EDITORIAL: Blue states want their SALT back

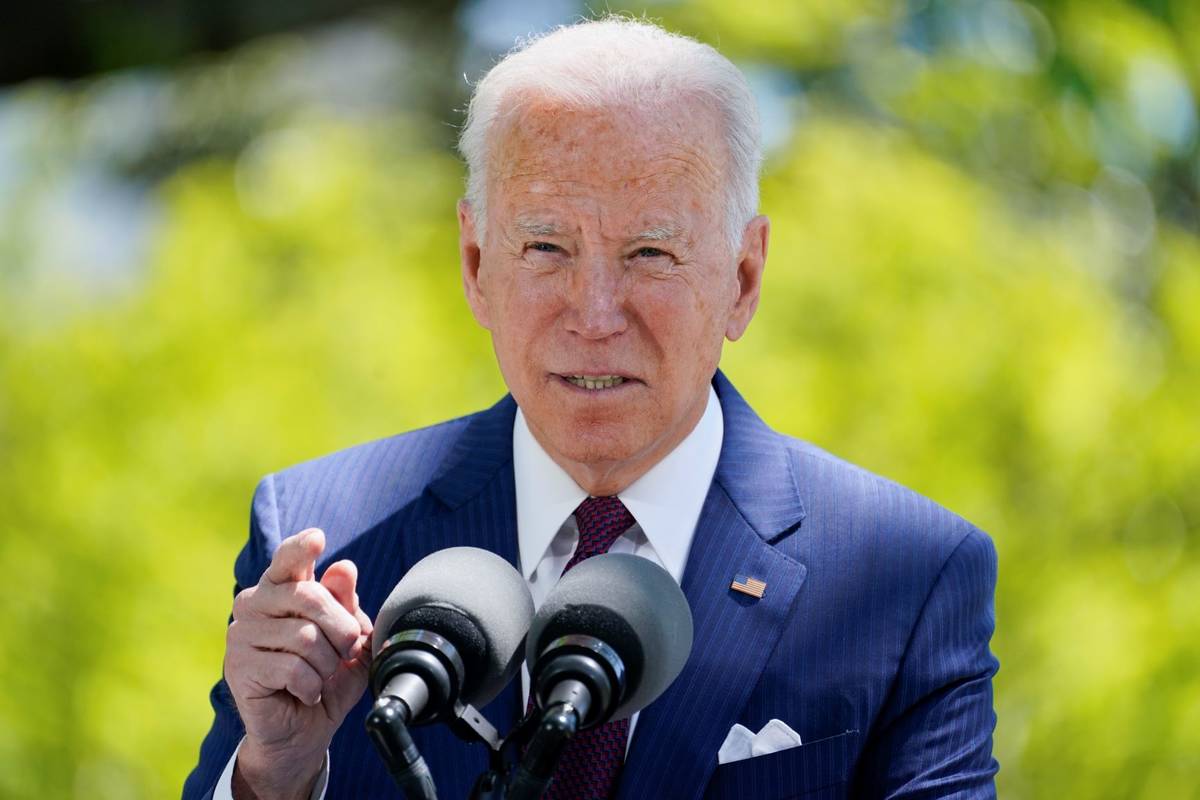

President Joe Biden’s infrastructure plan may unravel if it doesn’t include a significant tax break for wealthy Americans.

In 2017, a Republican-controlled Congress passed significant tax reform. The bill cut and simplified taxes for most Americans. But high earners in some blue states saw their tax bill increase because Republicans capped the deduction for state and local taxes, or SALT, at $10,000. Previously, taxpayers could deduct the full amount they paid in property taxes and either income or sales tax.

In Nevada, which doesn’t have a personal income tax, this deduction had limited benefit. In California, where the top tax rate is 13.3 percent, it made a huge difference for those at the top of the tax bracket. High-income earners could deduct the full amount of many state and local taxes. That meant they didn’t have to pay federal taxes — where the top rate is 37 percent — on those dollars.

This de facto federal subsidy made high taxes in predominant blue states more bearable for well-off taxpayers. After Republicans eliminated it, many Democrats — who profess a great desire to ensure the rich pay their “fair share” — suddenly clamored for the return of this tax break even though the benefits would flow primarily to the wealthy. The top 1 percent of income earners receive 57 percent of the benefits, according to the liberal Brookings Institution.

The latest effort to revive this gift to the well-off comes from a group of 30 House members, including 21 Democrats and nine Republicans. They’ve formed a coalition to push for a restoration of the unlimited deduction for state and local taxes. The members come from high-tax states whose wealthy residents benefit from the loophole.

“This issue is so critical to our state and our constituents that we will reserve the right to oppose any tax legislation that does not include a full repeal of the SALT limitation,” a letter signed by 17 Democrats from the New York congressional delegation reads.

Given Democrats’ narrow House majority, that could spell trouble for Mr. Biden’s pork-filled infrastructure plan. To pay for that spending, little of which deals with roads and bridges, he wants a massive tax increase. The headline proposal is hiking the corporate income tax to 28 percent.

Rep. Tom Suozzi, one of the letter’s co-signers, was more direct. “No SALT. No deal,” he said in a statement.

That sounds like a good outcome. The SALT deduction shouldn’t be increased, and Mr. Biden’s current infrastructure bill contains far too much non-infrastructure spending.

May this stalemate continue.