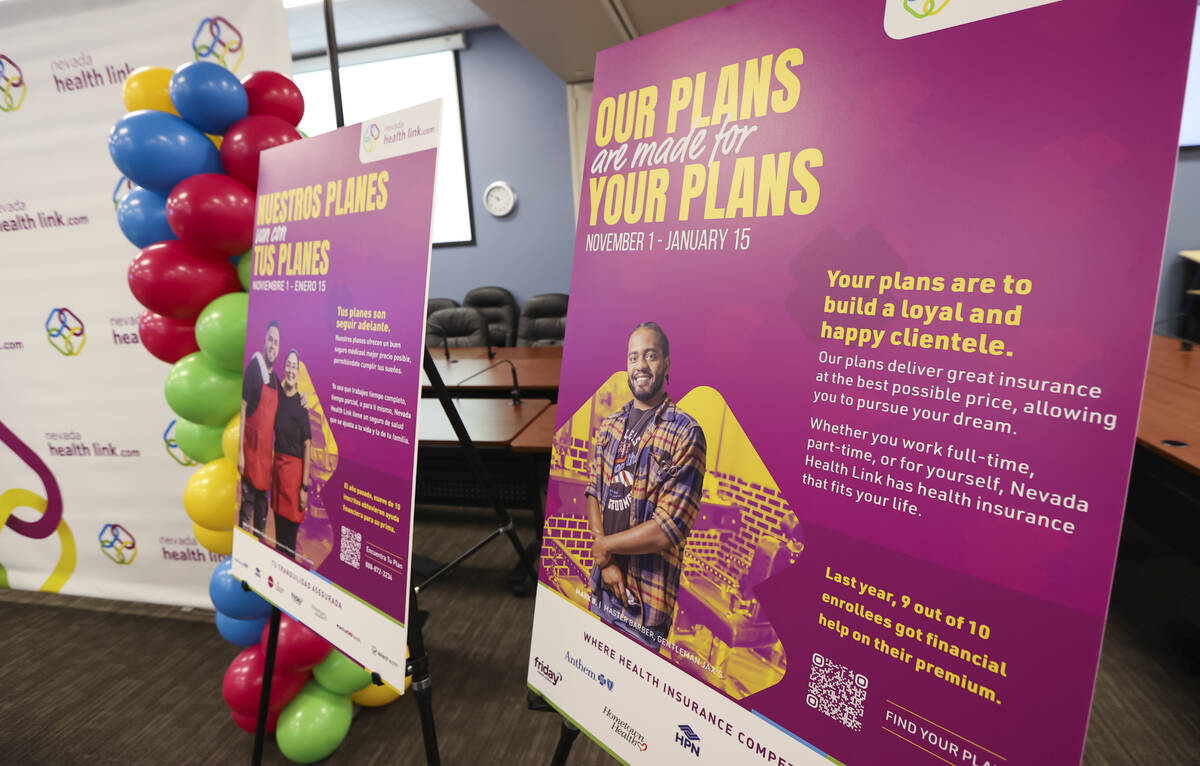

Open enrollment starts for Nevada’s health insurance exchange

Higher federal subsidies are making health insurance through Nevada’s exchange more affordable than ever, officials said Tuesday at a kickoff event for open enrollment.

Those eligible to purchase insurance through the Silver State Health Insurance Exchange include independent contractors and gig workers, those whose employers don’t offer insurance and others for whom premiums would take too big a bite out of their paychecks.

Officials at the event at the Southern Nevada Health District encouraged eligible Nevadans to enroll by the Jan. 15, 2023, deadline.

“The funny thing about insurance is we really don’t care about it until we need it,” said Alberto Ochoa, a broker with the exchange and CEO of Smart Buy Insurance. He recalled how he had enrolled one 40-year-old man for $30 to $40 a month who then unexpectedly required a heart stent just days after his insurance went into effect.

Nine out of 10 consumers on the exchange currently receive financial assistance, including subsidies and tax credits, to lower the cost of insurance, said Ryan High, executive director of the Silver State Health Insurance Exchange. More than half spend less than $100 on their premiums per month.

Federal funding extended

Additional subsidies first offered through the American Rescue Plan Act’s pandemic relief have been extended for three years through the Inflation Reduction Act, High said. The higher subsidies helped to increase the number of Nevadans on the exchange to 101,000 from 81,900, he noted.

The Affordable Care Act, also known as Obamacare, lowered premiums for people with incomes as high as 400 percent of the federal poverty level. This translates to $51,040 a year for an individual, and $104,800 for a family of four, according to the NevadaHealthLink.com website. Now, under the American Rescue Plan, those with higher earnings who would be paying more than 8.5 percent of their income for premiums also may be eligible to enroll.

A rule recently finalized by the Treasury Department aims to end what’s been termed the “family glitch.” Previously, determining whether insurance offered by an employer was considered affordable was based on the cost for the employee. Now the calculation includes the cost of adding family members. This means that many more families this year are eligible to purchase insurance on the exchange.

Demographic gaps remain

Officials said it is critical to address health equity in Nevada through the exchange.

Dr. Florence Jameson, a Southern Nevada ob-gyn and chair of the exchange’s board, said that 20 percent of those in the state identifying as Hispanic remain uninsured, compared with 7 percent who identify as white.

“We can and must close that gap,” she said.

Ochoa said there are rumors that obtaining a subsidy could mean the loss of a green card or residency. “That is completely false,” he said.

This year, there are seven private insurance carriers offering 163 plans — the highest number to date — though not every plan is available in every county. There also are five carriers offering 18 dental plans. Consumers can take a quick anonymous survey on the website to find out if they are eligible and get an estimated cost.

The exchange has a network of licensed enrollment specialists to assist consumers at no cost, and in multiple languages, with the application and enrollment process. At NevadaHealthLink.com, consumers can click the “Find Assistance” button on the website or call 1-800-547-2927.

Contact Mary Hynes at mhynes@reviewjournal.com or 702-383-0336. Follow @MaryHynes1 on Twitter.