How Sisolak’s budget sets up a future budget crisis

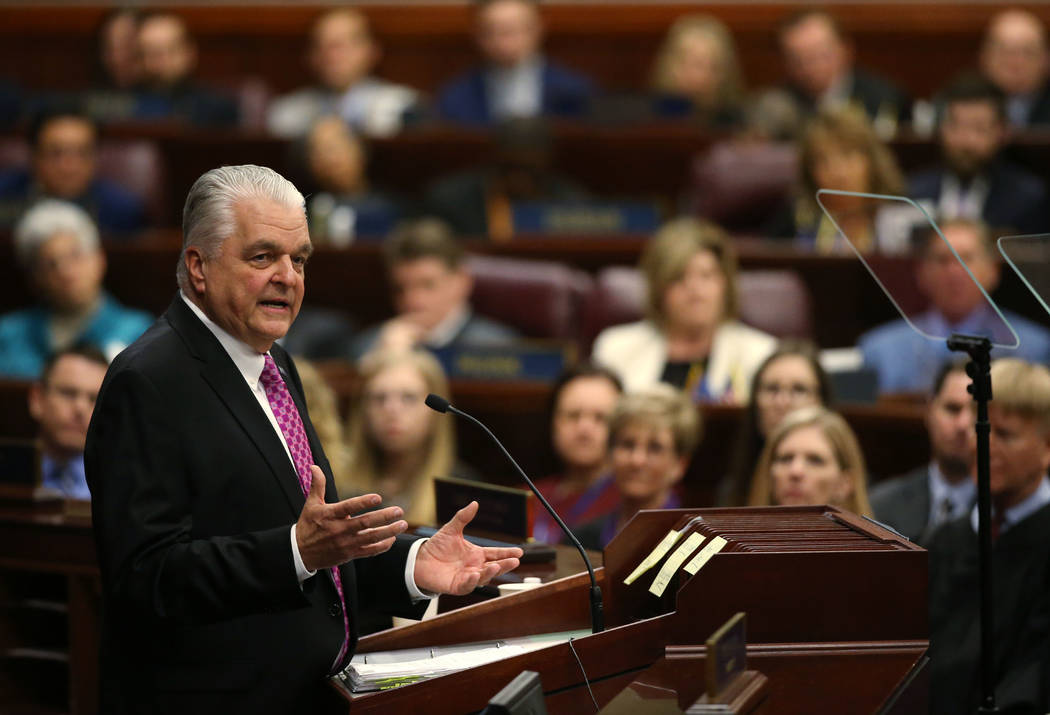

Nevada’s expanding economy and the largest tax hike in Nevada history, passed just four years ago, have given Gov. Steve Sisolak record amounts of money to spend. And spend he does, seeking a 10 percent increase of around $900 million over the coming two-year budget cycle. And despite Sisolak’s rhetoric, some of that money comes from a proposed tax hike.

It’s easy to call for spending increases when coffers are flush. Politicians, worried about the next election, rarely look forward to the future. If they did, they would realize this spending plan sets up Nevada for a significant budget crisis during the next recession.

Start with collective bargaining for state workers. Sisolak says it’s a priority, but he didn’t include it in this budget. He proposes that state workers receive a 3 percent pay hike. For contrast, former Gov. Brian Sandoval’s last budget included two 3 percent pay hikes.

It’s no surprise that Sisolak didn’t include more for state workers, because his budget doesn’t have any money left over. But collective bargaining will give state workers first crack at the state treasury next budget cycle. Given the disparity between local and state worker pay, state employees could receive yearly pay hikes of 10 percent or more. Those pay hikes are built in to the baseline budget and will compound over time.

That means Sisolak is going to start the 2021 session in a budget hole. If the economy continues to grow, the state may be able to absorb higher personnel costs without much immediate pain. But if there’s an economic downturn, he’ll have less money and higher expenses.

That’s not the only cost that would increase. The demand for government services, such as Medicaid, goes up when people lose their jobs or see their wages reduced. Right now, during one of the strongest economies in history, 22 percent of Nevadans are on Medicaid or CHIP. How high does that number soar during the next recession? Because of the declining reimbursement rate under Obamacare, Nevada will have to pay more for some of those enrollees than it did when it first expanded Medicaid.

An economic slowdown implies a stock market downturn, which will hurt investment returns for the Public Employees Retirement System. That will automatically increase contribution rates to PERS.

These rising expenses will come at the same time Nevada’s revenues are decreasing. What’s especially damaging — and little understood — is how education funding works. It’s counterintuitive, but when sales tax revenues increase, the state — thanks to the intricacies of the complicated funding formula — actually spends fewer general fund dollars meeting its basic per-pupil guarantee. Declining sales tax revenue, meanwhile, forces the state to boost general fund spending for education.

Sisolak has proposed putting 1 percent into Nevada’s Rainy Day Fund. That’s good, but it’s not going to go very far.

If politicians pass Sisolak’s budget, they’ll be increasing the pain of the next economic downturn.

Victor Joecks’ column appears in the Opinion section each Sunday, Wednesday and Friday. Contact him at vjoecks@reviewjournal.com or 702-383-4698. Follow @victorjoecks on Twitter.