What Americans don’t understand about Social Security

How much — or little — you know about Social Security can have a huge impact on your post-retirement finances. That’s especially true if you’re among the 64% of Americans with less than $10,000 in retirement savings, according to a 2019 GOBankingRates survey. What’s more: 46% claimed to have no savings at all.

See: 16 Effective ways to trick yourself into saving money

A lack of savings was the primary reason Social Security was founded in the first place. In the height of the Great Depression, many older Americans were left penniless and without means to retire or even house themselves. The 1935 Social Security Act ensured that, even if older Americans had no savings or pension, they’d still have some form of income to help keep them afloat in their later years.

To better understand how well-versed Americans are about the ins and outs of Social Security, GOBankingRates polled over 1,000 individuals on six questions to test their knowledge. Although the respondents were pretty evenly split between men and women, over 40% were between the ages of 55 and 65-plus, while just 28% were 34 and younger.

Take a look at how much Americans really know about Social Security.

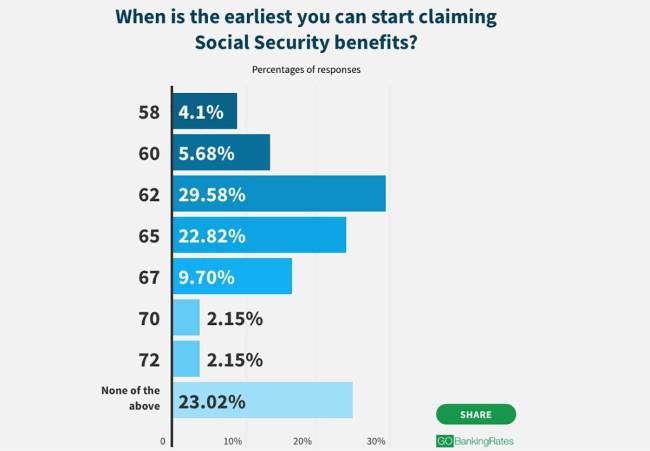

Majority of Americans don’t know when you can start claiming benefits

Just 30% of respondents gave the correct answer to a question about the age at which you can start collecting Social Security benefits. Twenty-three percent of respondents thought you can collect at age 65; nearly 15% placed it at ages 67-72; around 10% thought it was at 58 or 60, and 23% answered “None of the above.”

It’s a bit alarming that only 3 out of 10 respondents identified the Social Security eligible age as 62. As one might expect, the older respondents answered this one correctly more often than the younger respondents did, and the oldest group had the highest percentage of correct answers overall.

Although the difference by gender was small, more women (32%) answered this question correctly than men (27%).

But they do know the average Social Security benefit amount

Respondents fared better on a question about the average monthly Social Security benefit for retirees, with over 50% choosing the correct ranges: $1,001-$1,500 and $1,501-$2,000 per month. The actual average monthly check is $1,514, according to the Social Security Administration.

Make smart moves: 11 Social Security mistakes that can cost you a fortune

Older respondents fared better overall

Respondents ages 65 and older scored highest, with 61% choosing one of the two possible correct answers, and respondents ages 55 to 64 came in second with around 59% answering correctly.

Incorrect answers among younger respondents suggest that a good number of them underestimate the average benefit amount; or perhaps they’re already preparing for Social Security to run out. Among the 18- to 24-year-olds, nearly a quarter thought the average check was under $500 per month.

Make a retirement savings plan: How to create a budget

Men and women were roughly on the same page

Women may have a less optimistic view of what their retirement years will look like financially, and with good reason. In 2017, the average monthly Social Security check for a man was $1,503, whereas for a woman it was only $1,196. This is at least partly explained by the gender wage gap — the fact that working men tend to make more money than working women, which later reflects in the size of their Social Security payments.

Although roughly the same number of men and women chose the correct ranges for an average Social Security check, more women chose the $1,001-$1,500 option than the $1,501-$2,000 option. Moreover, 24% of women selected the $501-$1,000 answer, compared to only 13% of men who thought the same.

Americans struggle to sort out certain Social Security rules

The survey results indicate that there’s a lot of confusion around how Social Security benefits operate. Many respondents did not understand how Social Security benefits work for disabled people, or that Social Security pays evenly between men and women. Additionally, one-fifth of respondents believed that only one spouse can collect Social Security benefits at a time.

Many are not quite up to speed on Social Security disability

Today’s 20-year-olds have more than a 25% chance of becoming disabled before they reach age 67, the Social Security Administration reported. However, the 18-24 age group was one of the least likely to know that you can receive Social Security benefits if you’re disabled as long as you worked in jobs covered by Social Security. The other age group that lacked knowledge in this area was 55- to 64-year-olds.

In the event you’re not quite up to speed on this particular aspect of Social Security disability, no worries — the Social Security Administration has you covered. Once you reach your full retirement age, your Social Security disability benefits automatically convert to retirement benefits, and the amount stays the same. Respondents in the 65 and over age group scored the best on this question, with 41% of them answering correctly. Slightly more women than men answered correctly, at 38% and 37.20%, respectively.

Good To Know: Tips to live comfortably off just a Social Security check

Social Security spousal benefits were also unclear

An astonishing 43% of respondents didn’t know that you could receive Social Security benefits in conjunction with your spouse — that is, if you’ve worked at a job covered by Social Security.

