Legal loophole allows former Nevada government employees to continue contract work in retirement

Most Nevada government employees are barred from collecting a pension on top of a public paycheck because of state laws banning double dipping to prevent abuse of taxpayer funds.

But some government retirees have found a loophole — forming a limited liability corporation or similar company to obtain government contracts — that allows them to get paid by taxpayers while still collecting a lucrative pension, a Las Vegas Review-Journal investigation found.

Within local governments, a lack of regulations and lack of disclosure requirements surrounding the practice have drawn transparency concerns.

“I’m a government transparency guy: you need to be transparent,” said state Sen. Jeff Stone, R-Henderson. “And just forming an LLC is not an appropriate way to circumvent the law.”

The Review-Journal identified at least 15 companies that appear to be run by government retirees who obtained contracts worth at least $3.3 million from state and local governments within the past five years. The owners of those businesses collected about $5 million in Public Employees’ Retirement System of Nevada benefits during the same time period.

That’s likely the tip of the iceberg.

In 2019, the retirement system pushed for a state law allowing it to withhold nearly all information about retirees, except for their names and how much money they receive in benefits. The lack of data makes it nearly impossible to confirm if people with common names also own companies that contract with the government.

Pension system staff was aware of the work-around but has not asked lawmakers to close the loophole.

“I don’t know if this was just an oversight or whether it was intentionally left out to preserve more or less what you would call a loophole,” said Ian Carr, the general counsel for the retirement system.

Stone, who sits on the Interim Retirement and Benefits Committee that oversees the state pension system, said he was not aware of the work-around allowing beneficiaries’ companies to contract with local governments without any disclosure requirements before the Review-Journal asked him about it.

He said the contracts are not within the “spirit of the law,” which prevents most retirees from working for government agencies in Nevada.

“You’re the first to bring it to my attention and believe me, I’m going to bring it up for discussion,” Stone told the Review-Journal.

‘Inconsistency’ in the law

Under Nevada law, there are only a few ways retirees can circumvent double-dipping restrictions. An elected official can earn a pension on top of their salary, and some retirees can be re-employed by a government agency if they are deemed part of a “critical labor shortage.” The governing boards of those agencies have to certify the shortage.

Nevada’s government pension system has been underfunded for years, meaning pension assets cannot cover its total liability costs. The funding ratio for the retirement system dipped to 75 percent in fiscal 2022 and has only gradually increased, up to 78 percent by fiscal 2024. As a general rule, pension funds aim for funding ratios to reach 100 percent, though many fail to achieve that benchmark.

Government entities also have increased contributions of taxpayer funds to government pensions, also known as PERS, in recent years to address the underfunding.

Unlike a 401(k) or other retirement benefits preferred by private businesses, pensions are meant to ensure a retiree has a steady stream of income throughout their life without running out of money to pay the bills.

After 30 years of work with the government, retirees can receive up to 75 percent of the average of their highest three years of salary, plus cost of living increases. Retirees who were hired before 1985 can earn up to 90 percent of their compensation.

Restrictions around double dipping exist because pension benefits are meant to act as a replacement for income in retirement, not a supplement to someone’s income from a government entity, said Geoffrey Lawrence, the director of research at the Nevada Policy Research Institute.

The state preventing double dipping while allowing for retirees to get consulting work through an LLC is an “inconsistency” in the law, Lawrence said. If a government employee sought a contract before they retired, they would be required to notify the agency of their employment to prevent conflicts of interest. But retirees are not required to make the same disclosures.

“It is an opportunity for potential fraud,” Lawrence said.

Consulting services

Records obtained by the Review-Journal included purchasing orders and contracts with vague descriptions of “consulting services.” Oftentimes, the documents did not disclose the name of the consultant or the company’s owner.

Retirees who agreed to interviews confirmed that they were not required to disclose their former employment when contracting with local governments.

The majority of the retirees included in this story received more than the average yearly pension of about $44,000 in fiscal year 2024, records show.

Former Clark County Coroner Mike Murphy retired in 2015. After a few years with the National Center for Missing and Exploited Children, he began consulting through an LLC he and his wife formed in 2014.

He received a consulting contract with the Clark County coroner’s office and was paid at least $72,000 to address problems with the agency and help the county search for a new coroner. In 2022, he was brought into the public administrator’s office to address turmoil caused by former Clark County Public Administrator Robert Telles, who was later convicted of murdering Review-Journal investigative reporter Jeff German over reporting on the office’s conflict.

Murphy said he sought out clarifications on pension restrictions when he was asked to take on the consulting roles.

“The first thing I said was, before we go into this, I’m not going to do anything that may put my PERS in jeopardy,” Murphy said.

The county paid Murphy’s company more than $159,000 for the contracts, records show. He received about $135,000 in pension during fiscal year 2024.

