Senate bill to add $250B to paycheck protection program stalls

WASHINGTON — A bill to infuse another $250 billion into the Paycheck Protection Program of loans to small businesses stalled in the Senate on Thursday as Democrats tried to increase emergency funding for hospitals, states and cities.

President Donald Trump requested that additional money be approved for small-business loans, which would bring the total allocation for the program to $600 billion. (A $2.2 trillion bill approved by Congress earlier this month included $350 billion for small business loans.)

The program is designed to provide small businesses with loans to keep workers employed during the economic shutdown caused by measures to combat the coronavirus.

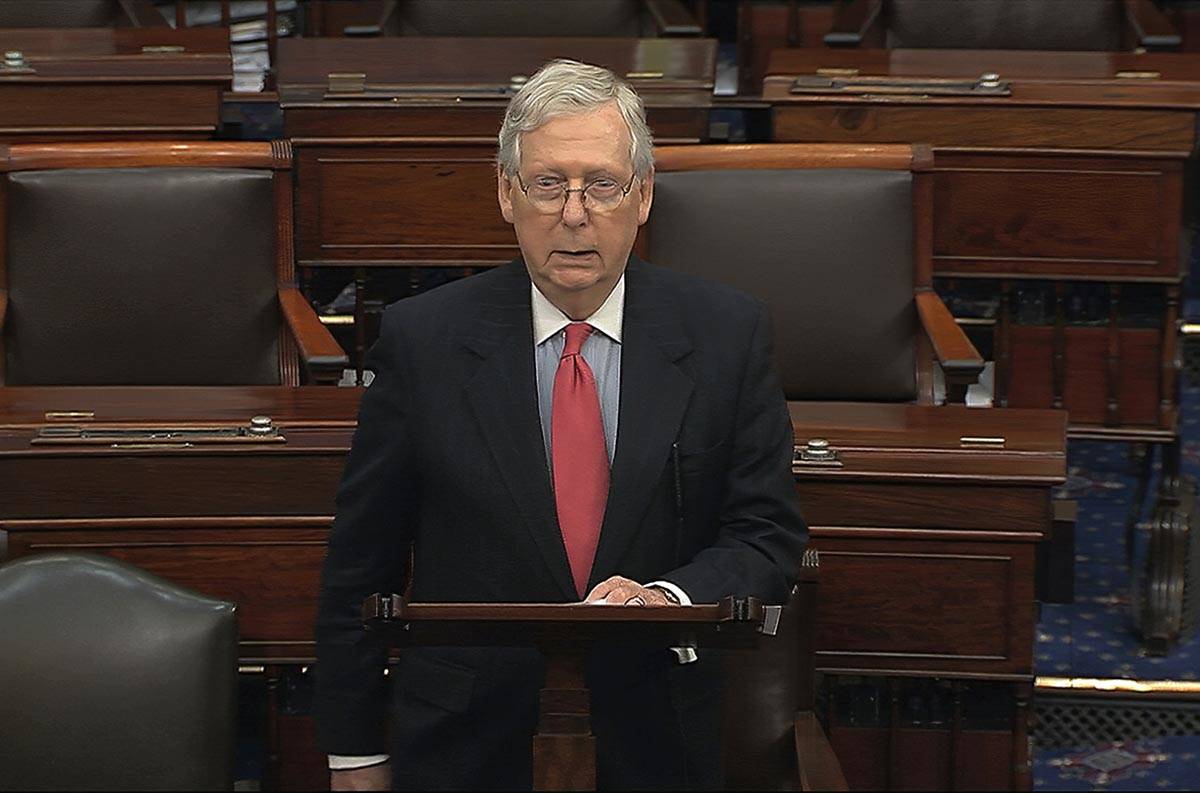

“We need more funding and we need it fast,” Senate Majority Leader Mitch McConnell, R-Ky., said. He wanted to pass the bill on a voice vote Thursday, setting it up for passage in the House on Friday.

