Nevada unemployment benefits delayed, but qualified workers to get back pay

Vincent Fried has heard the same noise every day for the past four days — a busy signal.

Since the Las Vegas-based nail technician learned he qualified for unemployment insurance benefits under the recently passed Coronavirus Aid, Relief, and Economic Security Act, he’s been trying to contact the unemployment office to file a claim.

The independent contractor doesn’t know when he’ll get paid. Neither does the state.

“We await details from the Department of Labor regarding funding timelines,” said Rosa Mendez, spokeswoman for the Department of Employment, Training and Rehabilitation, or DETR, which oversees the state’s unemployment insurance program.

A series of federal relief packages passed this month, including the CARES Act, provides states funding toward things like administrative costs to process what’s been an unprecedented number of unemployment claims and fund expanded unemployment insurance benefits.

But the grant toward administrative costs could be disbursed to states like Nevada up to 60 days after the bill was signed into law Friday, according to the Families First Coronavirus Response Act. And when it comes to lending a hand to unemployed gig workers under the $2 trillion stimulus bill, states are in a holding pattern as they wait for guidance and funding from the federal government.

Mendez said this is why the office decided people like Fried, who aren’t able to get through by phone or online, will automatically receive back pay from March 15 and “claims will be paid without waiting seven days for administrative review to ensure the most prompt payment of claims possible.”

‘Running out of money’

But as unpaid bills pile on, many are still feeling frustrated and helpless.

“I’m taking care of my dad and my mom,” Fried said, noting both are 75 with medical conditions. “I’m getting worried because I’m running out of money and we’ve got to eat. I did everything. I even wrote a letter to Congress. I’m being very proactive. I’m not sitting waiting around for things to fall in my lap.”

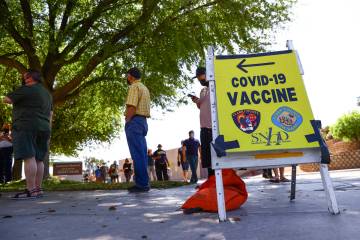

Independent contractors, self-employed and gig workers are eligible, for the first time, to file for unemployment insurance benefits, but the department is still getting the program off the ground — meaning claimants will need to wait for an unspecified amount of time before they’re able to file.

“This program is separate from (the) traditional unemployment insurance system,” Mendez said in an emailed statement. “We are already working through initial design and implementation plans to be able to provide the people in Nevada this vital support.”

Meanwhile, the office has swelled its ranks by more than doubling staff. Mendez wouldn’t provide an exact employee count, saying that it changes each day as it hires and onboards employees.

“In addition, we are leveraging staff from other areas of the department, adding some retired contractors, as well as bringing in staff from other state agencies with UI experience to provide direct services and support,” she said. “With these moves, we’ve more than tripled the number of people working in our call center to help process claims.”

Mendez said the office is also likely to qualify for a second set of funding through the Families First Coronavirus Response Act, which gives a state about $5 million in additional administrative grant funds if unemployment claims rise above 10 percent for the first quarter year over year.

Adding up

“It is important to note that immediately prior to the pandemic claim surge, we were experiencing historically low unemployment rates and staffing,” Mendez said.

DETR reported earlier this month that Nevada’s unemployment rate was 3.6 percent in January, the lowest since 1976, while matching the U.S. unemployment rate in January for the first time since before the economy crashed.

Things have very quickly changed since then with the global coronavirus pandemic.

Latest unemployment figures show 71,400 people filed for unemployment in Nevada last week, according to data released Thursday by the U.S. Department of Labor, pushing the number of jobless claims since casinos and other businesses closed in mid-March past 164,000. The previous record for weekly claims was 8,945 for the week ending January 10, 2009.

The U.S. Department of Labor reported 6.6 million new unemployment claims last week, double the 3.3 million a week earlier.

Matt Weidinger of think tank American Enterprise Institute and former deputy staff director of the House Committee on Ways and Means said states like Nevada already experienced a surge of claims but that there’s added stress as the CARES Act has expanded eligibility requirements.

“Along comes the CARES Act and it says we’re going to increase benefits — we’re going to bring a new group of people into the system — and by the way, states, you have to figure out how to do all that at the same time you’re navigating (this) massive surge in claims for regular benefits,” he said.

The Department of Labor issued flexible guidelines to states around who can qualify for unemployment insurance benefits under the CARES Act. For example, states can pay benefits to a person quarantined if there’s an expectation he or she will return to work after it’s over. Or, if an individual decides to quit his or her job because of a risk of exposure or to care for a family member such as children. The guidelines also say “federal law does not require an employee to quit in order to receive benefits due to the impact of COVID-19,” according to a release by the Department of Labor. But states have the final word on how lenient they want to be when providing benefits in relation to the coronavirus.

Mendez didn’t specifically say whether Nevada would amend its laws to provide UI benefits in every federally suggested scenario but said Nevada “continues to allow for the most flexibility of interpretations allowed by federal law and regulation and state statute whenever possible for filers related to the COVID-19 pandemic.”

Bright spot

It’s unclear how much money Nevada will receive from the federal government to help fund claims from gig workers, as the amount of funding “will depend on the number of individuals whose first week of payable benefits falls between March 29 and December 26,” according to Mendez.

There’s also the question of when Nevada will receive those federal funds, which also pay for the additional $600 a week in claimants’ checks and 13 additional weeks of benefits for those who have reached the state’s maximum benefits allowance of 26 weeks.

But these delays should have little impact since Nevada has a healthy unemployment trust fund of about $1.97 billion as of March 21, according to DETR.

Michele Evermore, senior researcher and policy analyst at National Employment Law Project, said Nevada is in “great shape” and is 1.52 percent funded, meaning there’s enough reserves to manage benefits for a year and a half during a normal recession.

It also means the state won’t have to tap into its own trust fund when paying claimants who qualify under the federal government’s more flexible eligibility rules.

That may be great news, but claimants like Las Vegas resident and event operator John D’Amico said it means nothing without a paycheck.

He’s been trying every day for the past three weeks to contact the office to complete a claim, after being prompted to call the help desk during his application process.

“I’m sure even the federal government hasn’t dotted all the i’s yet because there’s such an urgency to get something happening,” he said. “But even if they had their act together and the money was here, it’s not much use if no one can access it.”

Contact Subrina Hudson at shudson@reviewjournal.com or 702-383-0340. Follow @SubrinaH on Twitter.