Legislator wants to tax junk food

CARSON CITY -- Assemblyman Harvey Munford says there is nothing wrong with birthday cakes, candy, ice cream or soft drinks.

But the former teacher makes that statement with a big proviso -- as long as the eating of sweets and fast foods is done only occasionally.

To induce children and others not to binge on unhealthy food, the Las Vegas Democrat is drafting a bill to place as much as an extra 5 percent sales tax on junk food purchased in restaurants and convenience stores.

"I am trying to find new revenue and so I'm thinking, why not tax junk food and other such discretionary spending that contributes to obesity?" said Munford, vice chairman of the Assembly Taxation Committee.

Twenty percent of Nevada children are obese, higher than the 17 percent national average, according to a state Health Division study.

Legislative staff analysts are computing how much a junk food tax could bring in for state coffers. Munford said the money could be diverted to health care programs.

A state law passed by voters prevents him from extending his proposal to foods purchased in supermarkets.

Munford got the tax idea from watching first lady Michelle Obama's efforts to get children to exercise more and eat right.

As a former teacher, Munford, who turns 71 this year, remembers students bringing in bags of food from McDonald's before they started morning classes.

"I'd see donuts, Egg McMuffins, soft drinks, all sorts of fast food," he said. "I used to think the fast food industry depended on high school students."

As a 36-year teacher, he also noticed the increase in obesity among youths as fast food diets became commonplace.

While he realizes no-new-taxes Gov. Brian Sandoval would not support any tax increases, even on unhealthy fast foods, he said he has been trying to gather Republican support needed to override a governor veto. That might difficult since the party has been issuing statements it is united against any tax increases.

"There are moderate Republicans who might vote for it," he said.

But Senate Minority Leader Mike McGinness, R-Fallon, said he doubts Munford can muster Republican support for his junk food tax.

"I don't believe in using tax policy to get desired behavior from people," he said.

The term "pigovian" has been used to describe taxes used to reduce consumption of foods that contribute to obesity.

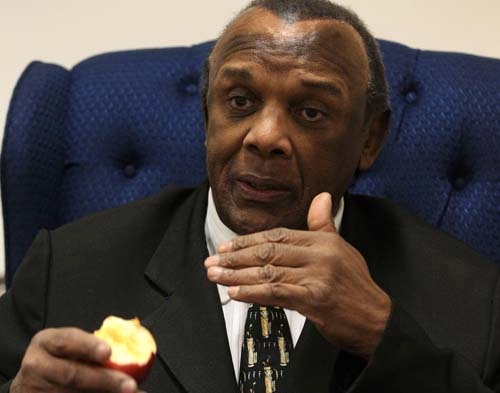

Defining what constitutes junk food won't be easy, Munford admitted while munching an apple in his office Friday. But he is working with Legislative Counsel Brenda Erdoes and has faith she will come up with a good definition.

Munford said junk food has "no nutritional value" and can be eaten quickly.

Junk food includes candy, ice cream, soft drinks, cakes, pies, hamburgers, pizza, chips and french fries, he said.

Eleven states have some form of junk food tax, most often on soft drinks, candy and food sold through vending machines.

A New England Journal of Health study in 2009 found that a 1 cent per ounce increase in taxes on soft drinks would lead to 25 percent less consumption of those drinks.

A Kaiser Family Foundation study last year found 55 percent of respondents favored higher taxes on junk food. But after a wave of public opposition, New York Gov. David Paterson withdrew a bill in 2009 to levy an 18 percent tax on soft drinks.

Junk food taxes were proposed in Nevada by legislators in 2003, but the measure went nowhere.

As for himself, Munford drinks only juices or water, and never has touched beer or wine. As a high school athlete, he was told by one of his sports coaches that a poor diet would retard his performance.

Munford, who stands 6 feet 9, played football and basketball at Montana State University, earning All-America status for his basketball skills. The Ohio native was drafted by the Los Angeles Lakers in basketball and the Los Angeles Rams in football, but bad knees prevented him from advancing to professional athletics.

While in Los Angeles in 1968, he took a day trip to Las Vegas where there were teaching vacancies. He was hired and never left Southern Nevada, except for his trips to Carson City after being elected to the Legislature in 2004.

Among his students were former gubernatorial candidate Rory Reid, state Sen. Greg Brower, R-Reno; Sen. Ruben Kihuen, D-Las Vegas; and former state archivist Guy Rocha.

Review-Journal writer Laura Myers contributed to this report. Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901.