But the bill failed to move through the Senate amid objections by Democrats, who wanted to add $100 billion more for hospitals and an additional $150 billion for states and cities.

Sen. Chris Van Hollen, D-Md., said hospitals in Maryland, Virginia and the District of Columbia have received only a small amount of medical supplies that they have requested.

“That’s one problem we need to address,” Van Hollen said.

Procedural problems

McConnell objected to an amendment by Van Hollen, who then objected to the bill, postponing a vote until Monday, when the chamber returns for another pro forma session. The Senate is not expected to return for regular business until April 20.

Nevada, like other states, also has complained about the lack of supplies from federal agencies, and cities in the state have said they lack the capacity to treat potential patients with the COVID-19 virus and protect first responders and health care workers.

Rep. Susie Lee, D-Nev., and 70 colleagues filed a bill in the House on Thursday to create a stabilization fund with $250 billion for cities with populations of fewer than 500,000, which includes Henderson and Boulder City.

Henderson Mayor Debra March said “we must be considered at the forefront for direct stabilization funds to help us continue to care for our community at a time when it will be needed most and ensure a full economic recovery once this crisis has passed.”

House Speaker Nancy Pelosi, D-Calif., said the money to states, cities and hospitals was equally important as the assistance to small businesses. She said the data shows that “they haven’t spent two-thirds” of the $350 billion that has been allocated.

“So we have time to negotiate,” she said in a teleconference with reporters.

Small business hurdles

The owners of small businesses complain that the application process has been fraught with problems, and many report being turned down for the loans to be used to keep employers on the job.

“We are almost a month into this now and I have had to put my employees on unemployment,” said Jeremy Gursey, owner of J Gursey Coffee Roasters in Las Vegas.

Gursey said he has applied for loans with a local bank, but frustration led him to call state Attorney General Aaron Ford and Sen. Catherine Cortez Masto, D-Nev. In the meantime, he’s had to furlough his six employees, who work at the business that caters to casinos, entertainment venues and sporting events.

“It’s a nightmare,” he told the Review-Journal. “My first and foremost concern has been my employees.”

McConnell said his bill would have just changed the number from $350 billion for the paycheck protection program to $600 billion. The GOP leader said a voice vote could have sent the measure to the House on Friday.

House Minority Leader Kevin McCarthy, R-Calif., said he was disappointed Democrats would delay action on increasing funding for a bipartisan program.

“I do not think people should play politics with a pandemic,” McCarthy told reporters on a teleconference.

But Rep. Thomas Massie, R-Ky., who forced the full House to return earlier this month for a roll call vote on the $2.2 trillion bill, threatened to block a voice vote to pass the interim bill in the House and require lawmakers to board airplanes and return to the Capitol at the height of the pandemic.

Meanwhile, Pelosi and Senate Minority Leader Chuck Schumer, D-N.Y., also sought $100 billion for hospitals and $150 billion for states and cities, and expansion of eligibility for food and nutrition programs for low-income families.

Help for gaming businesses

The Nevada congressional delegation also wants small businesses that derive some income from gaming to be eligible for the Paycheck Protection Program. Those small casino owners, truck stops or restaurants with slot machines or gaming tables are currently ineligible for the Small Business Administration loans distributed by banks and financial institutions.

Sen. Jacky Rosen, D-Nev., headed a letter to Senate and House leaders urging them to correct the bill in the interim legislation or future relief bills to help those businesses keep employees on the payroll. The letter was signed by the entire delegation.

As co-chair of the Congressional Gaming Caucus, Rep. Dina Titus, D-Nev., said she was working to make sure that the Small Business Administration knows “that our small employers must not be excluded from participating in the Paycheck Protection Program or accessing small-business loans. The entire travel and tourism industry — and the millions of people whose jobs depend on it — are hurting right now and they all should get relief.”

Contact Gary Martin gmartin@reviewjournal.com or 202-662-7390. Follow @garymartindc on Twitter.