Las Vegas economy, rocked by pandemic, faces end of federal benefits

Susan Marsian-Bolduc is the outdoorsy type, having bought a 14-foot travel trailer last year to hitch to her car for camping trips.

The Las Vegas tour guide was furloughed because of the coronavirus pandemic. With the job market bleak and federal unemployment benefits set to end this month, she fears not being able to make rent — and having to move into her $8,500 camper.

“I’m 54 years old. … I should not be in this position,” Marsian-Bolduc said.

The $2 trillion-plus federal Coronavirus Aid, Relief and Economic Security Act, approved in March after the pandemic shut down much of the economy virtually overnight, has provided $600 per week to masses of unemployed workers on top of their regular state unemployment benefits. The $600 payments are scheduled to expire at the end of this month unless renewed by Congress.

The possible cutoff could wipe out the vast majority of income for unemployed Nevadans, raising fears that Las Vegas’ badly battered economy could be dealt another blow at a vulnerable time.

Coronavirus cases have been surging, tens of thousands of furloughed hotel-casino workers could be permanently laid off, and the state’s temporary ban on evictions and foreclosures is winding down, raising the prospects of lockouts and increased homelessness.

“I have a concern with taking money out of folks’ hands that are getting it right now,” Gov. Steve Sisolak told the Review-Journal on Wednesday. “Our unemployment is higher than anybody else’s.”

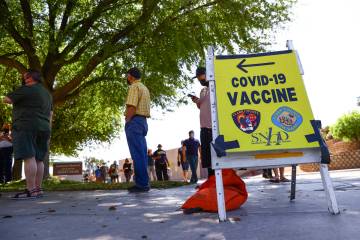

Spiking cases

Nevada recorded 1,004 new cases of COVID-19, the respiratory disease caused by the new coronavirus, according to data posted Friday. The infection tally was well above the daily average of roughly 740 cases over the preceding week and marked the second-biggest daily increase in Nevada since the outbreak began.

Workers have returned to their jobs, but the economy has already faced a setback amid the heightened caseload. Citing the increase, Sisolak on Thursday ordered bars that don’t serve food to close again Friday.

Meanwhile, several local resorts are still closed, and it’s unclear how long it will take for tourism-dependent Southern Nevada to recoup its enormous job losses, which have likely made the valley especially dependent on the federal benefits.

Las Vegas’ unemployment rate, just 3.9 percent in February, was 29 percent in May, by far the highest among major metro areas. Nevada’s jobless rate, 25.3 percent, topped all states and Washington, D.C., federal data shows.

All told, the Nevada Department of Employment, Training and Rehabilitation has paid out more than $4.3 billion in state and federally funded unemployment benefits since the start of the pandemic, “far higher” than all benefits paid in 2009 and 2010 combined during the Great Recession, according to Dave Schmidt, the department’s chief economist.

Nationally, the extra $600 in weekly benefits raised incomes by an annualized $842 billion in May, the Economic Policy Institute recently reported.

Las Vegas consultant John Restrepo, founder of RCG Economics, noted that the U.S. economy is fueled by consumer purchases, and jobs are not coming back strong.

“You need something to stimulate that spending,” he said.

Nancy In, of Las Vegas, filed for unemployment insurance benefits the first week of April. She expected to go back to her job at a Marriott hotel near the Las Vegas Convention Center on May 26 but learned a week before that her furlough would be extended until October.

In Nevada, traditional unemployment filers can receive $181 to $469 per week in state benefits, well below the federal supplement.

“I have to really hang on to that additional $600 … and who knows, my furlough may be even longer,” In said.

She is also taking care of her mother, who requires dialysis three times a week. In said her mother, who lives in Hawaii, flew to Las Vegas in December to visit with plans to leave in April. But with the spread of the coronavirus, she is still here.

“It’s been an extra expense because I’m also paying for her medication, for food and all of that,” In said.

Shedding workers

Sisolak ordered casinos and other Nevada businesses closed in March to help contain the virus’ spread, turning the Strip into a virtual ghost town. Casinos were allowed to reopen June 4 after more than two months on lockdown, but the industry, the backbone of the local economy, won’t fully recover from the turmoil anytime soon.

As seen in state records, tens of thousands of local hotel-casino workers have received notices since the pandemic hit that their employment could end.

The notices, sent directly to furloughed staffers, comply with the federal Worker Adjustment and Retraining Notification Act, which is meant to ensure that employees have notice before significant layoffs so they have time to find work elsewhere.

In May, for instance, more than 36,600 MGM Resorts International workers received notice that they could be laid off Aug. 31.

MGM spokesman Brian Ahern did not say whether those layoffs are still looking likely.

“We are hopeful that the industry will continue recovering, business demand will continue rising and we can welcome back many more employees soon,” he said.

More than 6,400 Station Casinos workers were given notice of layoffs that would occur in May. A spokesman for Station declined to comment.

