Legislators start to override Gibbons’ rejection of bills

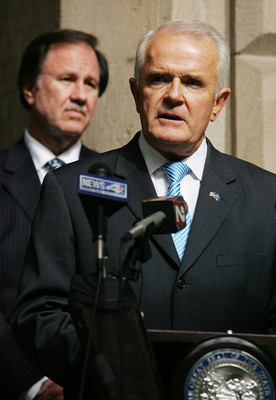

CARSON CITY -- Wielding his bright-red "VETO" stamp in a public ceremony on the steps of the state Capitol, Gov. Jim Gibbons on Thursday rejected the $781 million tax increase and $6.8 billion in spending approved by the Legislature.

His action was destined to be short-lived. Hours later, the Senate undid three of the vetoes, with more veto overrides in the Senate and Assembly expected today.

Senators overrode the veto on the tax hike bill by the same 17-4 vote that originally approved the package, with five Republicans joining the 12 Democrats in favor and four Republicans against.

"The veto would absolutely crash this state that is already crashing and burning," Sen. Mike Schneider, D-Las Vegas, said on the floor of the Senate before the override votes, around 10 p.m.

In a statement, Senate Majority Leader Steven Horsford, D-Las Vegas, said lawmakers made difficult decisions, including more than $1 billion in cuts to state services.

"We asked all Nevadans to bear the responsibility of carrying the state through this difficult time," Horsford said.

"This legislation is a bipartisan agreement that will provide the state with the revenue necessary to protect education until Nevada regains its economic strength," he added.

In vetoing the tax bill and seven spending bills at 5 p.m., Gibbons argued that it was legislators who were damaging the state's future.

"This budget is a job-killing, economy-crushing insult to the working families of Nevada," Gibbons said, calling raising taxes in a time of economic crisis "foolish and shortsighted."

Gibbons issued his vetoes beneath a banner of his slogan, "The People of Nevada deserve a Government that works for them, not against them."

Joining him behind the podium were four conservative Republican Assembly members: Ty Cobb of Reno, Don Gustavson of Sparks, John Hambrick and Richard McArthur, both of Las Vegas.

To one side were posters on easels featuring photos of Democratic legislators alongside past quotations: Assemblywoman Sheila Leslie of Reno saying sales taxes are regressive, and Horsford saying he would not support tax increases when businesses were losing jobs.

"The liberal leadership in the Legislature took the easy way out with these bills," Gibbons said. "They want more money from citizens who have less. Well, count me out."

After stamping the eight bills, he held them up for the assembled cameras and nodded sternly. A group of about 30 supporters cheered enthusiastically when he declared his opposition to taxes.

With the eight budget bills, Gibbons vetoed 12 other bills Thursday and 11 previously, bringing to 31 the number of vetoes he has issued during this Legislature.

That breaks the record 30 vetoes by Gov. Henry Blasdel during the state's very first legislative session of 1864-65, according to the Legislative Counsel Bureau.

Legislators Thursday evening moved quickly to pass the public employee pension reforms on which Senate Republicans had conditioned their tax votes. That bill, Senate Bill 427, was approved 19-2 in the Senate and unanimously in the Assembly.

The tax bill, Senate Bill 429, contains increases in sales, vehicle, business license and payroll taxes, most of which will expire in 2011. Legislators previously passed a $220 million increase in room taxes, bringing to about $1 billion the total tax hike approved for the next two years.

Two-thirds of the votes in the Senate and Assembly were needed to pass the tax bill last week. The same is needed to override the gubernatorial veto.

Republicans Mark Amodei of Carson City, Barbara Cegavske of Las Vegas, Mike McGinness of Fallon and Maurice Washington of Sparks voted against the tax veto override.

On Senate Bill 431, authorizing state government spending for the next two years, the vote was 19-2, with Amodei and McGinness against.

On Senate Bill 433, funding state employees' salaries while requiring them to take 12 unpaid furlough days per year, the vote was 18-3, with Amodei, McGinness and Cegavske against.

Sen. Warren Hardy, R-Las Vegas, one of the GOP senators who voted for the tax package and override, said in an interview that he could not stomach further cuts, especially those Gibbons proposed to higher education.

"We did the best we could under difficult circumstances," Hardy said of the budget. "I agree that raising taxes is not the best thing for business right now, but neither is closing one of our universities. I would have given anything not to raise taxes, but we could not allow these massive, Draconian cuts."

Horsford said his previous statement opposing tax increases was made under different economic conditions. "I don't think anyone anticipated the collapse of our national economy," he said.

Leslie said she still thinks sales taxes are regressive -- they disproportionately affect people with lower incomes -- but that including sales tax in the package of tax hikes was a necessary compromise.

Assembly Speaker Barbara Buckley, D-Las Vegas, defended the Legislature from the governor's accusations.

"I believe what we did was much harder than what the governor did," she said. "We spent months ensuring our decisions were the right ones."

The Assembly, in which Democrats hold a two-thirds majority, must also vote to override the vetoes for the bills to become law.

Besides the budget bills, it's not clear how many of Gibbons' other vetoes might be overridden. Last week, the Legislature overrode a gubernatorial veto for the first time since 1989.

Review-Journal Capital Bureau Chief Ed Vogel contributed to this report. Contact reporter Molly Ball at mball@reviewjournal.com or 702-387-2919.

Slideshow

Video

Gibbons' VETOES

THE EIGHT TAX AND SPENDING BILLS THAT GOV. JIM GIBBONS VETOED THURSDAY WERE THE FOLLOWING:

Senate Bill 429: Increases various taxes for the next two years.

Assembly Bill 562: Funds general appropriations.

Assembly Bill 563: Funds K-12 education.

Senate Bill 433: Funds state employee salaries.

Senate Bill 431: Authorizes expenditures.

Assembly Bill 423: Takes property taxes from Clark and Washoe counties.

Assembly Bill 552: Changes sales tax collection allowance.

Senate Bill 415: Funds Public Employees' Benefits Program.