Raiders practice facility changed hands twice without real estate transfer taxes

The Raiders received a big price break from taxpayers when they bought the land for their Henderson headquarters and practice facility five years ago.

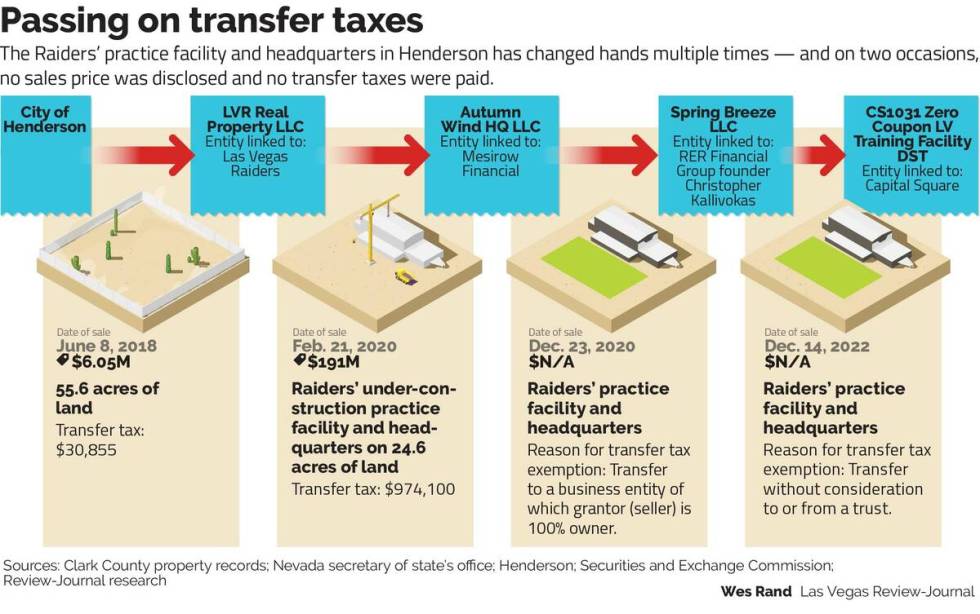

But the football complex has since changed hands twice without generating a dime of real estate transfer taxes — a fee routinely paid when people buy homes and other properties.

And while Nevada lawmakers are considering a bill to close a transfer tax loophole exposed by the Las Vegas Review-Journal last year, the tactics that avoided the tax with the Raiders facility deals would not be affected.

Chris Giunchigliani, a former Clark County commissioner and Nevada assemblywoman, said the new transfer-tax legislation is “at least an attempt to close the loophole.”

“Whose eyes should have been on this?” she said, adding she can’t recall seeing one agenda item or hearing any conversations about the transfer tax in her dozen years as a commissioner.

The recent sales did not involve the football team itself, which already had sold the compound and leased it back in a deal that did produce transfer taxes. But the last two transactions let the buyers and sellers avoid a tax that goes to Nevada’s general fund, schools, low-income housing and other services. The sales prices also were obscured from public view, a rarity in Las Vegas.

Assembly Speaker Steve Yeager, a Las Vegas Democrat who co-sponsored the bill to close the transfer tax loophole, declined to comment, writing in an email that he did not know about the situation with the Raiders’ facility. He did not respond to a follow-up email asking why his legislation targets only one exemption to the tax.

The bill leaves 13 other exemptions to the transfer tax unchanged, including the two cited in the Raiders facility deals.

The measure’s other lead sponsor, Assembly Majority Leader Sandra Jauregui, D-Las Vegas, did not respond to a request for comment.

Football real estate deals

The Raiders’ compound, 1475 Raiders Way, off St. Rose Parkway near the M Resort, spans more than 300,000 square feet. It boasts a three-story office building, indoor and outdoor football fields, a performance center with gym and locker rooms, and an outdoor pool.

The city of Henderson sold the land for the complex to the Raiders for just over $6 million, half of its market value, saying the deal would spur other economic activity.

After breaking ground on the project in early 2019, the team sold the under-construction facility in February 2020 for $191 million to Chicago financial services firm Mesirow and leased it back, property records show.

The sale was a rapid windfall for the football team before it even played its first home game in Las Vegas, earning the team more than 30 times its purchase price of the discounted land the facility occupies.

Property records show the sale generated more than $970,000 in transfer taxes. It wasn’t the last time an outside landlord acquired the Raiders’ facility, but it marked an end to these deals producing transfer tax revenue.

RER Financial Group founder Christopher Kallivokas acquired the football complex from Mesirow in December 2020, property records indicate. The deed to the property showed no sales price or transfer tax, with both listed as $N/A.

