Las Vegas property value appeals outpace 2010

A couple bought a four-bedroom home in the north valley a few years ago for $325,000 and soon learned that the property was assessed at $483,000.

Jason and Krystal Bladecki this year decided to appeal the assessment to reduce their tax bill and help make ends meet.

Jason Bladecki, an elevator tradesman, was laid off last month. And Krystal, a middle school teacher, worried she could lose her job in the current economic climate, a frightening prospect because they have three children to support.

They cut a deal with Clark County to lower the assessment to $350,000, about $50,000 higher than they sought.

"I was going to fight it because I don't think we should pay more than it's worth," Krystal Bladecki said. "But you have to hire your own appraiser, and there's no guarantee that's what you're going to get."

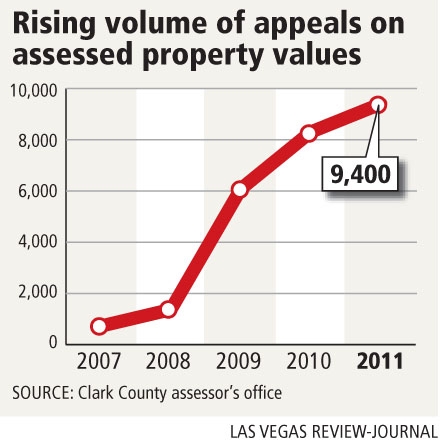

The Bladeckis are among the 9,450 property owners who challenged their assessed values this year, breaking last year's record of 8,300 appeals.

Resolving the appeals will compound the $130 million loss in local property tax revenue, though no one can say by how much. About 40 entities depend on the money, including the county, cities, libraries and fire districts.

Last year, the county collected $110 million less in property taxes because of appeals, pushing the total revenue loss for 2009 to $470 million.

Residential properties as a whole are stabilizing this year, while business properties are depreciating sharply, in large part because of high vacancy rates.

The county Board of Equalization today will begin ruling on the appeals, which had to be filed by Jan. 18. To accommodate the high volume, hearings will run through early March, two weeks past the normal wrap-up date.

Volume has surged in the past three years as the recession has caused property values to tumble and the jobless rate to soar above 14 percent.

"Definitely it's a factor of the economy and the high unemployment," assistant assessor Rocky Steele said. "People are going to try to lower their taxes and save money wherever they can."

Steele said some owners might be appealing in response to county appraisers bumping up assessments on some properties. In 2009, real estate prices plummeted so much that appraisers underestimated the value of many parcels, Steele said. Late last year, those assessed values had to be adjusted upward.

As a result, 280,000 homeowners, or roughly 44 percent in the county, could wind up paying higher taxes this year. It's a partial reversal of last year, when 90 percent of the county's 730,000 parcels yielded lower taxes.

Steele said some people will accuse his office of increasing assessments to pump up tax revenue in the budget crisis. He dismissed the allegations as false.

By law, the county can't assess the taxable value higher than the market value, he said.

In a slumping market, property values can fall significantly after the county does its final appraisals in November, Steele said. People, in turn, could have a legitimate gripe and should appeal.

Homeowners can show their assessed values are inflated by comparing them to neighboring sites, Steele said, noting that the easiest way is to check property values on the assessor's website.

Four years ago, the appeals could be taken care of in seven or eight hearings, Steele said. Now it takes as many as 17, even though most cases are settled outside the hearings.

Last year, about 5,000 owners worked out deals with the assessor's staff and didn't have to stand before the board.

If owners are dissatisfied with the board's ruling, they can file an appeal with the state, though few do, Steele said.

Contact reporter Scott Wyland at swyland@review journal.com or 702-455-4519.