Report says Las Vegas has world’s fifth-worst economy

You already know Las Vegas has one of the country's worst economies.

Now, a new report takes things further.

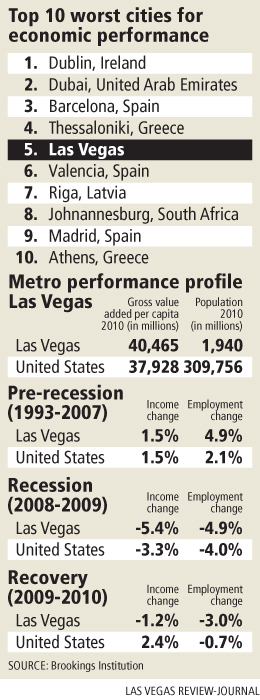

The Brookings Institution, which is based in Washington but has a local research arm, said Tuesday that the Las Vegas Valley has the world's fifth-worst economy. The think tank ranked the region No. 146 on its Global Metro Monitor, which rates the world's 150 biggest metropolitan economies on their economic strength before, during and after the recession.

The report also included details on how to revive the local economy. Its conclusion? Restoring growth will require a little time, a more educated work force and a diverse jobs base.

To develop its analysis, researchers at Brookings considered each region's overall gross value added, which measures the worth of goods and services produced in an area's economy. It also weighed gross value added per capita and changes in employment and population. Because some statistics from 2008, 2009 and 2010 aren't yet available, the group forecast some indicators to fill in the blanks.

In its final result, the Brookings report's assessment of Las Vegas is less a measure of economic torpor than it is proof of just how volatile the city's economy is, said Robert Lang, director of Brookings Mountain West at the University of Nevada, Las Vegas.

"Places like Buffalo (ranked No. 120) look fantastic because they didn't boom or bust," Lang said. "What this shows is, given how high a flier we were, our conditions are dismal relative to that performance. Not only did we crash deeply, but we're underperforming in the recovery."

Added Brian Gordon, a principal in local research and consulting firm Applied Analysis: "Where many of these markets didn't experience such a run-up, Southern Nevada is being equally penalized on the downside of the cycle. It's a sharp contrast from being one of the strongest and fastest-growing economies to one of the hardest-hit."

To understand the city's big bust, look first at its expansion heyday from 1993 to 2007.

The population of Las Vegas burgeoned by 104 percent to nearly 2 million in that 14-year period, making the city first in the United States and third in the world for population gains. Employment grew 4.9 percent annually, driven by construction, real estate and gaming, and the market added roughly 470,000 housing units from 1990 to 2007. Brookings ranked Las Vegas No. 14 in the world for its overall economic performance in the period.

When the recession took hold of the economy in 2008, though, the trends reversed.

Local employment dropped 4.9 percent from 2008 to 2009, compared with 4 percent nationally. Much of the job loss came in the region's most important industries: construction, which shed 28,000 jobs in the year, and leisure and hospitality, which cut 19,000 positions. Gross value added slumped even more, dropping 5.4 percent. That indicates the loss of high-value jobs in financial and business services, many of which supported real estate and tourism, the report said. And a region that added a net average of 40,000 residents a year in better times posted a net loss of 1,300 residents from 2008 to 2009.

In that slowest-growth period, Las Vegas ranked No. 128 worldwide.

At No. 146, the city's situation is still worse in 2010, nearly 18 months after the recession's June 2009 end. The valley's gross value added per capita has continued to erode, dropping 1.2 percent even as the nation's average improved. Employment dipped 3 percent, far more than the nation's 0.7 percent employment falloff.

The only major cities performing worse overall than Las Vegas in 2009 and 2010 were Thessaloniki, Greece; Barcelona, Spain; Dubai, United Arab Emirates; and Dublin, Ireland. Greece, Spain and Ireland have all battled fiscal crises stemming in part from rich worker-benefits packages and early retirement ages. Dubai, whose Dubai World investment arm owns half of CityCenter, has struggled with poor real estate investments and a 2009 collapse in oil prices.

Observers blame the valley's abysmal post-recession performance partly on the severity of the local housing crash and partly on the area's lack of economic diversity.

The Brookings report singled out Southern Nevada's high number of home foreclosures as a key obstacle to its recovery. The region had the nation's second-highest share of bank-owned properties in June, reflecting the "inflated prices, easy credit and exotic mortgages that pervaded the housing market during the 2000s," the report said. Two-thirds or more of residential mortgage holders in Nevada owe more on their loans than their home is worth.

But the report gave just as much attention to the importance of diversifying the local economy. Between them, construction and consumer-oriented industries such as gaming accounted for 53 percent of the city's 2007 output.

Lang pointed to the fact that the nation's better-performing cities, including Austin, Texas (No. 26), Washington, D.C. (No. 37), Dallas (No. 71) and Seattle (No. 50), are "mostly educated metro areas" with varied, high-skill economies.

"Those places have much greater economic diversification and a lot of high-end, white-collar services or technology jobs. It's a different mix of industries that has fared better," Lang said. "All our eggs were in the consumption basket. There was a collapse in consumption because if people didn't lose their house, they lost the equity in it. The wealth effect is gone."

Turning the economy around will require boosting the city's 22 percent college graduation rate, the Brookings report said. And city leaders should lasso the potential of existing research centers, including UNLV's Solar Solutions and Advanced Clinical Training and Research centers.

Las Vegas already has several advantages it can leverage into improved diversity, Lang said.

Thanks to major construction projects such as CityCenter, Las Vegas has plenty of laborers schooled in large-scale building. That labor force could help the region attract massive green-energy projects. Plus, McCarran International Airport is adding several international gates in its Terminal 3, scheduled to open in June 2012. That development will bring in more customs workers trained in clearing goods and people through Las Vegas, and it will provide more direct access to fast-growing East Asian markets, Lang said.

The city's housing price crash could pose benefits: Affordable real estate helped drive the city's growth in the 1990s and early 2000s, Lang said, and cheaper prices could bring a similar effect in coming years.

"I can see the sunshine on the horizon, but at the moment, everybody's going to over-read the negative news because they were over-reading the positive news for so long," he said.

Gordon agreed that Las Vegas could return to growth, but it'll take a while, he said. First, the nation's economy must improve, so that spending in the city's economy can flourish again.

More importantly, the state's leaders must work to persuade larger and more diverse companies to relocate to or open branch operations in Southern Nevada.

"It's going to be a slow and painful process. It will require baby steps," Gordon said.

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512.