VICTOR JOECKS: Biden’s greatest achievement is making Jimmy Carter look good

The ’70s are calling to ask for their economy back. But President Joe Biden shows no signs of reversing course.

On Monday, Federal Reserve Chair Jerome Powell said interest rates need to go up more quickly to slow runaway inflation. That comes after the Federal Reserve finally raised interest rates last week for the first time in more than three years, boosting rates by a quarter percent. The previous rate was near zero. The Fed expects to raise interest rates six more times this year and thrice in 2023.

Interest rate hikes are the financial equivalent of taking sour-tasting medicine. No one likes to do it, but the alternative can be much worse. Higher interest rates slow economic growth by increasing the costs of borrowing. This forces businesses to scale back on investments. Consumer loans tend to get more expensive, too.

Along with rising interest rates, the Fed is preparing to sell off trillions in mortgage-backed securities. That’s likely to push mortgage interest rates higher. On Tuesday, the average rate on a 30-year fixed mortgage was 4.72 percent, up 0.26 percent from Friday.

These changes will ripple through the economy. Lower investment and demand mean less revenue for businesses. That translates into fewer job opportunities. If the economy slows too much, unemployment can go up significantly.

Housing prices should stabilize or drop as higher interest rates limit how much buyers can afford. Things can go sideways if prices fall substantially too quickly.

Imagine, a buyer purchased a home for $450,000 at the peak of the market. Due to the slowing economy, his company experiences a revenue decline, and he loses his job. In a robust labor market, he could probably find another position locally. But even an out-of-state move wouldn’t be devastating financially. In normal times, he’d sell his house and pocket the equity to buy another home.

But that scenario changes dramatically when housing prices start to fall. If that home is now worth only $350,000, he doesn’t have good options if he’s underwater. Foreclosure is possible. If too many foreclosures or short sales happen at once, the market gets flooded with distressed homes when people are least able to afford them.

Las Vegas lived through this nightmare less than two decades ago.

But so is inflation at 40-year highs. It hit 7.9 percent in February. It’s not just gasoline prices. The cost of groceries, housing and vehicles are up significantly. These changes are hitting low-income families and fixed-income seniors especially hard.

In a worst-case scenario, you get stunted economic growth, high unemployment and high inflation. That’s known as stagflation, which the United States experienced during the Carter administration. To end high inflation, the Fed raised interest rates dramatically. In 1981, the average rate on a 30-year mortgage topped 18 percent. That slowed inflation and caused a recession.

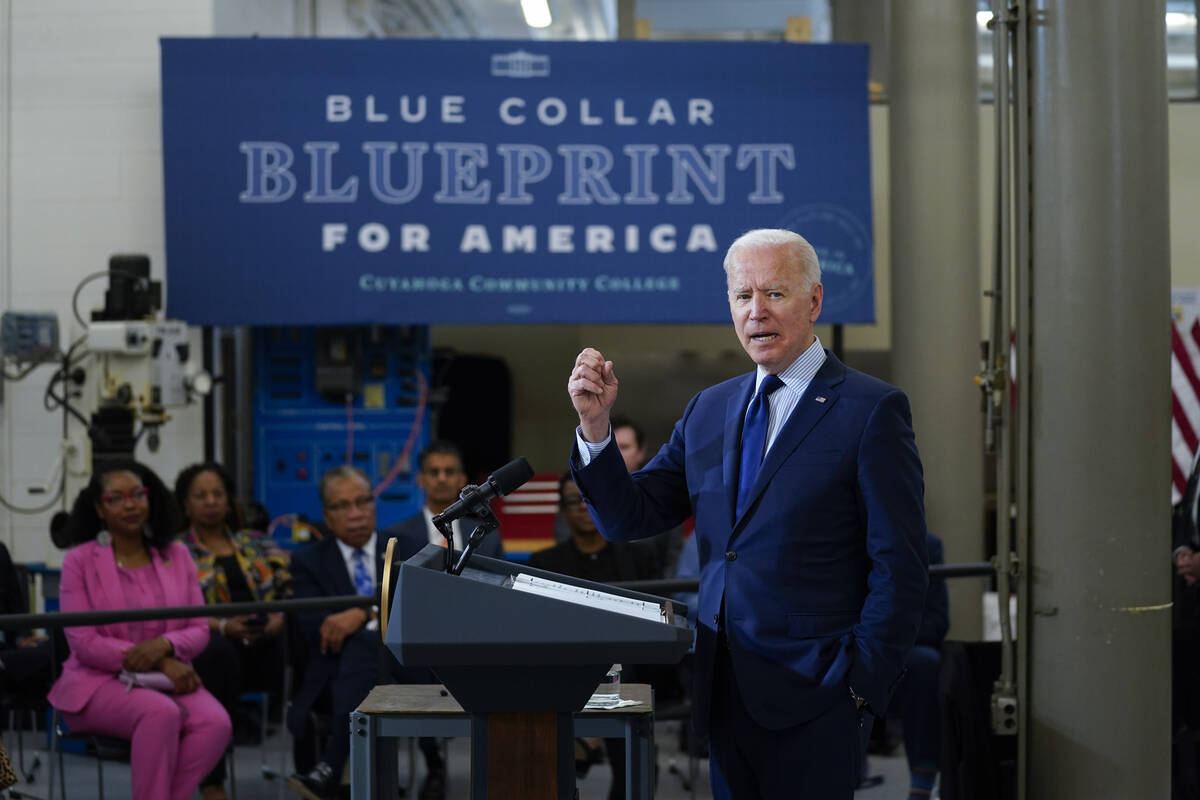

This is why elected officials shouldn’t pursue inflation-creating policies. But that’s what Biden did with profligate spending and by attacking fossil fuel production, extending coronavirus restrictions unnecessarily and foreign policy failures.

Biden doesn’t have a lot of accomplishments. But at least he’s making Jimmy Carter look good.

Contact Victor Joecks at vjoecks@reviewjournal.com or 702-383-4698. Follow @victorjoecks on Twitter.