Tony Hsieh’s family hired broker to sell Vegas real estate — and sold him key properties

When Brendan Keating’s brokerage firm was hired to find buyers for some of Tony Hsieh’s real estate in downtown Las Vegas, the company vowed to find the “best candidates” who would carry on the late tech mogul’s legacy.

It didn’t have to look far.

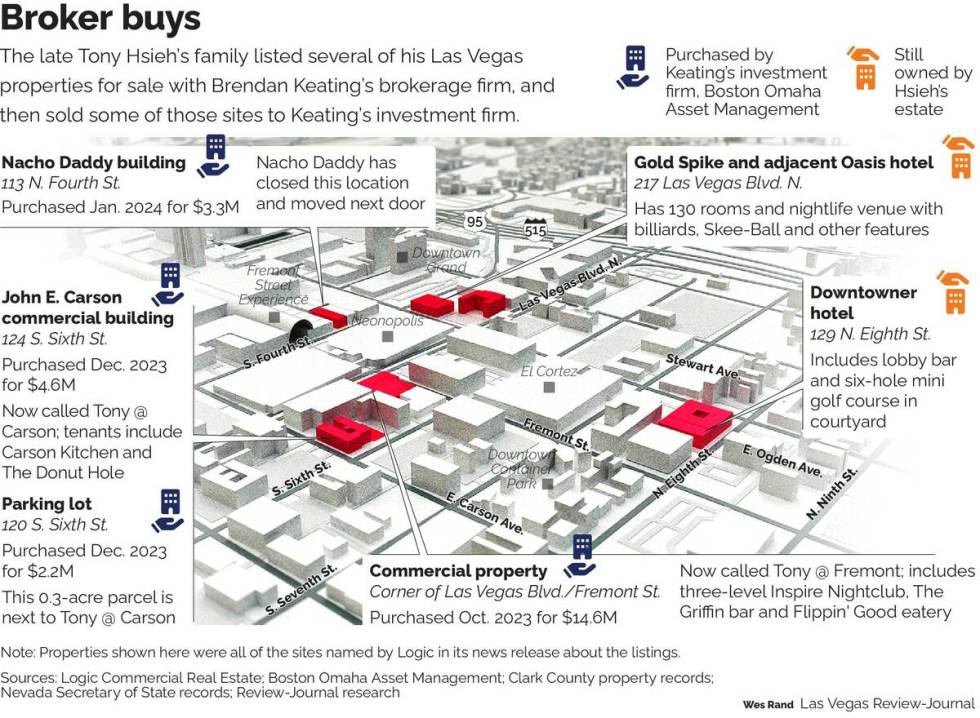

Keating’s investment firm Boston Omaha Asset Management has acquired multiple downtown properties from Hsieh’s estate for about $24.7 million in recent months, according to property and court records and business-entity filings. They were among the sites that Keating’s brokerage firm Logic Commercial Real Estate was hired to sell.

People familiar with the matter said it was surprising, even strange, that a broker purchased buildings he was hired to shop around.

Mike Mixer, chairman of commercial real estate brokerage Colliers International’s Las Vegas office, said this kind of purchase is not very common. It can be a slippery slope when brokers acquire the real estate they were hired to sell, given the appearance that they are competing with buyers, he added.

“As long as it’s done out in the open, and everyone involved has an equal and transparent opportunity to transact, it can work,” Mixer said. “However, the optics usually don’t sit well with those (buyers) who didn’t get the property. They may feel the sale process is rigged against them having to compete with a listing broker who has inside knowledge of the process.”

The plots now owned by Keating’s group account for a small share of Hsieh’s extensive real estate portfolio. But the deals include some choice properties and mark another chapter in the drawn-out effort to handle Hsieh’s estate — a task that has featured legal battles with his friends and associates and court filings with detailed accounts of Hsieh’s drug use and erratic behavior in his final year alive.

Keating, chairman and co-founder of Logic, was named a co-managing partner of Boston Omaha in early 2023, four months before his brokerage firm announced the Hsieh listings.

Logic and Boston Omaha also have the same Las Vegas office address on Hualapai Way in the southwest valley. At a panel discussion this month hosted by real estate association NAIOP, he said Boston Omaha invests in commercial real estate and that as chairman of Logic, it’s like being “the grandpa of the business,” adding he helps facilitate and guide the firm without running day-to-day operations.

Keating did not respond to requests for comment.

Hsieh, the former CEO of online shoe seller Zappos, died in 2020 at age 46 from injuries suffered in a Connecticut house fire. He did not leave a will.

His father, Richard Hsieh, is administrator of the estate and sold the properties to Keating’s group through his son’s probate case in District Court, records show.

Dara Goldsmith, an attorney for the elder Hsieh, released a statement from her client that said the estate “remains focused on improving the community that Tony loved.”

Tony namesakes

Keating’s investment firm purchased a commercial property at the southeast corner of Las Vegas Boulevard and Fremont Street for about $14.6 million in October through Hsieh’s probate case. It’s now called Tony @ Fremont in Logic’s marketing materials.

The property is in a prime location: It’s near the tourist-choked, casino-packed Fremont Street Experience and is in the thick of downtown’s nightlife scene just east of that canopy-covered corridor.

