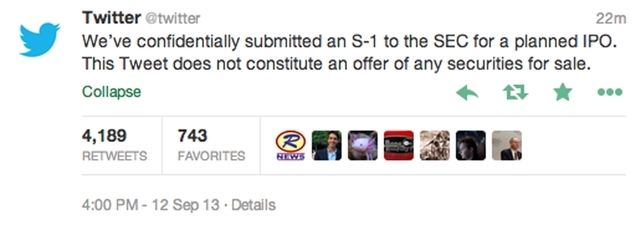

Twitter tweets it’ll go public

The documents Twitter filed with the Securities and Exchange Commission are sealed, as Twitter is taking advantage of federal legislation passed last year that allows companies with less than $1 billion in revenue in its last fiscal year to avoid submitting public IPO documents.

The confidentiality will likely help Twitter avoid the public hoopla and intense scrutiny that surrounded the initial public offerings of other high-profile social networking companies, including Facebook Inc., which went public in May 2012.

The San Francisco-based company posted on its official Twitter account that it has “confidentially submitted an S-1 to the SEC for a planned IPO.” A subsequent tweet said simply: “Now, back to work.” It’s accompanied by a blurry photo of the company’s offices.

Under the law, Twitter’s financial statements and other sensitive information contained in the IPO filing must become publicly available at least 21 days before company’s executives begin traveling around the country to meet with potential investors — a process known as a “road show.”

Twitter’s IPO has been long expected. The company has been ramping up its advertising products and working to boost ad revenue in preparation. But it is still tiny compared with Facebook, which saw its hotly anticipated IPO implode last year amid worries about its ability to grow mobile ad revenue.

Founded in 2006 and named after a sound tiny birds make, Twitter has since grown into a communications medium of remarkable cultural significance despite its relatively small size. In seven years, Twitter has grown from a few thousand users to more than 200 million. Its users include heads of state, celebrities, revolutionaries and journalists. Unlike Facebook, which insists that its users go by their real names, Twitter leaves room for parody and anonymity. As such, there are accounts for Jesus Christ and Lord Voldemort, Harry Potter’s mortal enemy.

Twitter’s big appeal is in its simplicity. Users can send short messages — either public or private — that consist of up to 140 characters. Anyone can “follow” anyone else, but the relationship doesn’t have to be reciprocal. This has made the service especially appealing for celebrities and companies that use it to communicate directly with customers.

Most of Twitter’s revenue comes from advertising. Research firm eMarketer estimates that Twitter will generate $582.8 million in worldwide ad revenue this year, up from $288.3 million in 2012. By comparison, Facebook had ad revenue of $1.6 billion in the April-June quarter of this year. By 2015, Twitter’s annual ad revenue is expected to hit $1.33 billion.

Twitter is planning its public offering at a time of heightened investor interest in the IPO market. There have been 131 IPOs that have priced so far this year, according to IPO tracking firm Renaissance Capital. That’s a 44 percent increase from the same period the year before. If the momentum continues, 2013 will have the most IPO pricings since 2007 — a year before the financial crisis.

The law that allowed Twitter to file its initial IPO documents confidentially is called the Jumpstart Our Business Startups, or JOBS, Act. President Barack Obama signed the law in 2012. It is designed to make it easier for small businesses and startups to grow and create jobs.

The law includes a provision that allows a company with revenue below $1 billion to file its registration statement for an initial public offering of stock with the Securities and Exchange Commission confidentially. This allows the paperwork to remain private until 21 days before the company starts marketing the deal to investors.

Wedbush Securities analyst Michael Pachter believes Twitter’s decision to tweet about the confidential filing signals the company’s intention to complete the IPO fairly quickly.

“The market is hot and the end of the year is usually is a good time to go public,” Pachter said. “I think we will get to see the documents by Halloween and the IPO will be done by Thanksgiving.”

SEC regulators ultimately dictate the timing of IPOs because they must sign off on all the documents before the stock can be sold.