NEVADA VIEWS: Nevada Democrats should reject SALT tax cut for wealthy Californians

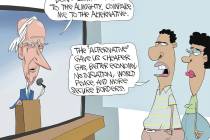

The stunning 2021 transformation of the Nevada Democratic Party could have an enormous impact on the fate of the $3.5 trillion spending package being debated in Congress. Progessive Democrats aligned with Sen. Bernie Sanders are now in control, and those progressive values are at the heart of a Democratic Party schism over the state and local tax deduction that progressives say is a giveaway to the rich.

They’re right: The SALT deduction is bad tax policy, and Nevada Democrats such as Sen. Catherine Cortez Masto should reject calls from her fellow lawmakers to enact this windfall for the wealthiest Americans.

This political backdrop is critical as Democrats in Washington are walking a fine line. The potential inclusion of a massive tax break for the wealthiest Americans is causing consternation, with Democrats from high-tax blue states overwhelmingly calling for the SALT deduction to be reinstated to 2016 levels. The deduction allows taxpayers who itemize — estimated to be only about 10 percent of taxpayers — to deduct certain taxes (e.g. property, sales, and income) paid at the state and local levels. Under the 2017 Tax Cuts and Jobs Act, this deduction was capped at $10,000.

The repeal of the SALT deduction cap would indeed amount to a massive tax cut for the wealthy. According to the Tax Policy Center, the top 1 percent of households would receive 56 percent of the tax cut, and the top 20 percent of households would receive more than 96 percent of the break. You’d be hard pressed to find a more cut-and-dried example of tax policy that overwhelmingly benefits the upper class.

Many lawmakers in high-tax states support the SALT benefit because they don’t want wealthy individuals to leave their state because of high taxes. The repeal of the SALT deduction cap would disproportionately benefit high-income earners in high-tax states. As the Tax Foundation demonstrates, residents of San Francisco County receive on average about 10 times the benefits compared with those in Clark County. A demonstration of this divide can be seen in the SALT caucus, a group of lawmakers pushing for the repeal of the deduction cap and made up almost exclusively of representatives from California, New York, New Jersey, Illinois and Maryland.

However, not all representatives of these high-tax states are on board. Rep. Alexandria Ocasio-Cortez called the repeal of the SALT deduction cap “a giveaway to the rich” and “a gift to billionaires.” Sen. Sanders stated on the topic of the SALT deduction cap repeal, “You can’t be on the side of the wealthy and powerful if you are going to really fight for working families.” This puts Nevada Democrats in a difficult position — the Nevada State Democratic Party boasts the leadership of a former national delegate for Bernie Sanders’ 2020 campaign and the former co-chair of Nevada for Bernie.

As Congress debates the $3.5 trillion legislation, Sen. Cortez Masto has the ability to appeal to her progressive base and score a win for sound tax policy. In a Senate equally divided between Republicans and Democrats, she can exert her influence and block efforts to remove the limitation on the SALT deduction. On this important issue, the new state party ought to hold her accountable.

Repealing the SALT cap is a giveaway to the wealthy, and Democrats shouldn’t support the repeal — especially if they intend to pass costly provisions to address issues such as reducing child poverty, promoting clean energy or advancing other progressive priorities. Repealing the SALT deduction cap would decrease federal revenue by roughly $85 billion per year over the next five years, according to the Committee for a Responsible Federal Budget, making paying for social programs even harder.

Sen. Cortez Masto and Nevada Democrats must do whatever they can during negotiations over the $3.5 trillion spending package to block this provision so Nevada’s taxpayers aren’t footing the bill for a big tax cut for wealthy Californians.

Will Yepez, a UNR grad, is a government and policy affairs associate with the National Taxpayers Union, a nonprofit dedicated to advocating for sound tax and fiscal policy at all levels of government.