Its businesses include Inspire nightclub, The Griffin bar and Flippin’ Good chicken and burgers. The building’s exterior features a huge mural of Hsieh along Las Vegas Boulevard.

Keating’s firm also purchased the John E. Carson building — home to Carson Kitchen and other tenants — and an adjacent parking lot for $6.8 million combined in December, property records show.

The building, on Sixth Street near Fremont, is now called Tony @ Carson in Logic’s leasing materials.

Additionally, Keating’s investment firm purchased a retail building on Fourth Street near the Fremont Street Experience for $3.3 million last month.

Nacho Daddy, a locally based restaurant chain whose investors included Hsieh, occupied the building. The eatery, known for its high-piled nacho plates and scorpion shots, has closed that location and recently moved next door.

Nacho Daddy co-founder Fred Mossler, a former longtime leader at Zappos, referred questions about the move to restaurant President Paul Hymas, who did not provide any comments.

Sprawling portfolio

Hsieh, who grew up in the San Francisco Bay Area, sold an online marketing firm to Microsoft Corp. for $265 million in stock in 1998. He also was an early investor in Zappos, which moved from San Francisco to Henderson in 2004.

Amazon acquired the company in 2009 in a $1 billion-plus deal.

After the buyout, Hsieh remained at the helm of Zappos and became a one-man redevelopment engine for a stretch of downtown Las Vegas that had grappled with crime and other issues.

He moved Zappos to the former Las Vegas City Hall in 2013 and invested heavily in the Fremont Street area through his $350 million side venture originally called Downtown Project.

He bankrolled bars, eateries and tech startups and became one of downtown’s biggest property owners, buying apartment complexes, office buildings, motel properties and other sites.

Hsieh lived downtown in an Airstream trailer with a pet alpaca, had a fondness for Northern Nevada’s Burning Man festival and sported a mohawk. But after the pandemic abruptly ended his interactions, events and good times in Las Vegas, he emerged in the ski town of Park City, Utah, buying several houses there in 2020.

He was replaced as CEO of Zappos in the summer of 2020 without a formal announcement from the company. He died that November.

As part of his probate case, his family filed more than 100 sale notices in court in a two-day span in February 2021 for his Las Vegas real estate. The next month, the family submitted nearly 20 sale notices in one day for his Park City properties.

Bids would have ‘negative impact’

Logic announced in May 2023 that Hsieh’s estate hired the firm to sell several properties. In a news release, Logic President Jeff Jacobs said his team understood the significance of Hsieh’s vision for revitalizing downtown.

“With great enthusiasm, we undertake this project, committed to finding the best candidates who will carry forward his legacy and contribute to the ongoing transformation” of the area, Jacobs said.

Less than a week later, real estate brokerage Avison Young announced that it had been hired to sell several other properties in downtown Las Vegas for Hsieh’s estate.

The company declined to comment for this story.

Richard Hsieh sought court approval last August to sell the properties assigned to those two firms, along with other real estate his son owned, without the need for a judge’s OK or a bidding process.

He said in the court filing that the estate was analyzing whether would-be buyers had ties to Las Vegas and downtown, if they had the funds and knowledge to invest downtown, and if their stated use of the properties would advance his son’s vision for the area.

The estate didn’t want to just pick the highest offers, and because of the volume of transactions, a bidding process would have a “negative impact” on the sales because it would let buyers whose visions didn’t align with the estate potentially acquire property, he wrote.

Plus, the estate figured the most desirable assets would sell at or above estimated values, he wrote.

District Judge Gloria Sturman approved his request last September.

The list of properties included the Atomic Liquors site on Fremont Street. Hsieh had acquired the popular tavern’s real estate in 2014, and his father sold it back to Atomic owner Lance Johns this past October, property records show.

Johns confirmed the deal to the Las Vegas Review-Journal, saying Hsieh’s estate seems to be “very picky” about who buys its holdings.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Segall is a reporter on the Review-Journal’s investigative team, focusing on reporting that holds leaders, businesses and agencies accountable and exposes wrongdoing.

HONORING TONY

Tony Hsieh's name and memory won't fade from Las Vegas anytime soon.

Just look at one of his old properties — where taxpayers spent millions to buy back a school campus from Hsieh's estate and opened their wallets again to further honor his legacy.

The property, at the corner of Ninth Street and Bridger Avenue, is home to a city-sponsored charter school called Strong Start Academy Elementary School at The Tony Hsieh Education Center. A bronze bust of Hsieh and a mural dedicated to him were recently unveiled there.

The city agreed to spend $37,500 for the creation of the sculpture, covering half of its cost, city records show. Hsieh's family paid for the mural, said city spokesman Jace Radke.

Hsieh had acquired the property from the city for $1.5 million in 2012, records indicate. His side venture Downtown Project, now called DTP Companies, opened a private preschool there in 2013.

Hsieh's estate sold the property back to the city in 2022 for $7.2 million, records show.

Radke said the property was neither renovated nor suitable for a school back in 2012, and he noted that Hsieh put $2 million into the complex.

When the city repurchased the site, it was ready for use as a school, and property values had climbed significantly, he said.

Radke also confirmed that Hsieh's family required the city to name the school after the late tech mogul as part of the purchase agreement.

— Eli Segall