Murphy and others interviewed for this article said these contracts save money in the long run by allowing local governments to hire people with prior knowledge of the agency for a specific, short-term role, rather than budgeting for a full-time position.

Irene Navis, a former Clark County Fire Department assistant emergency manager, said she typically takes on government consulting work with a “very short-term contract for a small amount of money.”

Navis’ company, Navis Strategic Solutions LLC, has been paid about $24,000 over the past five years for contracts with Clark County and state agencies, records show.

Additional reporting requirements to the County Commission could increase transparency around these contracts, Navis said, but she questioned if extra disclosure is necessary.

“To bog down the process in bureaucracy kind of defeats the purpose of being able to hire somebody quickly who knows what they’re doing,” she said.

She made about $97,000 from her pension last fiscal year.

Jonathan Simon, a retired Metropolitan Police Department sergeant whose company was paid about $1 million to provide security guard services to local courthouses, also questioned the need for more transparency about these type of contracts.

“I don’t think that’s really the public’s business to be honest with you,” Simon said.

He said his company only netted around $100,000 from the contract because of costs of hiring about 50 security guards for positions at the courthouses.

His pension last year totaled about $56,000.

Continuing legal work

Nancy Lemcke retired from the Clark County public defender’s office in 2020, four years before she was appointed to head the office in May 2024. But during that interim period, Lemcke received pension benefits of about $147,000 a year while her limited liability company was paid about $265,000 from the county and state for legal services, records show.

The payments were for “track attorney” services at the county level and included post-conviction work on criminal cases, paid for by the state. It’s unclear if she continues to receive retirement benefits in her current role.

Lemcke did not respond to requests for comment.

A retired police detective also was found to have contracted with the county after his retirement.

Former Metropolitan Police Department homicide detective Clifford Mogg formed CM Investigative Consulting three months before he retired in 2023, records show. His company has since been paid about $40,000 by Clark County while he receives pension benefits of about $93,000 a year, according to expenditure reports and pension data.

Contract records show Mogg was hired as an expert witness for the Clark County district attorney’s office. He charged $150 an hour for witness testimony during Telles’ trial, when Mogg testified about investigating German’s murder before he retired from Metro.

Mogg did not respond to a request for comment.

It at least one instance, Clark County and the city of Las Vegas reached out to a former employee to solicit consulting services.

