Weak safeguards make Nevada companies easy targets for fraud

This has to be a mistake, Andy Pham thought.

It was November 2016. Pham’s assistant was updating the Idaho-based property developer’s business records with the Nevada secretary of state. Everything looked good until she got to Caballos De Oro Estates LLC, a company that held five acres that Pham and a group of investors purchased in northwest Las Vegas for $4.95 million.

Someone apparently had logged onto the secretary of state’s website and removed Pham’s name as the company’s managing member. In his place: James Kalhorn, a Colorado Springs dentist.

Pham told his assistant to change it back and send Kalhorn a cease-and-desist letter. That should take care of it, he figured.

Four months later, Pham got a foreclosure notice in the mail. Kalhorn had moved the land into another LLC, borrowed nearly $2 million on it from private lenders and was now in default.

CLICK TO ENLARGE

Pham didn’t think it was a mistake anymore. He thought it was fraud — and he filed a lawsuit.

His story highlights how Nevada businesses are vulnerable to fraudsters because the secretary of state’s office for years has done little to prevent the filing of fake documents.

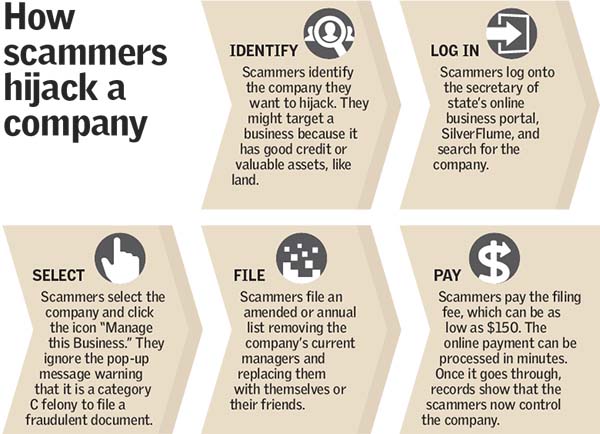

For as little as $150, anyone can submit records online or in person naming themselves directors or managers of whatever Nevada company they choose — and the secretary of state’s office will accept them, no questions asked.

Once the records are changed, scammers can exploit the credit and assets of the companies. Cases in Nevada and other states show how alleged thieves used phony business ownerships to buy cellphones and luxury vehicles en masse and sold off land. These scams rely in part on lazy lenders who give credit applications and other financial transactions little scrutiny.

By the time the rightful business owners realize what happened, it can be too late, and they’re saddled with bad credit or have to fight to get their property back.

The lack of safeguards poses hidden risks in Nevada, one of the most popular states to register companies because of its friendly business laws and low taxes. Secretary of State Barbara Cegavske’s efforts to recruit businesses to Nevada help generate about $180 million in filing fees for the state each year. More than 1.1 million active and inactive business entities are on the secretary of state’s books — and all of them are susceptible to fraud.

“It’s a serious issue,” said Jodi Grover, president of Southern Nevada operations for Ticor Title of Nevada. Title companies like hers are responsible for vetting real estate transactions and verifying property ownership, so she warned her employees about this problem when she learned about it more than a year and a half ago. “If you own your property in an LLC and then somebody fraudulently puts their name as the managing member, that would give them the authority — fraudulently — to sell your property,” she said.

Officials with the secretary of state’s office said it does everything within its authority to prevent the filing of fraudulent documents, but their power is limited under state law and there are few complaints. In a statement, the agency said it is “disingenuous” to blame the secretary of state for any loans issued or land sold as a result of fraudulent business filings because lenders and buyers need to do their due diligence.

“There are people that are not going to play by the rules,” Cegavske said in an interview. “We try to find them as we can. We look for them as we are able.”

Like most secretaries of state, Cegavske and her staff lack the legal authority to challenge the accuracy of any business document filed with their office. Her staff only ensures forms are filled out correctly. Filers do not have to show identification, and no notarized documents are required.

But state law allows the secretary of state to adopt regulations to prevent the filing of fraudulent records.

Nevada lags other states in its protections against business identity theft, and the secretary of state says “there is no process” to initiate searches for falsified records. The office typically learns about them through complaints from the public, and experts say business owners are reluctant to admit they have been scammed.

From 2015 through 2017, Cegavske’s office received at least 173 complaints about fake filings. In only one case did the secretary of state find fraud. Under Nevada law, it is a category C felony to file a falsified business document.

The secretary of state has the option of referring complaints to the Nevada attorney general for civil or criminal prosecution, but it did not have to in the one case, because the potential victim already had contacted law enforcement. The attorney general’s office said it received no referrals from the secretary of state from 2015 through 2017.

