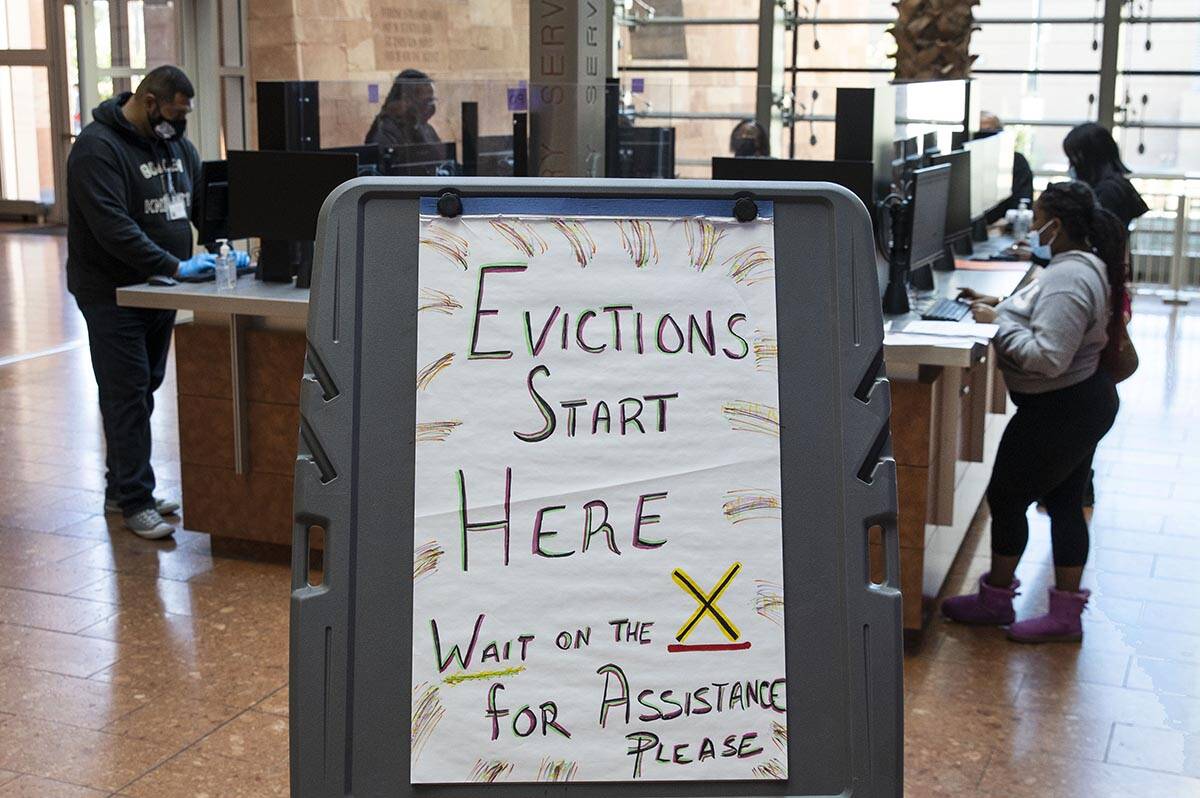

COMMENTARY: There is no eviction ‘tsunami’

There is no eviction tsunami. There is a housing crisis.

Renters and housing providers alike have faced massive challenges over the past year and a half. At the onset of the pandemic, many rightly feared about renters’ ability to meet their obligations as the economy shut down. Yet instead of an eviction tsunami, the pandemic revealed a broken housing system decades in the making.

Predictions were dire for the number of renters who would face eviction. At the onset of the pandemic, tens of millions were cited as at risk for eviction. As the federal moratorium was set to expire this summer, 11 million renters were considered likely to be homeless.

The good news is that the feared eviction wave has not come to pass. A recent report showed evictions are flat or down since the end of the eviction ban imposed by the Centers for Disease Control and Prevention. Many wondered why these eviction predictions did not come to pass.

The $4 trillion in economic relief — including the Paycheck Protection Program, stimulus checks and the nearly $50 billion of rental assistance — has all helped buoy the rental market, though significant work remains to address shortcomings in the rental assistance program.

What is not discussed, however, is the key role housing providers also played in ensuring there was no eviction tsunami. A narrative exists that the default position of housing providers is to try to evict at all costs. Nothing is further from the truth. An eviction is always a last resort and a worst-case scenario for both the renter and housing provider.

Blanket eviction moratoriums create unintended consequences, as well. Imagine what would happen to the grocery stores and the owners of grocery stores if there were a moratorium on grocery bills. For the rental housing industry, the effects of eviction moratoriums still burden housing providers, and ongoing restrictions continue to sideline housing units and interrupt revenue, forcing all residents to face tighter market conditions and more stringent application requirements for income and credit profiles.

In many instances, renters continue to live in rental homes they cannot afford — racking up insurmountable debt and harming their credit. In some cases, the moratoriums encourage bad actors who have the means to pay but choose not to. All of these unintended consequences exacerbate housing instability and make housing less obtainable for lower- and middle-income households that need it the most.

No other private industry has been asked to shoulder the burden like landlords have over the past year and a half. We still have mortgages, taxes, insurance, maintenance and employees to cover. Moreover, we incurred additional cleaning and PPE costs to ensure our front-line workers and residents alike are as protected as possible.

At the onset of the pandemic, the National Multifamily Housing Council, which I chair, supported a voluntary halt to evictions even before there were moratoriums or rental assistance programs in place. And all of our member firms surveyed offered eviction mitigation programs such as payment plans, deferred payments and waiving late fees throughout the pandemic.

The pandemic has shown the repercussions of a housing system incapable of meeting the needs of millions of Americans. Decades of underbuilding have left the nation dangerously short of the amount of housing required. The country’s most expensive places — and areas in greatest need of housing — are often the most difficult places to add needed homes, usually through Not-In-My-Back-Yard opposition and overly burdensome regulations.

For those who need direct financial support, significant bureaucratic hurdles make it difficult for both renters and housing providers to secure critical aid. One need look only at how widely disparate the hundreds of state and local emergency rental assistance programs have performed in distributing funds.

As we transition to a new “normal,” we cannot revert back to our “normal” approach to housing. The crisis created by the pandemic has laid bare the inadequacies of our nation’s housing policy. It’s time for all of us — advocates, policymakers and housing leaders — to come together to address our housing affordability crisis decades in the making.

David Schwartz is CEO, chairman and co-founder of Waterton, a real estate investment and property management company headquartered in Chicago. He also serves as board chair of the National Multifamily Housing Council, the industry association representing apartment owners, developers and managers.