Nevada’s congressional delegation pushes bill to help small casinos

WASHINGTON — Nevada’s congressional delegation sent a shot across the bow of the Trump administration Friday with legislation in the House and Senate to make small casinos and other businesses with gaming revenue eligible for Small Business Administration loans.

A last-minute rule change by the Treasury Department and the SBA to make more small businesses with gaming eligible for Paycheck Protection Program loans failed to appease lawmakers in Nevada and other states where many establishments have slot machines or table games.

The administration’s tinkering was too little, too late.

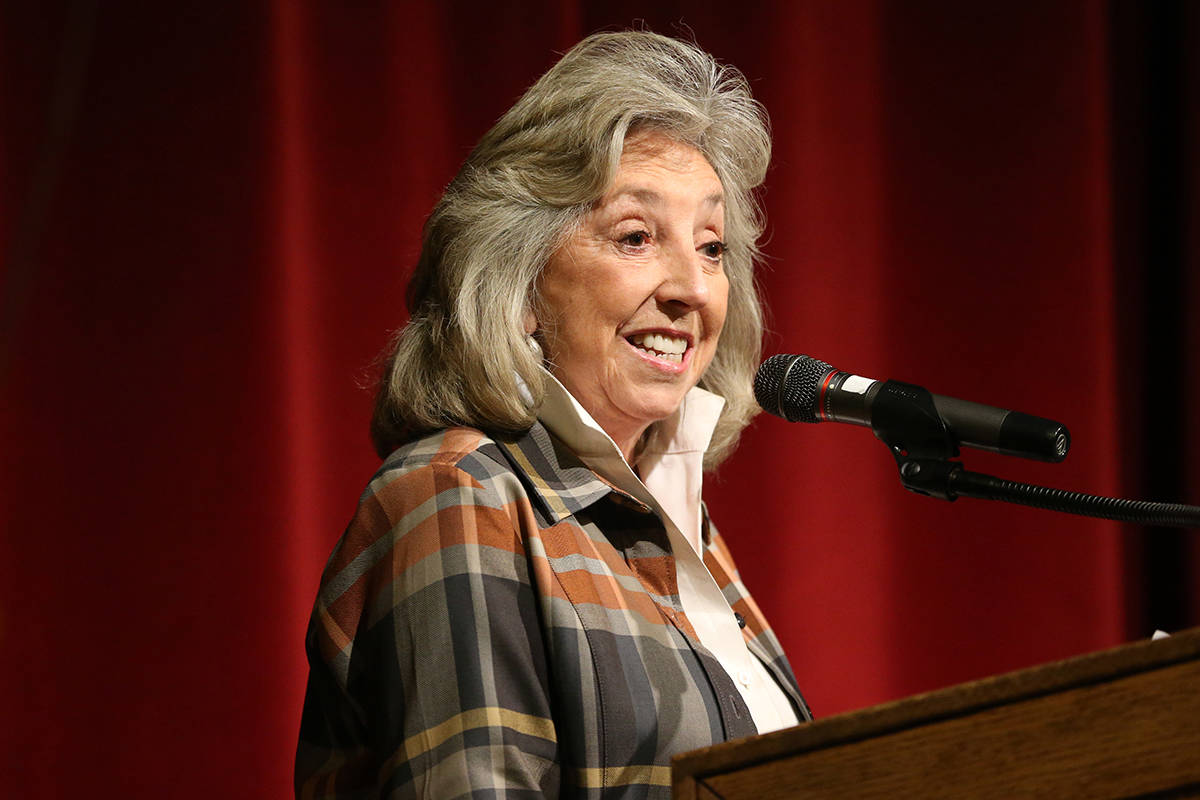

“The Trump administration’s attempt to prevent small gaming businesses from accessing relief is hurting Las Vegas,” said Rep. Dina Titus, D-Nev., who dropped her bill Friday in the House, where Democratic leaders have called for expanded access to PPP loans.

Her bill received bipartisan support, including that of every Nevada House member, with Rep. Mark Amodei, a Republican, and Democrat Reps. Steven Horsford and Susie Lee on board.

Legislation also will be filed in the Senate by Jacky Rosen, D-Nev., who was appointed by President Donald Trump to a bipartisan panel to work toward opening the country after state shutdowns from the coronavirus outbreak.

“Nevada small businesses that engage in legal gaming make up key parts of our state’s economy,” Rosen said. “These businesses should be given the same access to coronavirus relief as any other small business.”

Sen. Catherine Cortez Masto, D-Nev., signed onto the bill.

Titus said the goal is to have the legislation incorporated into the next, or fourth, relief funding bill that Congress is expected to pass to help the country recover from the coronavirus outbreak that has shuttered much of the nation.

Congress and Trump previously approved a $2.2 trillion relief package to help workers, families, businesses and governments preparing for the public health and economic blows of the coronavirus outbreak.

That package included $500 billion for industries and big business. The American Gaming Association lobbied to make large casinos, cut out of relief packages following Hurricane Katrina, eligible for industry loans.

Also included in the package was $350 billion for small businesses, to be distributed by lending institutions with the SBA. The money was for loans to help retain workers during the crisis. If payrolls are maintained, the loans can be forgiven.

But SBA rules excluded businesses that received more than 30 percent of their revenue from gaming, including slot machines or tables. That rule affected businesses in 43 states, where gaming has been approved by local governments.

After complaints were raised by Amodei and Nevada Democrats that the SBA violated the intent of Congress, a rule change was instituted to raise the revenue threshold to 50 percent.

Cortez Masto said 267 small businesses in Nevada would still be excluded from the PPP loans despite the administrative change. She called the SBA change in the rule “arrogant.”

The PPP ran out of funds Thursday, with Senate Majority Leader Mitch McConnell, R-Ky., opposed to rewriting legislation to streamline more funding to the project.

House Speaker Nancy Pelosi, D-Calif., said any further spending package must include changes to PPP to expand access to the program to more small businesses, as well as include funds for states, cities and hospitals.

Republicans and Democrats are in agreement that at least $250 billion needs to be added to the PPP program. And Treasury Secretary Steven Mnuchin has urged Congress to act quickly.

The push by Titus, with support of Pelosi and a bipartisan group of lawmakers, could force a compromise.

“Small businesses in the gaming industry support more than 350,000 jobs in the United States and are in desperate need of assistance in order to recover from this crisis,” Titus said.

In Nevada, where gaming is institutional and makes up 40 percent of the state’s tax base, Democratic and Republican lawmakers want an immediate fix to save businesses on the brink of financial calamity.

“The people who work at these small businesses are struggling right now and it’s shameful that the Treasury Department would try to ignore the intent of Congress,” Titus said.

Titus, whose congressional district is solely within Las Vegas, said her bill “will help make sure that small gaming businesses will get much-needed relief.”

Contact Gary Martin at gmartin@reviewjournal.com or 202-662-7390. Follow @garymartindc on Twitter.