Democrat isn’t shy about talking taxes

CARSON CITY -- Democratic legislators have talked a lot in the first two weeks of the session about the state needing more money, but have avoided using the "T" word.

They have said that Gov. Brian Sandoval's proposed spending cuts are too severe. They have said state and local governments need more revenue to adequately serve the public.

Although the Democrats are expected to call for new taxes, they have been true to their strategy of not talking about it until later in the session.

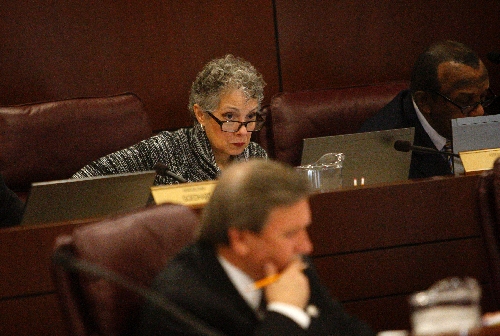

Then there's Las Vegas Democrat Peggy Pierce.

Pierce is drawing up bills that would levy a corporate rate income tax, make services subject to the sales tax, increase alcohol and cigarette taxes, and boost the mining tax.

"I have been upfront about this for a long time," said Pierce, who won re-election in November by almost 20 percentage points. "It is important to have tax bills. Let's talk about them."

Long associated with Culinary Local 226, Pierce is resources coordinator for the Labor Agency of Nevada and has served in the Assembly since 2003.

Senate Revenue Committee Chairwoman Sheila Leslie, D-Reno, said Monday that Pierce's bills "could be elements of a tax plan" that emerges from the Legislature late in the session.

Pierce has her own statistics to justify why legislators should raise taxes during what state historian Guy Rocha calls the worst economic crisis in Nevada's history.

A U.S. Department of Commerce report in November found American companies earned record profits of $1.659 trillion in the previous 12 months.

"Nevada may be in a recession, but big business in America is not in a recession," Pierce said last week. "American business is sitting on an absolute mountain of money. They aren't reinvesting the money. They aren't hiring anybody."

Nevada is one of five states without a corporate income tax. Pierce wants to write her business income tax bill so that small Nevada-based businesses are exempt, but "big box stores" like Walmart and J.C. Penney pay.

Geoff Lawrence, deputy director of policy for the conservative Nevada Policy Research Institute think tank, rejects her line of thinking.

"Businesses around the country may be earning record profits, but I am not sure that is the case in Nevada," Lawrence said. "They aren't hiring because there is a lot of uncertainty on what will happen with health reform, with their labor costs. Every state in the country is talking about dramatic changes (in taxes). You don't want to hire a new employee and then have to let him go six months later."

REPUBLICANS UNITED

Sandoval points to the state's highest-in-the nation 14.5 percent unemployment rate and its record number of foreclosures and bankruptcies as reasons to justify why taxes cannot be increased.

Republican leaders insist their members are unanimously opposed to taxes and back the governor and his two-year $5.8 billion state budget, which calls for no new taxes.

Even Sen. Dean Rhoads, R-Tuscarora, who voted for tax increases in 2003 and 2009, says he won't now support higher taxes.

Neither will new Sen. Greg Brower, R-Reno, who replaced longtime Republican leader Bill Raggio, who said last year the state budget already had been cut to the bone and new taxes were required.

Democrat John Lee, D-North Las Vegas, also has expressed his opposition to higher taxes.

That leaves Democrats who ultimately may support tax increases at least four votes short of the two-thirds majority needed in the Senate to pass higher taxes and override a veto. They also are two votes short in the Assembly, providing every Democrat votes for higher taxes.

"They say that now, but they may not say that later," Leslie about Republican opposition to tax increases.

She hopes Sandoval, Lee and the Republicans will not be so anti-tax in May when legislators finish reviewing budgets, make adjustments and come out with a list showing the cuts facing education and human resources.

EXISTING TAXES

Besides looking at the tax bill from Pierce and others, Leslie said her committee also will examine the tax structure and determine whether to reauthorize four taxes scheduled to expire June 30.

On that day, the 1.17 percent tax on companies' payrolls reverts back to 0.63 percent, a 0.35 percentage point increase in the sales tax rate expires, the $200-a-year business license fee drops back to $100, and changes in depreciation allowances that increased car registration fees end.

In his speech to open the Senate on Feb. 7, Senate Majority Leader Steven Horsford, D-Las Vegas, said Sandoval's budget is $2 billion short of the state's real needs.

While Leslie won't concede that figure is the target number for tax increases, Pierce said it might be in the ballpark.

Even Lawrence conjectured before the session began that enough Republicans could be persuaded to pass some taxes. Now that he is in Carson City, he believes they firmly will hold to no-new-taxes pledges.

"The governor has done a really good job of getting Republicans to back his plan," Lawrence said. "It is bad environment politically for Republicans to vote for tax hikes. They feel they were elected with a mandate to rein in spending."

If they voted for higher taxes, then Lawrence said voters would defeat them in the next election.

NEED FOR PUBLIC EMPLOYEES

It isn't just record business profits or the reluctance of businesses to hire new workers that irks Pierce.

For too long, she said, Nevada has been unwilling to increase the size of government, and the result has been a poor education system and a state that leads the nation in bad things, like its suicide rate.

She cited Legislative Counsel Bureau statistics that show Nevada had 602 public employees per 10,000 residents in 1978. That number fell to 430 per 10,000 residents in 2008.

To stay where the state was in 1978, the state and local governments would have needed to hire 44,000 more workers, Pierce said.

"How did this happen?" she asked. "We were the fastest growth state for most of that time. We'd hold a Legislature and conservatives would scream 'We can't expand government.' Then we would go home and, when we came back, Nevada would have added 50,000 or 75,000 more people. And conservatives again would scream 'We can't expand government.' We need to end this failed experiment in tiny government."

Review-Journal writer Laura Myers contributed to this report. Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901.