Eleven percent answered that they could receive benefits even if they’ve never worked at a job covered by Social Security, and another 11% responded that they could receive these benefits at any age. Over one-fifth of respondents believed they could not receive any Social Security benefits if their spouse was already receiving them.

Thankfully, this means that 57% of respondents answered correctly.

Women were a bit more likely to be right about this question. Over 58% selected the right answer as opposed to 56% of men, and only 18% of them selected the outright “No, I cannot receive any benefits” answer, as opposed to 24% of men.

Correct answers followed a predictable pattern across age groups, with 18- to 24-year-olds scoring lowest, with only 42% answering correctly, and the 65-plus group scoring highest, with 65% knowing the right answer.

Do men and women receive different benefit amounts?

This question tripped up around 41% of respondents, 5% of which answered that women made more in Social Security money, and 36% of which answered that men made more.

Survey question: If a man and woman have identical earning histories, which one will receive the higher Social Security check?

Nearly 60% said the man and woman will receive equal amounts, which is the correct answer.

However, 35.65% said the man would receive more and 5.4% said the woman would receive more.

The true correct answer is that, with identical earning histories, the man and the woman will receive the same amount in Social Security money. The Social Security Administration does not discriminate based upon gender. However, the same can’t be said for society in general.

A 2020 study on the gender pay gap by PayScale revealed that women are earning 81 cents for every dollar made by men. This translates to $900,000 lost on average over a 40-year career; which is actually a much bigger loss when you factor in the potential interest that could’ve accrued over that four-decade period.

So even though men and women who earned the same salaries will make the same in Social Security, men on average do receive larger Social Security checks than women. In that context, 36% of respondents who answered “The man” may have been onto something.

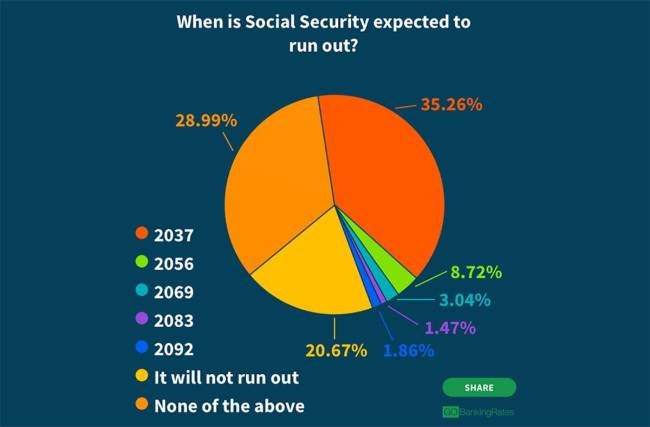

Many believe Social Security will never run out

When asked what year Social Security is expected to run out, over one-fifth of respondents answered, “It will not run out.”

This is a troubling belief to possess, given that the Social Security Administration acknowledges its reserves will be depleted by the year 2037. Other sources, such as AARP, place that time nearer to 2035. Although this doesn’t signify the total end of Social Security, if taxes stay where they’re at, beneficiaries will only receive about 76% of their scheduled benefits.

It may also become harder for the SSA to pony up the money for retirees if so many working Americans continue to be out of jobs.

Respondents in the 35-44 and 55-64 age groups were the most correct on this question, with 43% and 42% selecting the right answer, respectively. Interestingly, almost one-quarter of 55- to 64-year-olds went the opposite way, answering that Social Security will never run out. Meanwhile, 27% of those 65 and over believe they don’t need to worry about their Social Security checks.

As far as gender goes, more men (22%) than women (20%) believe that Social Security will never run out, and more women gave the correct answer, although by a very marginal amount.

Americans need to brush up on their Social Security knowledge

Many Americans are woefully unprepared to take full advantage of the Social Security benefits they’ve earned. And given that 64% have less than $10,000 stashed in retirement savings, it seems more important than ever that they understand how Social Security works.

Overall, respondents didn’t have a good grasp on spousal or disability benefits, and a sizable chunk believed that Social Security will never run out. Unfortunately, it may come as a shock to them when their benefit amounts drop by nearly 25% — something currently projected to happen in 2037.

Most concerning was the fact that only 30% of survey takers knew the age at which they can start receiving Social Security benefits. Unless Americans want to lose out on this money, they need to educate themselves on when they’ll be taking Social Security and how much of their income it’ll represent.

A good way to start is by creating a “my Social Security” account on the Social Security Administration site. It’s a convenient way for future beneficiaries to learn more about Social Security and how it fits into their retirement planning. More importantly, it allows you to view your Social Security statement and an estimate of your future benefits.

More From GOBankingRates

How long $1 million in savings will last in every state

27 ugly truths about retirement

Daria Uhlig contributed to the reporting for this article.

Methodology: GOBankingRates surveyed 1,021 Americans aged 18 and older from across the country between Sept. 9, 2020, and Sept. 10, 2020, asking six different questions: (1) When is the earliest you can start claiming Social Security benefits?; (2) What is the average Social Security benefit amount?; (3) If a man and woman have identical earnings histories, which one will receive the higher Social Security check?; (4) When is Social Security expected to run out?; (5) If your spouse receives Social Security (SS) benefits can you also receive benefits?; and (6) Can someone receive Social Security (SS) benefits if they’re disabled?. GOBankingRates used Survata’s survey platform to conduct the poll.

This article originally appeared on GOBankingRates.com: Americans don’t understand these facts about Social Security