COMMENTARY: Credit card rewards are in political peril

The same politicians who mostly killed free checking and debit card rewards programs through price controls are setting their sights on credit cards — and that means miles, cash back and other rewards are in jeopardy.

That’s a potential political earthquake, because a recent study found that 84 percent of all credit cards are rewards cards, and 70 percent of cardholders who make less than $20,000 a year have rewards cards. Many small businesses also rely on rewards cards — especially cash-back cards.

Those individuals and small businesses need to engage quickly to stop efforts underway by Sen. Dick Durbin, D-Ill., to build support to extend his 2010 price-control and network-routing regulations on debit cards to credit cards.

The debit card experience should be viewed as a cautionary tale.

Rushed to the Senate floor with no committee consideration as part of the Dodd-Frank Act, the Durbin Amendment placed price caps and network routing mandates on debit card transactions, benefiting the biggest retailers but disrupting the business models of banks, credit unions and stores selling smaller-ticket items. When banks and credit unions were squeezed, they had to cut expenses — and that meant cutting free-checking accounts to customers with lower balances and ending nearly all debit rewards programs.

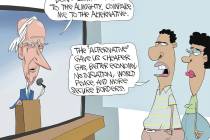

To garner the support of a handful of Republicans in 2010, Sen. Durbin pitched his regulations as a boon to both retailers and to consumers. This is what actually happened:

■ Seventy-seven percent of retailers kept prices the same and 21 percent actually increased prices because of the Durbin regulations, per the Richmond Federal Reserve.

■ Free checking dropped from 60 percent of all accounts to 20 percent, according to a University of Pennsylvania study.

■ The Durbin Amendment cost the average low-income American about $160 per year, per a Boston University study.

■ The number of unbanked Americans increased by about 1 million, according to the same study.

Durbin considers this a success — because his only real purpose was to push down transaction costs for the biggest retailers. And just as debit regulations hurt consumers, imposing Durbin-style price and routing controls on credit cards will result in rewards programs disappearing — particularly for lower-income customers who are less valuable to banks.

Is that worth it to relieve influential big box retailers of what they claim are excessive transaction fees? If the costs are really so high, why have “cash only” stores almost completely disappeared?

Electronic payment costs vary, but average around 2 percent. But the average cost of cash across all retail sectors is 9 percent in a recent study. The study defined the cost of cash as managing cash drawers, interacting with their banks with deposits, reconciling cash flows and “shrinkage” from cash that goes missing from loss, theft and fraud.

Aside from their transaction-cost savings from using cards, retail merchants know that most of their customers prefer using cards and spend more per transaction when they use cards than when they use cash.

Of course retailers want to cut their costs, and they already drive hard bargains with payment networks. Having government step in with price controls and routing rules, however, would enrich them by disrupting a well-functioning market and harming consumers.

Before signing on to Durbin’s latest bad idea, senators should ask themselves how they will defend their vote to constituents who stop earning miles, cash back and other rewards with every purchase.

Phil Kerpen is the president of American Commitment and the author of “Democracy Denied.” Contact him at phil@americancommitment.org.