Taxes on cigarettes, liquor could double

CARSON CITY -- Sin City sinners face an escalation in the cost of their indulgences as state lawmakers consider more than doubling the taxes on liquor and smokes.

Cigarette and liquor industry lobbyists testified Tuesday that drinkers probably would switch to cheaper alcohol and smokers probably would buy less expensive brands over the Internet if the Legislature increases state "sin taxes."

"Fifty percent of the alcohol drinking is by people who earn less than $50,000 a year," said lobbyist Alfredo Alonso, who represents liquor distributors and the R.J. Reynolds Tobacco Co. "The high-end brands may suffer."

With the tax increase, Nevada liquor taxes would be the fifth highest in the nation.

Lobbyists from other liquor companies, as well as the Nevada Taxpayers Association and the Reno-Sparks Chamber of Commerce, joined Alonso in opposing Assembly Bills 255 and 277. No vote was taken on the proposals by the Taxation Committee. Legislators probably will not vote on any bill to increase taxes until Democratic leaders decide whether they are necessary.

Gov. Jim Gibbons has vowed to veto any tax increase, even in so-called "sin taxes."

Hae Lee, the owner of 13 liquor stores, said Nevada already has slightly higher liquor taxes than California. The increases in the bill would cause a drop in his out-of-state customers and hurt local residents, he said from Las Vegas.

"We are in an economic slowdown everywhere," Lee said. "People who used to buy $10 bottles now buy $5 bottles. Those who used to drink good beer go to cheaper beer. This is a bad time for us."

With the increases, Nevada liquor taxes would be much higher than taxes in surrounding states, he said.

Assembly members Sheila Leslie, D-Reno, and Bernie Anderson, D-Sparks, want to earmark the revenue raised from the tax increases--over $200 million a year -- for programs to reduce alcohol dependency and to fund health care programs.

Anderson also wants half of the alcohol taxes to go to counties to fund programs to take and test DNA samples from felons.

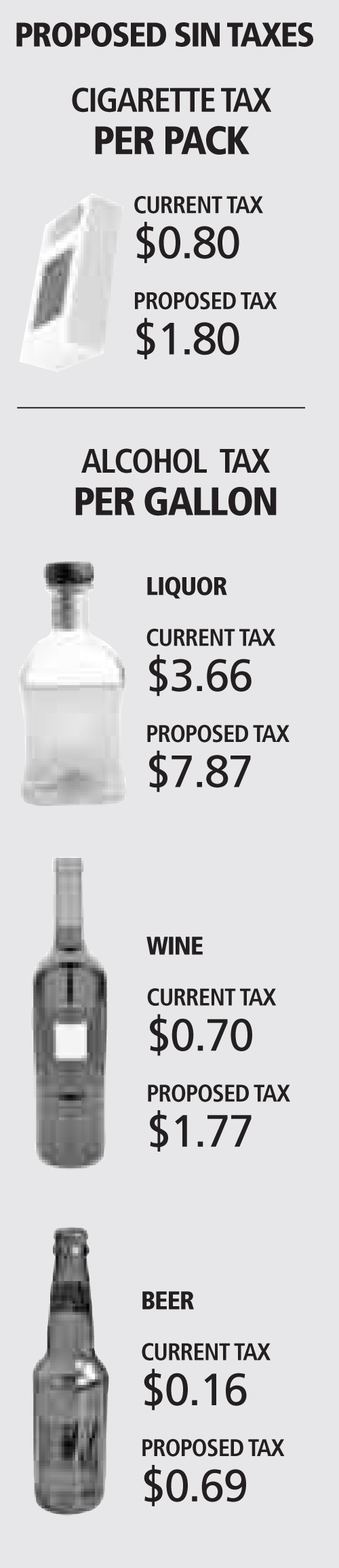

Under Anderson's AB277, the tax on a gallon of liquor would increase to $7.87 per gallon from the current $3.66.

The tax on wine would climb to $1.77 a gallon, compared with the current 70 cents.

Taxes on a gallon of beer would jump to 69 cents per gallon, compared to 16 cents.

Anderson said the increase on a bottle of beer would be a nickel. That would not be a problem for most people, he said.

"I have been known occasionally to have a beer. I probably will have another sometime today."

Anderson said he wants to use the money to fund DNA checks because last year, residents of Washoe County had no choice but to contribute $300,000 to allow the sheriff's crime lab to test a backlog of DNA samples.

The samples were checked following the kidnapping and murder of 19-year-old Brianna Denison.

Thirty criminal cases were solved through that testing, according to Anderson. A man later was arrested and charged with Denison's murder.

Under Leslie's AB255, the tax on a package of cigarettes, now 80 cents, will rise by $1.

Leslie had both personal and legislative reasons for increasing the cigarette tax, saying, "I am sick and tired of not being able to fund essential health programs."

She noted Nevada ranks last in prenatal care for women.

Both her parents smoked, and the family often traveled in a smoky station wagon with the windows closed, Leslie said. Her father died of lung cancer and her mother suffers from emphysema, she said.

Even with the tax increase, Nevada cigarette taxes would rank in the middle of what other states charge, witnesses said.

Applied Analysis principal Jeremy Aguero said his research showed cigarette purchases dropped from 14.8 million packages to 13.3 million packages a month in 2003, the last time that tax was increased.

But alcohol consumption increased from 5.3 million gallons a month to 6.3 million gallons after liquor taxes were raised that year.

Liquor sales are still increasing, he added, although they have not kept up with the population growth in the state.

"To me that says a lot about (smoking) prevention programs," said Taxation Chairwoman Kathy McClain, D-Las Vegas, who quit smoking herself.

Other witnesses testified Nevada now ranks 16th among the states in consumption of cigarettes, a dramatic improvement over the past, when it ranked as high as second among the states.

Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901.