Trump revels in tax cut as Americans file their returns

WASHINGTON — Polls show most Americans don’t think they benefited from the Tax Cuts and Jobs Act signed by President Donald Trump in December 2017 — even though some 80 percent of Americans paid lower income taxes to the federal government in 2018.

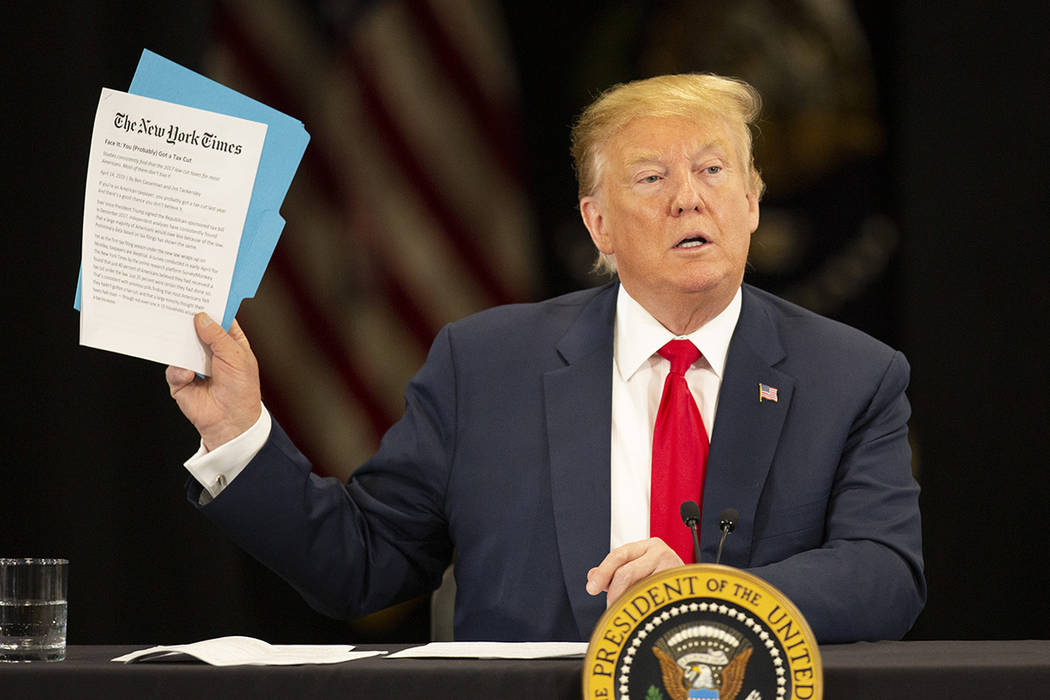

It’s a point Trump was so happy to make that he read a headline from a newspaper he frequently criticizes, The New York Times, during a roundtable in Minnesota on the economy and tax reform on Monday, the traditional deadline for filing federal income taxes.

The headline — “Face It: You (Probably) Got a Tax Cut” — was for a story about the high number of taxpayers who are paying lower taxes under to the 2017 law, but don’t believe it.

Before he read the headline, Trump deadpanned that it came from “the very fake New York Times” and that the reporters “must have made a mistake. I’m sure these writers will be fired shortly.”

When Trump said, “nothing good comes from the New York Times,” the room applauded. When he noted it was “tax day,” there were boos.

Times staffers Ben Casselman and Jim Tankersley wrote, “To a large degree, the gap between perception and reality on the tax cuts appears to flow from a sustained — and misleading — effort by liberal opponents of the law to brand it as a broad middle-class tax increase.”

If you’re a Nevadan, according to the nonpartisan Tax Foundation, your average income is between $61,000 and $62,000 — and your average tax bill for 2018 is at least $1,322 smaller than it would have been without the law.

A recent NBC News/Wall Street Journal poll found only 17 percent of Americans thought they would pay less under the 2017 law, while 28 percent expected to pay more, 27 percent about the same and 28 percent weren’t sure. Other polls expose similar erroneous perceptions about the effect of the measure, passed by a Republican Congress and signed by Trump.

In fact, 80 percent of tax filers saw a lower tax liability in 2018 than they would have had without the 2017 changes, according to the Tax Foundation. Another 15 percent saw no material change, and some 5 percent of households filing returns paid more in 2018 than they would have under the previous tax code.

Tax Foundation Vice President Nicole Kaeding told the Review-Journal she thinks some taxpayers may not realize that their income tax rate had fallen because their income or deductions changed and because the Internal Revenue Service altered withholding tables to reflect the lower rates.

Also, Kaeding noted, “Many individuals don’t know how much they pay in federal taxes to begin with.”

Nevadans, Kaeding added, are likely to benefit because the 2017 measure lowered tax rates, doubled the child tax credit and doubled the standard deduction.

The measure also included “a quite generous deduction” for small and large businesses.

“With the tax cuts, we were able to give all our employees bonuses,” said Vic Poma, vice president of Universal Plumbing and Heating of Las Vegas, at the Trump roundtable. Universal Plumbing also bought new vehicles and iPads for those working in the field, he said. Poma thanked Trump and urged him to “stay your course.”

David Kerzetski, also with Universal Plumbing and Heating, told Trump, “What you’ve done with the tax and jobs reform has really boosted our economy in Vegas. We saw it overnight go from nothing to, you know, 60 miles per hour. It’s unbelievable.”

Kerzetski also said the company more than doubled its employee count from 15 to 35, and went from training 30 apprentices to more than 85.

Last April, Kerzetski’s father, Richard, and Poma attended a similar event in the White House Rose Garden. Both Richard and David Kerzetski first met Trump when the then-candidate was in town for the Nevada caucus.

Contact Debra J. Saunder at dsaunders@reviewjournal.com or 202-662-7391. Follow @DebraJSaunders on Twitter.

President Donald Trump addressed the fire that ravaged Notre Dame before discussing the economy:

"I will tell you the fire they're having at the Notre Dame cathedral is something like few people have witnessed…

That puts a damper on what we're about to say, to be honest, because that is beyond countries, it is beyond anything. That is part of our growing up, it is a part of our culture, it is part of our lives. That is a truly great cathedral, and I've been there, and I've seen it."

-President Donald Trump addressed