The Las Vegas Review-Journal requested complaints about fraudulent filings since 2012, but the secretary of state’s office said it only had records dating to 2015.

Among the other complaints, agency officials corrected records and ended their probes in 35 cases after investigators received no response to their inquiries from possible scammers.

Cegavske’s office dismissed 46 complaints because it determined the alleged victim knew the potential fraudster. Secretary of state officials say they do not have the authority to resolve disputes in which the parties know each other.

“That doesn’t make sense to me,” said Austin Wyatt, who helped his 70-year-old father file a complaint last year after they learned an unauthorized business trust had been established in his father’s name.

Wyatt said the trust was established by a person his father had hired to draw up a living will. Wyatt said his father never had that will notarized, because an attorney reviewed it and found the person was attempting to steal his property.

Wyatt was outraged when the secretary of state dismissed their complaint. “If somebody is trying to rob me, whether I know who it is or not, you should be trying to help me,” he said.

A few clicks

The Nevada secretary of state has had problems with fraudulent business filings for years.

In 2008, an Orange County, Calif., businessman filed a lawsuit after his name was improperly removed from documents on file with the secretary of state’s office and his consulting company was sold without his knowledge. One of the defendants later gave the company back to him, court records show.

In 2011, a woman allegedly submitted false records to the secretary of state’s office naming her an officer of a Las Vegas company. She then reportedly used the company’s credit to purchase three new vehicles worth a total of $177,000. The Nevada attorney general filed criminal charges against her, but she was never arrested.

And in 2014, a Las Vegas-registered technology company said in a news release that an unauthorized person had logged onto the Nevada secretary of state’s website and changed the names of its officers. A day later, someone used that information to switch the company’s online password with the Securities and Exchange Commission. The company warned that the new password could have been used to submit fake SEC filings.

Attempts to interview Ross Miller, who was Nevada’s secretary of state from 2007 to 2015, were unsuccessful.

Filing through the secretary of state’s online business portal, SilverFlume, is particularly easy. Scammers can upload documents with just a few clicks. The only possible deterrent is a pop-up message that says submitting a false document violates state law.

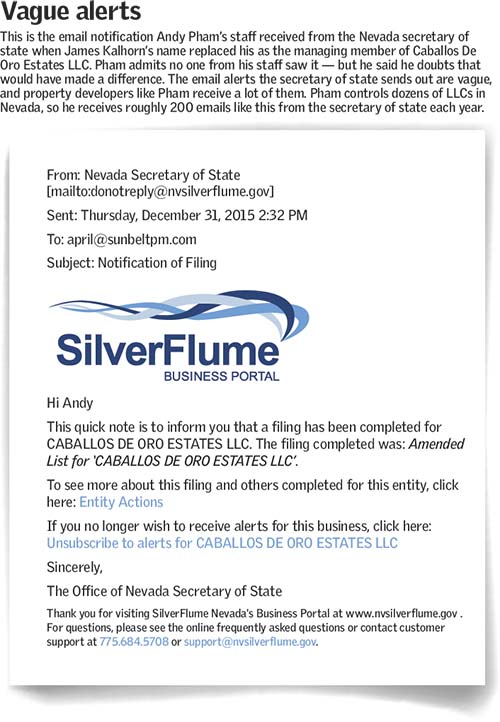

Nationwide, states have tried to stop such fraud by warning businesses when new records are posted for their companies. Nevada and many other states offer email alerts for business owners and registered agents who sign up for them.

However, Nevada’s notifications are lacking. Unlike New Mexico, for example, Nevada does not warn business owners when a paper filing is submitted. Alerts go out only if a document is filed online.

And warnings are only sent by email, which can get lost in spam folders. Hawaii, Louisiana and Vermont allow businesspeople to sign up for alerts delivered by text message.

Like the email alerts of many states, Nevada’s are vague, merely telling business owners a document has been submitted for their company. Utah’s alerts are more detailed. They specify the information that was updated, such as the removal of an officer or the listing of a new address.

Secretary of state officials say they are developing a commercial filing system that will provide better alerts. But business owners complain that email alerts alone do not provide enough protection.

“By the time you send out a notification email that things have changed, it’s too late. What if you’re out of the country? What if you’re otherwise preoccupied with something else?” said Jason Lamberton of Chino Hills, Calif., who complained to the Nevada secretary of state in 2017 that someone changed the ownership information twice for the flight school he owned.

The secretary of state did nothing about Lamberton’s complaint. “You know, 9/11 is still in the forefront of our minds,” he said.

“If you can log in and take ownership of an aviation company without proving anything to the state at all, that’s really concerning from my point of view.”

Several states offer more protections than Nevada.

