Housing

When Fannie Mae, one of two troubled government-backed mortgage-finance companies, guaranteed mortgage loans in Southern Nevada, homes were more expensive, and the average loan was worth 75 percent of the value of the home that secured it.

Nevada’s congressional Democrats, up for re-election next month, agree that Fannie Mae and Freddie Mac must improve to protect taxpayers from future bailouts, but Silver State Republicans argue taxpayers would be off the hook if the government-sponsored companies were replaced by private interests.

North Las Vegas’ economy could see some bright spots, but the valley’s housing market may not experience a full rebound for nearly a generation, predicted a local observer at the city’s Directions 2010 event Thursday.

A joint investigation by every state could force mortgage companies to settle allegations that they used flawed documents to foreclose on hundreds of thousands of homeowners. Lenders could be forced to accept an independent monitor to ensure they follow state laws and pay some people whose foreclosures were improperly handled.

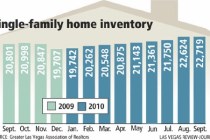

Single-family home sales dropped sharply to 2,806 in September, a 16.4 percent decrease from the same month a year ago, and inventory of homes on the market jumped 9.2 percent to 22,719, the Greater Las Vegas Association of Realtors reported Friday.

Facing increased competition from foreclosures and short sales, Las Vegas homebuilders have not only had to cut production, but keep prices around $100 a square foot, the standard from about 10 years ago.