291 in the first four months of 2017. It’s one of the best condo sales years ever with 970 closings of primarily existing units on the Multiple Listing Service, Barbee said.

Luxury sales of $1 million also stood out in the first four months of 2021, Barbee said. There were 36 such sales this year compared with 15 in 2020, 21 in 2019, 24 in 2018 and 21 in 2017.

“I think you can explain that by people moving from California,” Spiegel said. “You have a flight from San Francisco and flight from New York, Chicago and markets like that are more conditioned to a high-rise product. It’s also a flight to a more tax-friendly environment. It’s always been that way, but people who own condos generally aren’t primary residents other than One Queensridge and Park Towers. There’s a lot of transiency in the condo market. It’s an easy way to establish a domicile without having the burden of a home.”

Kamran Zand, broker and founder of Luxury Estates International, recorded a record-breaking top price per square foot for a condo in Las Vegas history during the first quarter at the The Cosmopolitan during the first quarter of this year. He said low interest rates and access to capital with confidence in Las Vegas are boosting condo sales.

“The first quarter has been great,” Zand said. “There’s no new buildings being constructed, and buyers have limited choices. It’s confidence, the vaccine and people recovering from COVID as things are opening up like restaurants and sports venues. People are less scared of it and OK with being in dense living situations now.”

Randy Char, broker and president at Char Luxury Real Estate, tied for the No. 3 sale in the first four months with a $3.8 million sale at One Queensridge Place. He said that high-rises tend to be a discretionary purchase and the pandemic put a kibosh to that. Wealthy clients were protecting themselves and their investments, but now that they’re vaccinated, the economy is recovering and the stock market remains strong, they’re coming to town, he said.

“We have seen more sales in the first four months of this year at One Queensridge Place (11 sales) than we did all of 2020 at 10,” Char said. “People are moving out of California and high-tax brackets and don’t necessarily want another house.”

Char echoed Spiegel in saying that with the lack of single-family home inventory and increasing home prices, high-rises look like more of a value and opportunity when they weren’t even looking at them six months ago. There were six sales at One Queensridge in April alone, he said.

“It tells you that people are coming out of the pandemic, they’re coming to Vegas,” Char said. “It’s not just One Queensridge. It’s a lot of the high-rises. It’s still not selling at the pace as single-family homes are but in the last 30 to 60 days have been faster as a relative increase in business. It’s a lifestyle. With the Raiders coming back (with fans at Allegiant Stadium now allowed for the first time) and entertainment coming back, you’re going to get a natural push of trying to obtain high-rises. They’re going to want to come to the Strip and look around.”

Condo pricing

The average price of condos sold in the first quarter of 2021 was $541,150 and $405 per square foot.

That’s close to the $548,166 in 2020 and $395 per square foot over 12 months.

Those are higher than the slump in the prices in 2019 when the average unit sold was $497,127, or $396 a square foot. Before that, pricing was strong in 2018, when the average closing was $583,008, or $446 per square foot.

“Pricing is a function of supply and demand, and as demand waned, pricing came down,” Spiegel said. “There’s a testament to variables in the market that never existed before. There’s a confluence of issues that are coming to a head that are telling a story of an underappreciated and historically undervalued product category. The only high-rise in the city that’s had meaningful values is the Waldorf Astoria, formerly Mandarin Oriental.

“With every other luxury building, from Park Towers and One Queensridge, there’s never been meaningful value in any of those buildings. When people thought about Las Vegas as a place to live, they never thought about living in a high-rise. That has now changed.”

Trump International

It was the usual suspects at the top of the sales list led by Panorama and its three towers with 32 in the first quarter, surpassing the 20 in the first three months of 2020.

There were 25 sales in Turnberry Place, better than the 24 in 2020. MGM Signature, a condo hotel where people also live, had 24 sales, up from 17 a year ago.

The surprise on the list in fourth place was Trump International with its 20 sales, which is 16 more than the first quarter of 2020. It had 25 sales each in the 12 months of 2020 and 2019. Trump was ranked 12th in the first quarter of 2020 and 10th for 2020 as a whole.

Spiegel said that with a condo hotel product, most people are buying a hotel unit and putting it in the pool of rooms rather than choosing to live there. Palms Place had 13 sales in the first quarter, one more than 2020 as the Palms, to which it’s attached, remains closed. Vdara, the condo hotel at CityCenter, had 10 sales, four more than 2020.

“It might be a flight to a tax-friendly state,” Spiegel said of the Trump sales increase. “People don’t tend to live in these hotel rooms. Someone who is truly moving to Las Vegas would pick a traditional product whether it’s a home or condo rather than living (at the Trump). They are used as investment vehicles or a flight to establish your domicile in Las Vegas as quickly as possible. It’s usually the most inexpensive and cost-effective way to do that.”

The average price of Trump International units sold in the first quarter was $218,375, or $363 per square foot. In 2020, the average price was $387,155, or $511 per square foot. It was similar pricing in 2019.

Char speculated the boost in sales compared with MGM Signature Palms Place and Vdara condo hotels may in some way be connected to political and brand handicapping because President Donald Trump is no longer in office and owners of units may perceive the value is tarnished by his brand after losing a presidential re-election and being impeached for a second time. Those sellers appeared to have lowered the prices they were seeking to get sales. That contrasts to a spike in Trump International sales after he announced his presidency in 2015, Char said.

“There are buyers who aren’t evaluating it from a political standpoint,” Char said. “When you are talking $200,000 for a nice hotel room, that’s a pretty good value.”

Among other high-rise sales in the first quarters:

■ Veer, 11, compared with seven in 2020.

■ Waldorf Astoria, 10, compared with three in 2020.

■ One Las Vegas, 10, compared with 14 in 2020.

■ Allure, 10, compared with five in 2020.

■ Sky Las Vegas, nine, compared with six in 202.

■ One Queensridge Place, five, compared with four in 2020.