Delays in coronavirus relief checks frustrating for Nevadans

WASHINGTON — Frustrated people have been calling the IRS and congressional offices, seeking an update about their delayed coronavirus relief checks.

In Nevada, lawmakers report multiple calls every day from people having difficulty navigating the IRS website or, in some cases, receiving only partial payments for money they are eligible to receive for dependents.

“I recognize some of our country’s most vulnerable are still awaiting relief and answers,” said Rep. Steven Horsford, D-Nev., who held a telephone town hall two weeks ago on the federal response to the COVID-19 outbreak.

Of the roughly 4,500 constituents who took part, 59 percent said they had not received an Economic Impact Payment.

Horsford’s expansive district runs from North Las Vegas to Ely and includes Pahrump and Mesquite.

The IRS reported this week that it has sent money to 88 million Americans. The agency estimated that 150 million people will get a payment under the $2.2 trillion coronavirus relief bill passed by Congress and signed into law by President Donald Trump in March.

Nevada payments

Nevada, with a population of about 3 million, has 892,155 residents slated to receive about $1.5 billion in Economic Impact Payments. Neighboring California has 9.1 million residents eligible for $15.9 billion in relief.

Arizona has 1.8 million residents eligible for $3.4 billion, and Utah has 818,700 residents slated to receive $1.6 billion.

But even while the IRS marked its progress, it has tried to improve its website and tracking tool to help the growing number of people with questions about eligibility, payment amounts and when they will see the money.

An elderly caller who did not identify himself in a message left with a Review-Journal reporter complained about the lack of detailed information from the IRS — and the media — to questions he has about payments for him and his wife.

“There is no information at all,” he said.

The man said the tracking tool on the IRS website blocks him from moving forward because his information doesn’t match current tax files.

A Review-Journal reporter tried the tracking tool and was also advised his information did not match records, even though the reporter filed a federal tax return for 2019 and received a refund sent in April.

An IRS representative said each case differs. Officials urge people to continue to visit IRS.gov, which is updated every 24 hours.

Direct deposit fastest

Most of the money distributed by the IRS so far has been deposited directly into bank accounts.

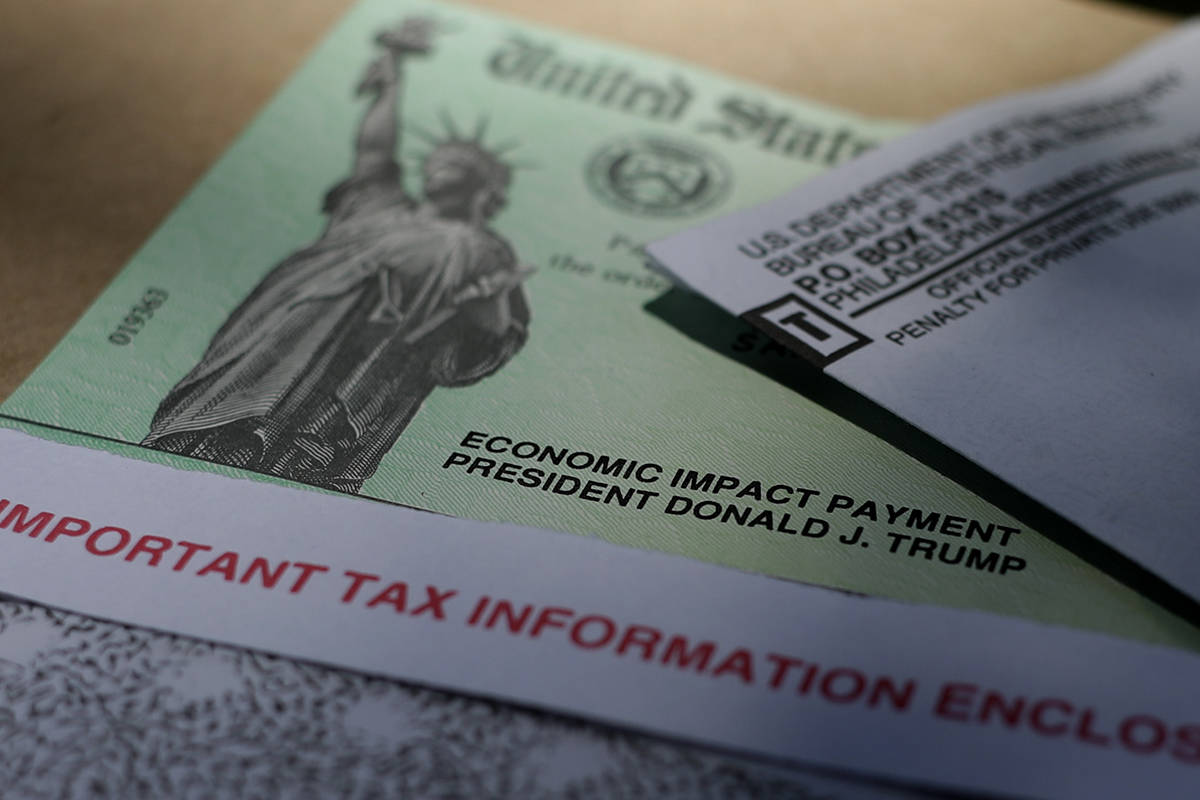

But many people will receive paper checks, and that process was briefly delayed when the administration decided to put Trump’s name on the checks. The first paper checks were mailed last week.

Horsford, a member of the tax-writing House Ways and Means Committee, cautioned that the task of distributing the money to eligible individuals, with roughly 5 million checks mailed each week, could take as long as 20 weeks.

IRS Commissioner Chuck Rettig said this week that the agency has made changes to the Get My Payment application on IRS.gov to help people add direct deposit information to expedite payment and track funds.

In some cases, couples who qualify for and have received the $2,400 for themselves have yet to see their $500 payments for each dependent child. The IRS has encouraged those families to update their information on the website.

Big job

For now, the delays appear to be linked mostly to the magnitude of the task.

The IRS had two weeks to get the Economic Impact Payment program up and running, during the height of tax season, and the coronavirus threat has left the agency without full staffing, with workers observing social distancing and other precautions.

Many states are grappling with skyrocketing unemployment claims as nonessential businesses have been shuttered.

But other than volume, staffing and the monumental task of getting the money to Americans quickly, the IRS has no simple answers for the delay in delivery, other than noting that those eligible have differing circumstances.

Sens. Catherine Cortez Masto and Jacky Rosen, both Nevada Democrats, said they were working with every member of the state’s House delegation to push the administration and the IRS “to get these funds as quickly as possible to the Nevadans who need it most.”

Last week, the office of Rep. Dina Titus, D-Nev., received about 25 calls about the payments.

Titus said millions have received their payments, “but the IRS is taking far too long to get this relief into the hands of everyone who qualifies for it.”

According to various news reports, some tax filers who used tax preparation companies or filed using tax-calculation software could see delays. In those cases, refunds might be sent to tax preparers or might be delayed because some software doesn’t include direct deposit information.

The IRS website includes information about how to add that information, a fact sheet about eligibility and information on how those who are on Social Security or have not filed a federal tax form recently because of income level can obtain an Economic Impact Payment.

A representative said the agency is acting quickly to get the program functioning as it was intended: “getting all this money out as soon as possible.”

“We understand the frustrations,” the representative said.

Contact Gary Martin at gmartin@reviewjournal.com or 202-662-7390. Follow @garymartindc on Twitter.

A previous version of this story incorrectly reported the total amount of Economic Impact Payments California residents are eligible to receive.