Meanwhile, Boyd Gaming Corp. notified more than 5,800 employees in May of layoffs to come in the first two weeks of July.

Boyd spokesman David Strow said “not all team members who received this letter will be laid off. We do not have any additional information to share at this time.”

Bradford Cook Jr., a lead electronics technician at MGM Grand, was furloughed in March as the valley rapidly shut down and hasn’t been called back yet. The $600 weekly federal benefits, on top of his roughly $470 weekly state benefits, are “really what’s been keeping me afloat these few months,” he said.

A 40-year-old Navy veteran from Detroit, Cook rents a house for $1,360 per month and has “barely” been able to cover those payments during the pandemic.

He noted that the new coronavirus is resurging in Nevada and could spark more job losses, and if nothing is done about the federal benefits, people won’t be able to pay their mortgage or rent.

“What are you going to do, have everyone on the street?” he said.

Fears of homelessness

Across the U.S., unemployment benefits have been a “lifeline” for renters, but if funds go away, the country “could be headed toward historic dislocations of renters and business failures among apartment firms, exacerbating both unemployment and homelessness,” National Multifamily Housing Council President Doug Bibby said in a recent news release.

In Las Vegas, there was already pressure on the housing market before the pandemic hit, as rents were rising faster than wages, said Pete Aldous, a staff attorney for the Legal Aid Center of Southern Nevada.

The threat of increased homelessness is “much worse now,” he said.

Sisolak froze evictions and foreclosures after the pandemic hit. He ordered a gradual lifting of the moratorium June 25, clearing the way for residential repos and evictions to resume in full Sept. 1.

“Eventually, they are going to get evicted, unfortunately,” Aldous said of cash-strapped tenants. “You can’t continue forever without paying rent.”

Government agencies are offering financial help as the moratorium winds down.

State Treasurer Zach Conine’s office has been working on a rental assistance program. Funded with federal coronavirus relief money, it would offer $30 million for residential rental help and $20 million for commercial property rents.

Clark County officials are creating a program to provide rental, mortgage and utility assistance to households financially affected by the pandemic, county spokesman Dan Kulin confirmed.

Meanwhile, the city of Las Vegas launched a grant program July 1 to provide up to three months of mortgage or rental assistance to people who lost income because of the pandemic.

Arcelia Barajas, deputy director of the office of community services, said city officials are trying to prevent evictions and keep Las Vegas’ homeless population, which “we’re already struggling to serve,” from growing.

City officials had expected 500 applications per week for the assistance program, Barajas said. Around 500 came the first day.

Southern Nevada nonprofits are bracing for increased demand when the federal benefits expire.

Three Square food bank’s chief operating officer, Larry Scott, said demand for food can fluctuate from month to month. But when something as large as the CARES Act no longer provides funding for families, “we know that will create a regular, increased demand on the food banks to be a source for the needy,” he said.

Three Square relies on federal commodities from the U.S. Department of Agriculture to keep its supplies well-stocked, but that could change if a coronavirus food assistance program that is part of the CARES Act ends.

“We receive in excess of a million pounds of food a month from that federal program,” Scott said.

Packing up

Marsian-Bolduc, the tour guide, was furloughed as the valley shut down. She filed for traditional unemployment insurance in March, but after switching to the independent-contractor system, she started receiving state and federal jobless benefits, totaling $945 per week last month, she said.

Her employer has helped cover the rent on her $1,750-per-month house during the pandemic, but there’s only so much the company can do, said Marsian-Bolduc, who led a tour Friday for the first time since March.

Marsian-Bolduc said she had no savings going into the pandemic, applied for food stamps after the crisis hit, and has started packing and throwing things away in preparation for possibly having to live in her camper.

It features a bed, a shower with a bathtub and a kitchen with a mini-fridge, a microwave, a two-burner gas grill and a toaster oven.

It’s a scary situation, she said. She added that if the federal funds go away, she “will not be able to survive at all.”

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter. Review-Journal staff writers Bill Dentzer, Subrina Hudson, Jonathan Ng and Richard N. Velotta contributed to this report.

Benefits extension?

Democrats included in their next coronavirus relief bill an extension of the $600 unemployment benefit until January 2021.

That bill was passed along a mostly partly-line vote, with Nevada's congressional delegation voting with respective party leaders.

Senate Majority Leader Mitch McConnell, R-Ky., said his chamber's version of the next relief bill would be taken up after Congress returns from its July Fourth holiday.

There is little appetite among rank-and-file Republicans to extend the $600 benefit in the next relief bill, but some GOP lawmakers and President Donald Trump want a payroll tax cut, something that has drawn Republican opposition as well as a strong denunciation by House Speaker Nancy Pelosi, D-Calif.

Republicans also want legal protections for businesses, hospitals, schools and universities to prevent those contacting COVID-19 from having an opening to file lawsuits.

Democrats have urged McConnell to begin bipartisan, bicameral negotiations to sort out differences and find consensus on the next relief bill.

Gary Martin/Las Vegas Review-Journal