To claim the tax exemption, it stated the property was transferred to a business entity that was wholly owned by the seller.

This past week, RER’s website still stated the company owns the Raiders’ facility under a long-term lease with the team.

Virginia real estate firm Capital Square announced this past December that it acquired the Raiders’ facility, saying in a news release the deal was a “touchdown” for the company and its investors. It did not announce the terms or the seller’s name but said it acquired the property on behalf of a so-called Delaware statutory trust investment offering.

The deed listed the sales price as $N/A and the transfer tax blank. To claim the tax exemption, it stated the property was transferred “without consideration to or from a trust,” records show.

Mesirow senior managing director Garry Cohen told the Review-Journal that “due to confidentiality agreements,” he was “not in a position to share any more information than is otherwise publicly available.”

Kallivokas said that as a private investor, he doesn’t give interviews or discuss his reasons for how he structures transactions. However, he confirmed that he acquired the football facility from Mesirow and sold it to Capital Square late last year.

Capital Square declined to comment.

The Raiders did not respond to requests for comment.

Jared Smith, Henderson’s director of economic development and tourism, said the Raiders’ facility is “performing exactly like we hoped it would,” adding it draws attention to the area and entices development nearby.

Smith, who was hired by the city last summer, said he wasn’t aware of how the Raiders facility sales were structured.

Price disclosure ‘empowers consumers’

When real estate in Southern Nevada is sold, the purchase price, buyer’s and seller’s names, transfer tax, and other information are routinely listed on the deed that records the transaction with Clark County.

Luxury home buyers and other property owners sometimes hide their identity behind limited liability companies or other entities, but it seems even less common in Las Vegas for a property’s sales price to be shrouded in secrecy.

Luke Bell, director of government relations and public affairs at home listing site Zillow, said sales disclosure information “empowers consumers, helping them better assess and navigate the real estate transaction.”

The real estate transfer tax in Clark County amounts to 0.51 percent of the sales price, meaning a $300,000 house sale produces a $1,530 tax bill.

Nevada generated more than $330 million in transfer tax revenue last fiscal year, though Las Vegas has seen plenty of lucrative deals over the years that spared large companies from paying it.

Last spring, the Review-Journal reported that at least $27.5 billion worth of transactions in the Las Vegas area — comprising roughly two dozen sales involving hotel-casinos, malls and other properties mostly on or near the Strip — had closed since 2007 without any publicly reported real estate transfer taxes. In such deals, investors often acquire an entity that holds ownership of the real estate, instead of buying the property directly.

The companies involved typically announced the sales prices in news releases. Deeds filed with the county, however, routinely showed no sales price or transfer tax and frequently cited a tax exemption allowed under state law when property owners shift real estate to a subsidiary.

Legislation seeking to change that exemption cleared a key hurdle last month when the Nevada Assembly Committee on Revenue passed Assembly Bill 448. The measure would require payment of the transfer tax if a property is shifted to a business entity that was “formed for the purpose of avoiding those taxes.”

In Clark County, certain transfer tax exemptions require supporting documentation that shows who owns various business entities at the time the transaction is recorded, according to an instruction packet on the county’s website.

These documents might include operating agreements, federal tax returns, stock certificates or partnership agreements but are not made public, the packet says.

After the Review-Journal requested copies of any transfer tax exemption supporting documentation submitted to the county for the last two deeds to the Raiders’ facility, county spokesman Erik Pappa said those records were “confidential” under state law.

‘We all should be cheerleading this’

The Raiders haven’t won a Super Bowl since 1984, but their value nonetheless soared in the past decade, including since their move to Las Vegas from Oakland, California.

The team, which plays home games in a newly built stadium backed by $750 million in public funds, was valued last year at $5.1 billion, ninth highest in the NFL. That’s compared with $2.4 billion in 2017 — the year after Nevada lawmakers approved the hefty public subsidy for their new stadium — and $825 million in 2013, according to Forbes magazine.

When the Henderson City Council was considering selling 55.6 acres of city-owned land to the Raiders in 2018 for their new headquarters and practice facility, city officials and business boosters said the deal would help accelerate development in the area and attract other employers to Henderson.

Peter Guzman, president and CEO of the Latin Chamber of Commerce, told council members the sale was an “absolute no-brainer.”

“We all should be cheerleading this,” he said.

Not everyone did.

Crystal Hendrickson, then a Henderson resident, told the council it seemed like “some things going on in the city just don’t make very much sense.”

“I welcome the Raiders to Henderson as long as they aren’t building their fortunes on the backs of local taxpayers,” she said.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter. Segall is a reporter on the Review-Journal’s investigative team, focusing on reporting that holds leaders, businesses and agencies accountable and exposes wrongdoing.