At least five states, for example, allow business owners to establish passwords or personal identification numbers for their companies. Documents cannot be submitted online for those businesses without the passwords or PINs.

In Louisiana, anyone who files business records in person must show identification. In Georgia, the secretary of state may search for other documents submitted by suspicious filers. The North Carolina secretary of state has the legal authority to question the accuracy of information filed with the office — and it oversees at least 40 percent more active businesses than Nevada.

Colorado is one of the most aggressive states in fighting business identity theft. It was one of the first to implement a password system for online filings, and some of the money it charges for lien filings is used to fund fraud investigators.

Since 2010, the Colorado Bureau of Investigation has reviewed 1,326 incidents of business identity theft. Often these investigations lead to suspects outside Colorado. One recent case, for example, involved a Boulder City woman who is alleged to have hijacked 107 registered Colorado businesses and used their credit to purchase more than $255,000 in cellphones and accessories. Some of the phones eventually were activated in China, Iraq and Vietnam.

Nevada Chief Deputy Secretary of State Scott Anderson said his office’s filing system is wide open because the agency has no power to determine who is authorized to submit records for a business.“Things change within a business,” he said. “There could be a change in officers. There could actually be a change in ownership.” The secretary of state doesn’t have the ability to sort that out, he said.

Anderson, who has been with the office since 1997, said he is not aware of any efforts to change state law and give the agency legal authority to verify the accuracy of business information filed with the office. He said the Legislature and the business community have generally viewed such investigatory power “as a barrier to commerce.”

Cegavske said providing greater scrutiny of business records would require more staff, and she does not know if that would be worth it, given the relatively few complaints her office receives about fraudulent filings. But if the Legislature wants more safeguards, she said, “we will work with them in the next session.”

Cegavske said the new commercial filing system her office is developing will provide better services for businesses.

“It’s not anything we’re taking lightly. We take it very serious and we are trying every, every opportunity to make it better.”

Andy Pham’s big mistake was talking about Caballos De Oro Estates LLC, the company that held the land he and other investors purchased in Las Vegas in 2005. They waited to develop the land for years, hoping property values would rise. Periodically, while he worked on other projects, Pham talked to people about Caballos to see if they had any ideas about what to do with it.

One person he told was Csaba Meiszburger, a Las Vegas entrepreneur. According to court records, in 2015, Meiszburger described the property to two convicted criminals: his good friend Jihad Anthony Zogheib and a man they had recently met, Robert Krilich Jr. Krilich said Meiszburger and Zogheib claimed Pham was their “front man” and that the property was secretly theirs. He said the pair needed money and asked him to find someone who could qualify for a loan to take over the property.

That’s where James Kalhorn came in. Krilich said he asked his friend, a Colorado Springs dentist who records show has a history of falsely billing patients and insurance companies, to take ownership of Caballos and obtain a loan. Krilich said he watched Zogheib log onto the secretary of state’s website and change the managing member of Caballos from Pham to Kalhorn in December 2015. Meiszburger and Zogheib deny the story.

Kalhorn then took out two loans on the property from private lenders totaling $1.75 million. Later, he moved the land into a new LLC, Prometheus & Atlas Real Estate Development, and listed it for sale for $2.6 million.

Pham said he knew nothing about the changes until he received a foreclosure notice in March 2017. He immediately filed suit to stop any sale of the property. The case has been tied up in court ever since.

In court records, Kalhorn said he is the victim. He claimed the property was rightfully his and that Pham colluded to defraud him.

However, Kalhorn’s story has inconsistencies. He said in court records that he had never met Pham. But in January 2017, the secretary of state received an email from “James Kalhorn” indicating he had once met Pham at the Suncoast, the message said. Kalhorn’s attorney told the Review-Journal that the email was sent from an account Krilich created in Kalhorn’s name — a charge Krilich denies.

Pham, meanwhile, filed a complaint with the secretary of state, but Cegavske’s office rejected it after seeing the email that suggested Kalhorn had met with Pham. Anderson, with the secretary of state’s office, said he is not aware of anyone at the agency checking to see if the January 2017 email was true. But he said the agency later learned about Pham’s lawsuit and forwarded the case to the attorney general’s office in March, two months after the Review-Journal started asking about it.

The attorney general’s office said it could not confirm or deny an investigation into the matter. Pham said he was never told his problem was referred to law enforcement.

Pham now expects to spend a quarter-million dollars fighting in court to get the property back and resolve the dispute.

“I blame the Nevada secretary of state for not protecting business owners,” he said.

Contact Brian Joseph at bjoseph@reviewjournal.com or 702-387-5208. Follow @bjoseph1 on Twitter.