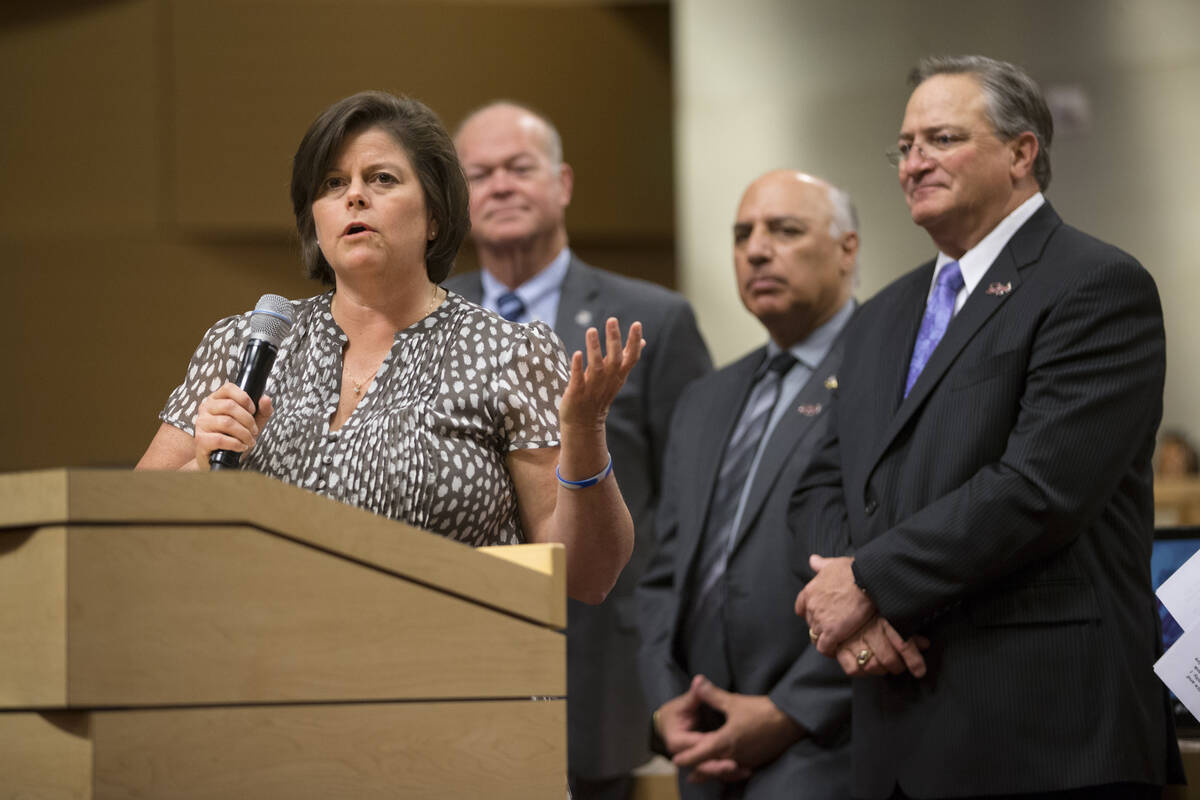

Betsy Fretwell, former Las Vegas city manager and the current interim CEO of the Las Vegas Global Economic Alliance, created C4ward Strategies in 2023 after retiring from the city six years earlier. Over the past five years, she received about $136,000 from her company’s consulting contracts with Clark County and the city of Las Vegas, records show. She also gets about $215,000 a year from the state pension system.

Fretwell’s 2024 contract with the county was for executive development services such as “professional coaching,” she said. A year prior, she was contracted by the city to provide advisory services on the Southern Nevada Economic Development and Conservation Act, a bill that has yet to be passed in Congress but seeks to free up federal land for development.

When asked if her work under the consulting contracts varied much from her role as city manager, Fretwell said her roles were similar because she had to “be able to do everything” in her prior job.

“Did I have experience doing that kind of work? Absolutely,” Fretwell said. “That’s probably why those two organizations hired me.”

Nationwide issue

States across the country have to grapple with employees who become eligible for their pensions but still want to contribute work in the public sector, said David Draine, a senior researcher on public retirement systems with Pew Charitable Trusts.

Some states take Nevada’s approach and allow for employees to return to work if they’re deemed critical. Other states offer deferred retirement, where the employee’s pension benefits are placed in a separate account they cannot access until they cease employment with the government entity.

Draine said there is little data on double-dipping restrictions across the country.

His research has not come across any pension plans that restrict former employees from obtaining government contracts through their own company in retirement.

“Really, the pension plan’s job is to take the contributions coming in from employer and employee, effectively invest those dollars so they’re available when people are in retirement, and then pay out that money,” Draine said. “It’s the public employer’s job to decide … on how do you want to manage your workforce, and how do you want to manage contracting and reaching out to people who were in your workforce after they’ve retired.”

Comparisons to double dipping

The retirees who spoke to the Review-Journal for this article all said their contract work is not the same as double dipping.

“I don’t think it’s the same,” Murphy said. “I think on first blush it can appear similar.”

Lawrence said pension beneficiaries should be allowed to form businesses in retirement, but local governments need to be alerted when a company being considered for a contract has a controlling member who is a former government employee.

Even under the critical labor exemption, governments are required to submit paperwork explaining why the retiree is being rehired, Lawrence said.

“It’s worse than double dipping because if you incorporate an LLC with a generic name, it’s kind of like you’re trying to conceal the nature of the payments,” Lawrence said. “At least with a critical labor shortage exemption there’s transparency and honesty around it.”

Contact Katelyn Newberg at knewberg@reviewjournal.com or 702-383-0240. Newberg is a member of the Review-Journal’s investigative team, focusing on reporting that holds leaders and agencies accountable and exposes wrongdoing.

HOW WE DID THIS INVESTIGATION: The Las Vegas Review-Journal obtained a list of Public Employees Retirement System recipients and matched the names with a database of officers of Nevada corporations maintained by the Nevada secretary of state. The corporations that had names of officers that matched PERS recipients then were compared to state and major local government contracting databases. Those lists then were vetted, using government contracts, LinkedIn profiles and other publicly available information to confirm that the people who owned the business entities were indeed the PERS recipients. Because of a 2019 law that limited what the state retirement system is required to release, many common names were discarded from the story because the Review-Journal was not sure they were the same person. Contracting restrictions Nevada law does not regulate retirees contracting with local governments. However, there are restrictions at the state level. Statutes prohibit state agencies from contracting with retirees if they were employed by the state in the past two years. State contracts obtained by the Review-Journal showed that potential vendors are required to document if they had recently been employed. In Clark County, only certain former high-level county officials with a controlling interest in a company seeking a contract would trigger a conflict of interest review by the County Commission — but only if that employee had retired within the past year. The county will only inquire if a vendor is a PERS beneficiary if they are contracting with an individual, not a company, according to an emailed statement from Clark County. There is no legal requirement for retirees to disclose that they are former employees when seeking a contract with Clark County, and the county does not track vendors who are former state employees, according to the statement.